Brunswick Ga Sales Tax Rate

Understanding the sales tax rate in Brunswick, Georgia, is crucial for any car enthusiast, owner, or hobby mechanic, especially when purchasing a vehicle or automotive parts. While it might seem like a simple percentage, several factors influence the total cost, and knowing the details can save you money and prevent unwelcome surprises. This article breaks down the complexities of the Brunswick, GA, sales tax rate, focusing on its impact on the automotive world.

What is the Sales Tax Rate in Brunswick, GA?

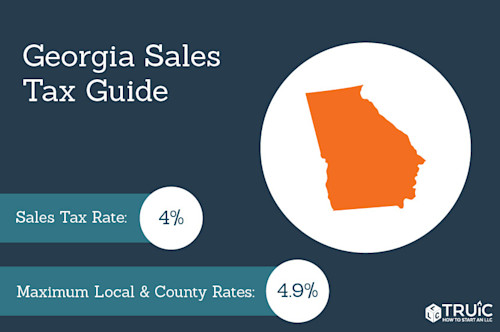

The base sales tax rate for the state of Georgia is 4%. However, counties and cities are allowed to add their own local option sales taxes (LOST), special purpose local option sales taxes (SPLOST), and other taxes. Therefore, the total sales tax rate can vary depending on the specific location.

As of [Insert current date here], the total sales tax rate in Brunswick, Georgia, is 7%. This is a combination of the 4% state sales tax and a 3% local sales tax. It's important to confirm this information with the Glynn County tax assessor's office or the Georgia Department of Revenue, as rates can change.

How Does This Impact Car Purchases?

The 7% sales tax applies to the purchase price of a vehicle, whether it's a brand-new 2024 Porsche 911 GT3 RS or a used 2005 Honda Civic. Let's look at a couple of examples:

- Example 1: New Porsche 911 GT3 RS. Suppose you are purchasing a new Porsche 911 GT3 RS with a purchase price of $230,000 (before taxes and fees). The sales tax calculation would be: $230,000 x 0.07 = $16,100. Your total purchase price, before any other fees, would be $246,100.

- Example 2: Used Honda Civic. Consider buying a used 2005 Honda Civic for $4,000. The sales tax would be: $4,000 x 0.07 = $280. Your total purchase price, before any other fees, would be $4,280.

These examples clearly show that the sales tax significantly impacts the total cost, especially for higher-priced vehicles. It's essential to factor this into your budget when planning a car purchase.

Sales Tax on Automotive Parts and Repairs

The 7% sales tax in Brunswick also applies to automotive parts and repair services. This means that when you purchase a new set of Brembo brake pads for your track-day Mustang or get your Subaru WRX STI's engine rebuilt, you'll be charged sales tax on the parts and, in some cases, the labor.

Parts

Any tangible parts purchased for your vehicle are subject to sales tax. This includes:

- Replacement parts (e.g., spark plugs, air filters, brake rotors)

- Performance upgrades (e.g., turbochargers, exhaust systems, suspension components)

- Cosmetic enhancements (e.g., aftermarket wheels, body kits, spoilers)

For instance, if you buy a set of Michelin Pilot Sport 4S tires for $1,200, the sales tax would be $1,200 x 0.07 = $84. The total cost for the tires would be $1,284. Similarly, if you're adding an aftermarket Borla exhaust system to your Chevrolet Corvette and the parts cost $2,500, expect to pay $2,500 x 0.07 = $175 in sales tax, bringing the total parts cost to $2,675.

Repairs

The application of sales tax on repair services can be a bit more nuanced. Generally, sales tax is charged on the parts used during the repair. In some cases, depending on the specific repair and the service provider's policy, sales tax might also be applied to the labor cost. It's best to confirm this with the repair shop beforehand to avoid surprises.

Consider a scenario where you're getting your BMW M3's suspension repaired. The parts cost $800, and the labor cost is $600. The sales tax would be calculated on the parts cost: $800 x 0.07 = $56. The total bill would then be $800 (parts) + $600 (labor) + $56 (sales tax) = $1,456. However, if the shop also charges sales tax on labor, the calculation would be ($800 + $600) x 0.07 = $98, making the total bill $1,498.

Exemptions and Considerations

While the 7% sales tax generally applies to most automotive transactions in Brunswick, GA, there might be some exemptions. These exemptions are subject to change and usually apply to specific situations. Common examples include:

- Sales to Exempt Organizations: Sales made to certain non-profit organizations or government entities may be exempt from sales tax.

- Resale Certificates: If you are purchasing parts for resale (e.g., as a repair shop), you may be able to use a resale certificate to avoid paying sales tax.

- Out-of-State Purchases: The rules regarding sales tax can be complex when purchasing a vehicle from out of state and registering it in Georgia. Generally, you'll pay sales tax based on the rate in your county of residence, but it's best to consult with the Department of Revenue for specific guidance.

Always verify the specifics with a qualified tax professional or the Georgia Department of Revenue to ensure you're complying with all applicable laws and regulations.

Practical Takeaways for Automotive Enthusiasts

Here are some practical takeaways to help you navigate sales tax in Brunswick, GA, as an automotive enthusiast:

- Budget Accordingly: When planning a car purchase, remember to factor in the 7% sales tax. Use online calculators or consult with the dealership to get an accurate estimate of the total cost.

- Clarify Repair Costs: Before authorizing any repairs, ask the shop to provide a detailed estimate that clearly breaks down the cost of parts, labor, and sales tax. Confirm whether sales tax is applied to both parts and labor.

- Explore Potential Exemptions: If you believe you might qualify for a sales tax exemption (e.g., due to your organization's status or the nature of the purchase), research the requirements and provide the necessary documentation.

- Keep Detailed Records: Maintain records of all automotive purchases, including sales receipts, invoices, and registration documents. This will be helpful for tax purposes and potential audits.

- Stay Informed: Sales tax laws and rates can change, so it's essential to stay informed. Regularly check the Georgia Department of Revenue's website or consult with a tax professional for updates.

- Consider Out-of-State Purchases Carefully: Understand the sales tax implications of buying a vehicle from out of state. You may need to pay sales tax in both the state of purchase and Georgia, although you may be able to claim a credit for taxes paid in the other state.

Understanding the Brunswick, GA, sales tax rate and its implications for automotive transactions can save you money and ensure compliance with the law. By budgeting carefully, clarifying repair costs, exploring potential exemptions, and staying informed, you can make informed decisions and enjoy your passion for cars without unnecessary financial surprises. Always remember, when in doubt, consulting a qualified tax professional is always the best course of action.

Disclaimer: This article is for informational purposes only and does not constitute tax advice. Please consult with a qualified tax professional for personalized guidance.