Longest Loan Term For Used Car

The allure of a new (to you) ride is strong. Whether it's a classic Ford Mustang project car, a reliable Toyota Camry for daily commutes, or a rugged Jeep Wrangler for off-road adventures, the used car market offers something for everyone. But financing that dream, especially in today's economic climate, often involves navigating the world of auto loans. And one of the biggest questions many buyers face is: how long of a loan term should I consider for a used car?

Understanding Loan Terms and Their Impact

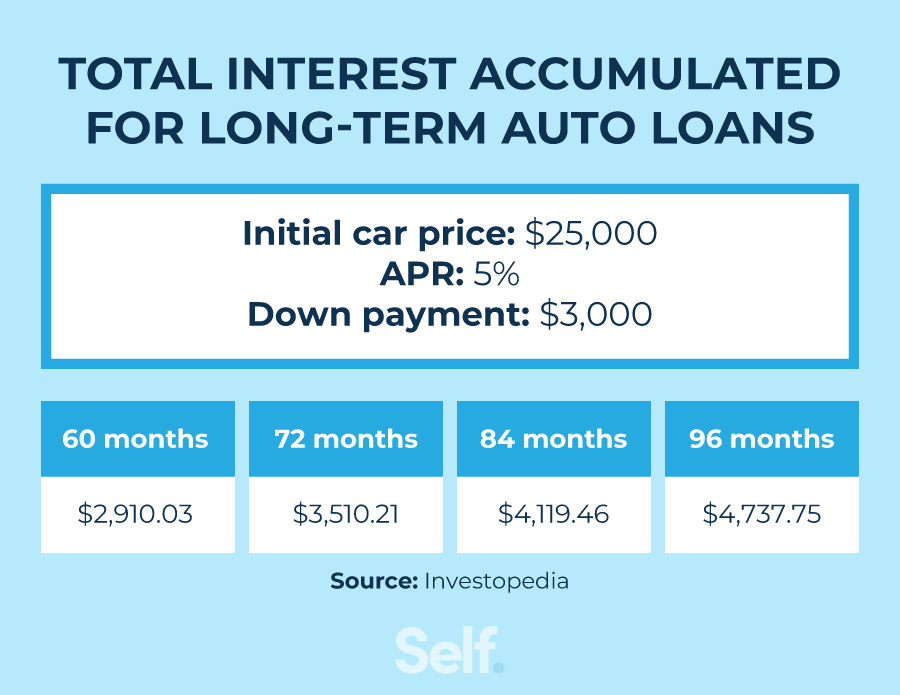

A loan term, in its simplest form, is the amount of time you have to repay the loan. For used cars, loan terms can range from as short as 24 months (2 years) to as long as 84 months (7 years), and even longer in some cases. The longer the term, the lower your monthly payment will be. Sounds great, right? Not so fast. There's a significant trade-off at play: interest.

Think of interest as the cost of borrowing money. It's the fee the lender charges you for the privilege of using their funds. The longer your loan term, the more interest you'll pay over the life of the loan. This is because interest accrues on the outstanding balance, and with a longer term, your balance remains higher for a longer period.

Example: The Classic Camaro

Let's say you're eyeing a 1969 Chevrolet Camaro. The asking price is $25,000, and you've secured an interest rate of 7% (a hypothetical rate for illustration). Here's how different loan terms might affect your finances:

- 36-Month Loan (3 Years): Your monthly payment would be around $773.04, and you'd pay a total of roughly $2,732.14 in interest.

- 60-Month Loan (5 Years): Your monthly payment drops to around $495.01, but you'll pay a total of roughly $4,700.55 in interest.

- 72-Month Loan (6 Years): Your monthly payment decreases further to about $427.94, but the total interest paid balloons to approximately $5,791.72.

- 84-Month Loan (7 Years): The monthly payment is even lower at around $382.43, but the total interest paid becomes a hefty $7,124.41.

As you can see, while the 84-month loan offers the lowest monthly payment, you'll end up paying nearly $4,400 more in interest compared to the 36-month loan. That extra money could be used for repairs, upgrades, or even another project car!

Factors Affecting Loan Term Availability and Rates

Not all used cars qualify for the longest loan terms, and interest rates vary significantly based on several factors:

- Age and Mileage of the Car: Lenders typically prefer to finance newer cars with lower mileage. Older cars with high mileage are seen as riskier investments because they are more likely to require repairs and maintenance. A 2005 Honda Civic with 200,000 miles may not qualify for a 72- or 84-month loan, while a 2018 Ford F-150 with 60,000 miles might.

- Credit Score: Your credit score is a crucial determinant of your interest rate. A higher credit score (700 or above) signals to lenders that you are a reliable borrower, and they will offer you lower interest rates. A lower credit score means you're perceived as a higher risk, leading to higher interest rates.

- Loan Amount: Smaller loan amounts often come with shorter loan terms. If you're only borrowing $5,000 for a used Mazda Miata, you might only be offered loan terms of 36 or 48 months.

- Lender: Different lenders have different policies and risk tolerances. Credit unions often offer lower interest rates and more flexible loan terms compared to traditional banks or dealerships. Online lenders are another option to explore.

- Down Payment: A larger down payment reduces the loan amount, potentially leading to better interest rates and a shorter loan term. Putting down 20% on a used Subaru Outback, for instance, will show the lender that you are serious and reduces their financial exposure.

The Technical Side: Amortization Schedules

Understanding how your loan is structured requires a look at amortization. An amortization schedule is a table that shows how each payment is allocated between principal and interest. In the early stages of a longer loan term, a larger portion of your payment goes towards interest, and only a small amount goes towards reducing the principal balance.

Imagine a scenario where you're restoring a classic Mercedes-Benz W123. You take out a 72-month loan. For the first year or two, a significant chunk of each payment is just covering the interest. You might not see a substantial decrease in the principal balance for quite some time. This means that if you decide to sell the car or refinance the loan after a year or two, you might still owe a considerable amount.

You can often request an amortization schedule from your lender or use online calculators to create one. This allows you to visualize how your loan balance will decrease over time and how much interest you'll pay in total.

Depreciation vs. Loan Balance

Another crucial factor to consider is depreciation. Cars, like most things, lose value over time. New cars depreciate rapidly in the first few years, but used cars also continue to depreciate, albeit at a slower rate. Ideally, you want your loan balance to decrease faster than the car's value depreciates.

If you opt for a very long loan term, there's a risk of becoming "upside down" on your loan. This means that you owe more on the car than it's actually worth. For example, if you buy a used Nissan Altima with an 84-month loan and then have an accident after three years, the insurance company might only pay out an amount that's less than what you still owe on the loan. You'd be stuck paying the difference.

Practical Takeaways

Here are some practical steps you can take when considering a loan term for a used car:

- Determine Your Budget: Before you even start looking at cars, figure out how much you can realistically afford to spend each month on a car payment, insurance, and maintenance. Be realistic and factor in potential unexpected expenses.

- Shop Around for Interest Rates: Don't settle for the first interest rate you're offered. Get quotes from multiple lenders, including banks, credit unions, and online lenders. Even a small difference in interest rate can save you hundreds or even thousands of dollars over the life of the loan.

- Consider a Shorter Loan Term if Possible: While a longer loan term may seem appealing because of the lower monthly payment, it's usually better to opt for a shorter term if you can afford it. You'll pay less interest overall and build equity in the car faster.

- Make a Larger Down Payment: If you have the cash, making a larger down payment will reduce the loan amount and potentially qualify you for a lower interest rate and a shorter loan term.

- Factor in Future Repair Costs: Used cars are more likely to require repairs than new cars. Set aside a budget for potential maintenance and repairs, especially if you're buying an older or high-mileage vehicle. A pre-purchase inspection by a trusted mechanic is always a good investment.

- Understand the Total Cost of Ownership: Don't just focus on the monthly payment. Consider the total cost of ownership, including interest, insurance, fuel, maintenance, and repairs. This will give you a more accurate picture of how much the car will really cost you in the long run.

- Don't Be Afraid to Walk Away: If you're not comfortable with the loan terms or the overall deal, don't be afraid to walk away. There are plenty of other used cars out there.

Ultimately, the best loan term for a used car depends on your individual financial situation and priorities. By understanding the trade-offs between monthly payments and total interest paid, you can make an informed decision that's right for you.