Credit Check Monitoring Usaa

Understanding your credit score is crucial in today's financial landscape. It impacts everything from loan approvals and interest rates to insurance premiums and even rental applications. That's why credit check monitoring is a valuable tool for safeguarding your financial health. This article will delve into the importance of credit monitoring, specifically focusing on how USAA members can leverage these services to protect their credit.

What is Credit Check Monitoring?

Credit check monitoring is a service that tracks your credit report for any changes or suspicious activity. Whenever a new account is opened in your name, a credit inquiry is made, or significant changes occur in your credit report, you'll receive an alert. This allows you to quickly identify and address potential fraud or errors before they cause significant damage to your credit score.

Think of it like a security system for your credit. Just as a home security system alerts you to potential break-ins, credit monitoring alerts you to potential fraudulent activities affecting your creditworthiness. Early detection is key to minimizing the impact of identity theft and maintaining a healthy credit profile.

Why is Credit Monitoring Important?

There are several compelling reasons to consider credit monitoring:

- Fraud Detection: It helps you quickly identify fraudulent activity, such as unauthorized credit card applications or loans taken out in your name.

- Identity Theft Protection: By monitoring your credit report, you can catch identity theft early and take steps to mitigate the damage.

- Error Detection: Credit reports can contain errors. Monitoring allows you to identify and dispute inaccurate information that may be negatively impacting your score.

- Credit Score Improvement: By staying informed about your credit activity, you can take steps to improve your credit score over time.

- Peace of Mind: Knowing that your credit is being monitored can provide peace of mind and reduce the stress associated with managing your finances.

USAA and Credit Monitoring: What are Your Options?

While USAA doesn't directly offer its own standalone credit monitoring service, it partners with reputable companies to provide its members with access to these valuable services. The specific offerings and partnerships may change over time, so it's essential to check USAA's website or contact them directly for the most up-to-date information.

Historically, USAA has partnered with companies like Experian or provided access to credit monitoring services through their financial wellness programs. These partnerships typically offer USAA members discounted rates or enhanced features compared to purchasing the services directly from the credit bureaus.

Exploring Potential USAA Credit Monitoring Benefits

When considering credit monitoring through USAA's partnerships, look for these potential benefits:

- Discounted Rates: As a USAA member, you may be eligible for discounted rates on credit monitoring services.

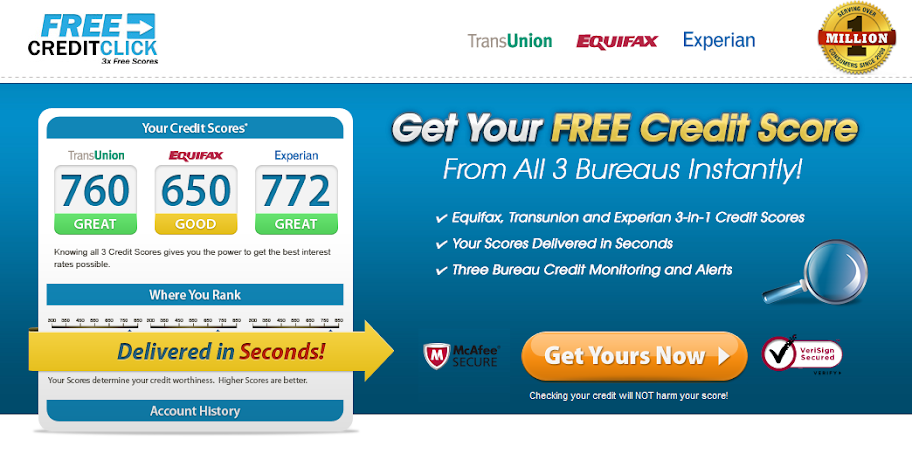

- Comprehensive Monitoring: The service should monitor all three major credit bureaus: Experian, Equifax, and TransUnion.

- Alerts and Notifications: You should receive timely alerts via email or text message whenever there are changes to your credit report.

- Identity Theft Protection: Some services may include identity theft insurance to cover expenses related to identity theft recovery.

- Credit Score Tracking: The service should provide you with access to your credit scores and reports, allowing you to track your progress over time.

- 24/7 Support: Access to customer support is crucial in case you need assistance with understanding alerts or resolving potential issues.

It's vital to carefully review the terms and conditions of any credit monitoring service offered through USAA to understand the scope of coverage, limitations, and associated costs.

Alternative Credit Monitoring Options for USAA Members

Even if USAA's partnered options don't perfectly suit your needs, numerous other credit monitoring services are available. Here are some popular choices:

- Experian CreditWorks: Experian offers a variety of credit monitoring plans, including options with identity theft protection and credit score tracking.

- Equifax Complete Premier: This service from Equifax provides comprehensive credit monitoring, including alerts, credit lock, and identity theft insurance.

- TransUnion Credit Monitoring: TransUnion offers its own credit monitoring service, which includes alerts, credit reports, and credit scores.

- Credit Karma: This free service provides access to your TransUnion and Equifax credit reports and scores, along with free credit monitoring. While free, keep in mind it is supported by advertising.

- MyFICO: MyFICO provides access to your FICO scores, the scores most commonly used by lenders, along with credit monitoring and other financial tools.

Before choosing a credit monitoring service, compare the features, benefits, and costs of different providers to find the best fit for your individual needs and budget.

Beyond Credit Monitoring: Proactive Steps for Credit Protection

While credit monitoring is a valuable tool, it's essential to take proactive steps to protect your credit and prevent fraud.

- Regularly Check Your Credit Reports: You're entitled to a free credit report from each of the three major credit bureaus annually through AnnualCreditReport.com. Review these reports carefully for any errors or suspicious activity.

- Create Strong Passwords: Use strong, unique passwords for all your online accounts and avoid using the same password for multiple accounts.

- Be Wary of Phishing Scams: Be cautious of suspicious emails or phone calls requesting personal information. Legitimate companies will rarely ask for sensitive information via email or phone.

- Secure Your Mail: Consider using a locking mailbox to prevent mail theft, as thieves can use your mail to steal your identity.

- Shred Sensitive Documents: Shred any documents containing personal or financial information before discarding them.

- Monitor Your Bank Accounts: Regularly monitor your bank accounts for any unauthorized transactions.

- Consider a Credit Freeze: A credit freeze restricts access to your credit report, making it more difficult for identity thieves to open new accounts in your name. You can lift the freeze temporarily when you need to apply for credit.

Conclusion: Prioritizing Credit Check Monitoring for Financial Security

In today's digital age, credit check monitoring is no longer a luxury; it's a necessity. Whether you're a USAA member exploring their partnered options or considering alternative services, actively monitoring your credit is a crucial step in protecting your financial well-being. By staying vigilant and taking proactive measures, you can minimize the risk of fraud, identity theft, and credit errors, ultimately safeguarding your financial future. Remember to regularly review your credit reports, create strong passwords, and be cautious of phishing scams to further enhance your credit protection efforts. Taking control of your credit health empowers you to make informed financial decisions and achieve your long-term financial goals.

Don't wait until you're a victim of fraud to start monitoring your credit. Take proactive steps today to protect your financial future.

By understanding your options and implementing effective credit protection strategies, you can confidently navigate the complex world of credit and maintain a healthy financial profile.