When Looking For Pre-approval On A Car Loan You Should...

Securing pre-approval for a car loan is a crucial step in the car buying process. It gives you a clear understanding of your budget and strengthens your negotiating position at the dealership. However, approaching pre-approval haphazardly can lead to disappointment, higher interest rates, and even loan denial. This article outlines how to navigate the pre-approval process effectively, ensuring you get the best possible loan terms for your situation. Failing to take the right steps can cost you thousands over the life of the loan and limit your vehicle choices.

Symptoms of a Poorly Managed Pre-Approval Process

- Unexpectedly high interest rates: Finding that the interest rate offered is significantly higher than advertised or what you expected based on your credit score.

- Lower loan amount than needed: Being approved for a loan amount that doesn't cover the cost of the vehicle you want.

- Loan denial: Being rejected for pre-approval altogether, forcing you to scramble for financing at the dealership with potentially worse terms.

- Multiple hard inquiries on your credit report: Seeing numerous hard credit inquiries from different lenders in a short period, negatively impacting your credit score.

- Confusion and stress: Feeling overwhelmed by the paperwork and terminology, and unsure about the best loan options for you.

- Limited vehicle choices: Being restricted to specific makes and models due to the limitations of your pre-approved loan.

- Pressure from the dealership to accept their financing: Feeling pressured to abandon your pre-approval and accept a dealership-offered loan, which may not be in your best interest.

- Discovering discrepancies in your credit report: Finding errors on your credit report that could impact your pre-approval chances.

- Missing out on potential incentives: Failing to research and take advantage of manufacturer or lender incentives that could lower your overall cost.

Root Causes of Pre-Approval Problems

Several factors can contribute to a less-than-ideal pre-approval experience. Understanding these root causes is essential for avoiding them:

- Poor credit score: This is the most common factor. A low credit score signals higher risk to lenders, resulting in higher interest rates or loan denial. Credit scores are determined by several factors, including payment history, amounts owed, length of credit history, credit mix, and new credit.

- Inaccurate credit report: Errors on your credit report, such as incorrect account balances, misreported late payments, or even accounts that aren't yours, can significantly lower your credit score and impact your pre-approval.

- High debt-to-income ratio (DTI): DTI is the percentage of your monthly income that goes towards debt payments. A high DTI indicates that you may struggle to repay the loan, making lenders hesitant to approve you or offering less favorable terms.

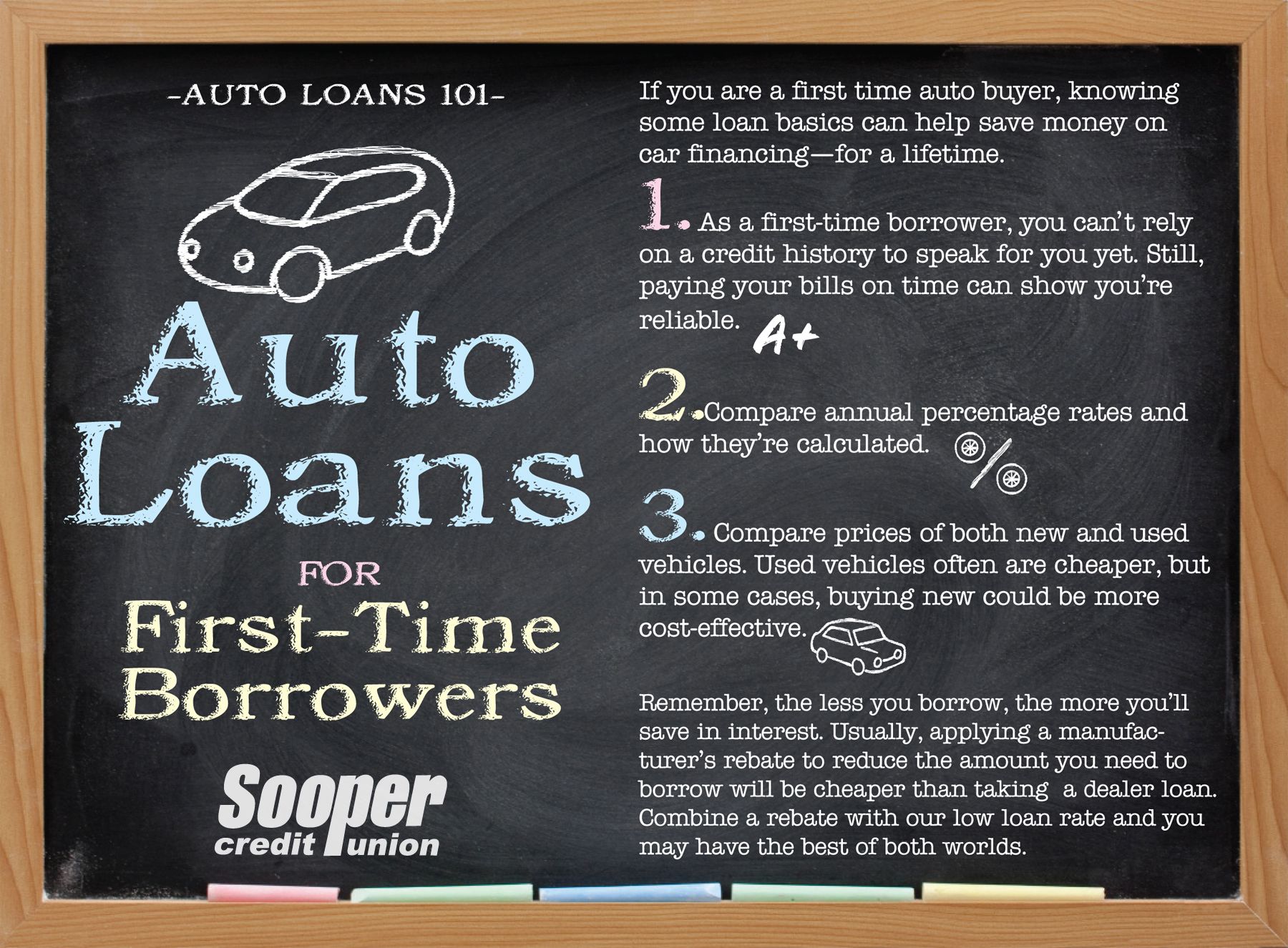

- Limited credit history: If you have a short or limited credit history, lenders may have difficulty assessing your creditworthiness, leading to higher interest rates or loan denial.

- Applying to too many lenders at once: While shopping around for the best rates is recommended, applying to too many lenders within a short timeframe can trigger multiple hard inquiries on your credit report, potentially lowering your score.

- Incomplete or inaccurate information on the application: Providing incorrect or incomplete information on your loan application can raise red flags for lenders and lead to delays or denial. This includes things like misrepresenting your income or employment history.

- Lack of research: Not researching different lenders, interest rates, and loan terms can leave you vulnerable to accepting a suboptimal loan offer.

- Not understanding your budget: Failing to realistically assess your budget and determine how much you can afford to spend on a car loan can lead to overspending and financial strain.

- Ignoring manufacturer incentives: Overlooking manufacturer incentives or special financing offers that could significantly reduce the cost of the vehicle.

- Unstable employment history: A history of frequent job changes or periods of unemployment can raise concerns for lenders about your ability to repay the loan.

What Happens If Pre-Approval Is Ignored or Handled Poorly?

Neglecting the pre-approval process or handling it carelessly can have several negative consequences:

- Higher loan costs: Without pre-approval, you may be forced to accept the financing offered by the dealership, which may have higher interest rates and less favorable terms. Over the life of the loan, this could translate into thousands of dollars in extra interest payments.

- Limited vehicle choices: If you don't know how much you're pre-approved for, you may waste time looking at vehicles outside your budget, leading to disappointment and frustration.

- Damaged credit score: Multiple hard credit inquiries from applying to too many lenders can temporarily lower your credit score.

- Increased financial stress: A poorly managed loan can strain your budget and make it difficult to meet other financial obligations.

- Difficulty refinancing later: If you accept a bad loan offer, it may be difficult to refinance to a better rate later on, especially if your credit score has been negatively impacted.

- Missed opportunities: You may miss out on potential incentives or discounts that are available to pre-approved buyers.

Recommended Fixes for a Smooth Pre-Approval Process

To ensure a successful pre-approval experience, follow these steps:

- Check your credit report and score: Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com. Review them carefully for any errors or inaccuracies. Dispute any errors immediately with the credit bureau and the creditor reporting the information. Knowing your credit score allows you to estimate the interest rates you're likely to qualify for.

- Improve your credit score: If your credit score is less than ideal, take steps to improve it before applying for pre-approval. This includes paying your bills on time, reducing your credit card balances, and avoiding opening new credit accounts.

- Calculate your debt-to-income ratio (DTI): Determine your DTI by dividing your total monthly debt payments by your gross monthly income. Aim for a DTI of 43% or lower for the best chances of approval with favorable terms.

- Determine your budget: Before you even start looking at cars, figure out how much you can realistically afford to spend each month on a car payment. Consider factors like insurance, gas, maintenance, and other expenses.

- Shop around for the best rates: Compare interest rates and loan terms from multiple lenders, including banks, credit unions, and online lenders. Pre-qualification tools (soft credit pulls) allow you to check potential rates without impacting your credit score. Aim to submit all your formal applications within a 14-day window to minimize the impact of multiple hard inquiries on your credit.

- Gather necessary documentation: Be prepared to provide lenders with documentation such as proof of income (pay stubs, tax returns), proof of residence (utility bills, lease agreement), and identification.

- Be honest and accurate on your application: Provide accurate and complete information on your loan application. Lying or omitting information can lead to denial or even legal consequences.

- Read the fine print: Carefully review the terms and conditions of any loan offer before accepting it. Pay attention to the interest rate, loan term, fees, and any other restrictions.

- Understand manufacturer incentives: Research any manufacturer incentives or special financing offers that may be available for the vehicle you're interested in. These incentives can often be combined with pre-approved financing for even greater savings.

- Consider a co-signer: If you have a limited credit history or a low credit score, consider asking a trusted family member or friend with good credit to co-sign the loan. This can increase your chances of approval and potentially lower your interest rate.

- Negotiate with the dealership: Even with pre-approval, don't be afraid to negotiate the price of the vehicle and the terms of the loan with the dealership. Use your pre-approval as leverage to get the best possible deal.

Cost Estimates and Shop Advice

While the pre-approval process itself doesn't involve direct costs (other than potential application fees from some lenders, which are rare), there are indirect costs associated with neglecting the process:

- Higher interest rates: An interest rate that's even 1% higher can add hundreds or even thousands of dollars to the total cost of the loan.

- Fees and penalties: Some loans may include fees for early repayment or other penalties, which can add to the overall cost.

- Credit repair services: If your credit report contains errors, you may need to hire a credit repair service to help you correct them. This can cost several hundred dollars.

Shop Advice:

- Focus on the total cost of the loan, not just the monthly payment. A lower monthly payment may seem attractive, but it could mean a longer loan term and more interest paid overall.

- Be wary of dealerships that pressure you to abandon your pre-approval. They may be trying to steer you towards a loan with higher interest rates and fees.

- Don't be afraid to walk away from a bad deal. There are plenty of other lenders and dealerships out there.

By taking a proactive and informed approach to the pre-approval process, you can secure the best possible loan terms and make the car buying experience much smoother and more enjoyable. Remember to prioritize your credit health, research your options, and negotiate confidently.