Car Lease Deals Baton Rouge

Navigating the world of car leasing can feel like deciphering a complex engine. Especially in a market like Baton Rouge, Louisiana, where regional preferences and economic factors subtly influence the deals available. This guide aims to dissect the anatomy of car lease deals in Baton Rouge, empowering you to make informed decisions.

Understanding the Lease Equation

A car lease, fundamentally, is a long-term rental agreement. Instead of purchasing the vehicle outright, you pay for its depreciation during the lease term, plus interest and fees. Several key components influence the monthly lease payment:

1. The MSRP (Manufacturer's Suggested Retail Price)

The MSRP is the sticker price of the vehicle. While not always the final selling price, it serves as the baseline for calculating depreciation. Negotiating a lower selling price before discussing the lease can significantly reduce your monthly payments. Think of it like reducing the initial cost of an engine before calculating its performance impact.

2. The Residual Value

This is the estimated value of the car at the end of the lease term, expressed as a percentage of the MSRP. A higher residual value translates to less depreciation during the lease, resulting in lower monthly payments. Automakers and leasing companies determine residual values based on projected market demand and depreciation rates. Factors like make, model, trim level, and anticipated mileage affect the residual value. For example, a popular SUV with a proven track record of holding its value will likely have a higher residual than a less-established model.

3. The Money Factor (Interest Rate)

The money factor, often expressed as a small decimal (e.g., 0.00015), represents the interest rate you're paying on the lease. To convert it to an annual interest rate, multiply it by 2400. So, 0.00015 translates to 3.6% (0.00015 * 2400 = 3.6). The money factor is largely determined by your credit score. A strong credit history will qualify you for a lower money factor, saving you significant money over the lease term. Think of it as the cost of borrowing – a higher risk profile (lower credit score) leads to a higher borrowing cost.

4. Lease Term

The lease term is the duration of the agreement, typically expressed in months (e.g., 24, 36, or 48 months). A shorter lease term generally results in higher monthly payments because the vehicle depreciates more within that timeframe. Conversely, a longer lease term spreads the depreciation over a longer period, leading to lower monthly payments, but you'll be paying interest for a longer duration.

5. Down Payment/Capitalized Cost Reduction (Cap Cost Reduction)

A down payment, or capitalized cost reduction, is an upfront payment that reduces the capitalized cost (the agreed-upon price of the vehicle). While a down payment lowers your monthly payments, it's generally not recommended for leases. If the vehicle is totaled or stolen during the lease, you'll likely lose your down payment. It's generally better to aim for a zero-down lease, focusing on negotiating the best possible selling price instead.

6. Fees and Taxes

Lease agreements include various fees, such as acquisition fees (charged by the leasing company to initiate the lease), disposition fees (charged at the end of the lease for vehicle disposal), and taxes. These fees can significantly impact the total cost of the lease, so it's crucial to understand and negotiate them whenever possible. Louisiana's state and local taxes will also be applied to the lease payments.

Baton Rouge Specific Considerations

The Baton Rouge car market, like any regional market, has its own nuances. Several factors influence lease deals in the area:

1. Vehicle Popularity

SUVs and trucks are exceptionally popular in Louisiana. This high demand can sometimes lead to less aggressive lease deals on these vehicle types compared to less popular models. Dealers may be less inclined to offer significant discounts on vehicles that are already selling well.

2. Local Economic Conditions

The health of the local economy directly impacts car sales and leasing. In periods of economic prosperity, dealers may be less motivated to offer deep discounts. Conversely, during economic downturns, they may offer more attractive lease deals to stimulate sales.

3. Dealer Competition

The level of competition among dealerships in Baton Rouge influences pricing. A greater number of dealerships selling the same brand can lead to more competitive lease offers. Shoppers should leverage this competition by obtaining quotes from multiple dealers.

4. Impact of Natural Disasters

Louisiana's vulnerability to hurricanes and flooding can disrupt the car market. After major storms, demand for vehicles often surges, potentially leading to price increases and less favorable lease terms. Conversely, some manufacturers may offer special financing or lease programs in the aftermath of natural disasters.

Strategies for Securing the Best Lease Deal in Baton Rouge

Armed with an understanding of the lease equation and local market dynamics, you can employ several strategies to secure the best possible lease deal in Baton Rouge:

1. Do Your Research

Before visiting a dealership, research the MSRP, residual value, and money factor for the specific vehicle you're interested in. Websites like Edmunds and Leasehackr can provide valuable information. Knowing these numbers will empower you to negotiate effectively.

2. Negotiate the Selling Price

Focus on negotiating the selling price of the vehicle *before* discussing the lease terms. A lower selling price directly translates to lower monthly payments. Treat the lease as a financing option for a negotiated purchase price.

3. Shop Around

Obtain quotes from multiple dealerships. Don't be afraid to let them know you're comparing offers. Leverage the competition to your advantage.

4. Consider a One-Pay Lease

A one-pay lease involves paying the entire lease amount upfront. This eliminates the need for monthly interest payments, potentially saving you a significant amount of money. However, it also ties up a large sum of cash upfront, and you risk losing that money if the vehicle is totaled.

5. Be Aware of Mileage Limits

Lease agreements typically include mileage limits, usually expressed as miles per year (e.g., 10,000, 12,000, or 15,000 miles). Exceeding the mileage limit results in a per-mile charge at the end of the lease. Accurately estimate your annual mileage needs to avoid these charges. It's often more cost-effective to negotiate a higher mileage allowance upfront than to pay the overage fee later.

6. Read the Fine Print

Carefully review the lease agreement before signing. Pay close attention to all fees, taxes, and terms and conditions. Don't hesitate to ask questions if anything is unclear.

7. Understand GAP Insurance

Guaranteed Asset Protection (GAP) insurance covers the difference between the vehicle's value and the amount you owe on the lease if the vehicle is totaled or stolen. Many lease agreements include GAP insurance, but it's essential to confirm whether it's included and whether it adequately covers your risk.

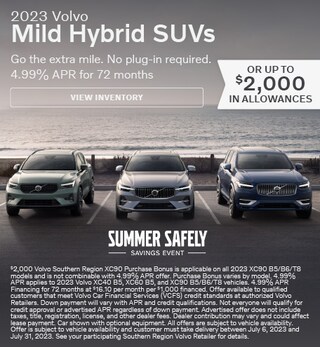

8. Check for Lease Incentives

Manufacturers often offer lease incentives, such as rebates or subsidized interest rates, to promote specific models. Check for available incentives before negotiating the lease terms. These incentives can significantly reduce your monthly payments.

The End of the Lease

At the end of the lease, you have several options:

* Return the vehicle: Simply return the vehicle to the dealership, subject to inspection for excess wear and tear. * Purchase the vehicle: You can purchase the vehicle at the agreed-upon residual value. * Extend the lease: In some cases, you may be able to extend the lease for a short period.

Leasing a car in Baton Rouge, Louisiana, requires careful consideration of the lease equation, local market dynamics, and strategic negotiation. By following the guidelines outlined in this guide, you can navigate the leasing process with confidence and secure a deal that meets your needs and budget. Remember, knowledge is power, and a well-informed consumer is a savvy negotiator. Good luck!