When Do You Need Gap Insurance

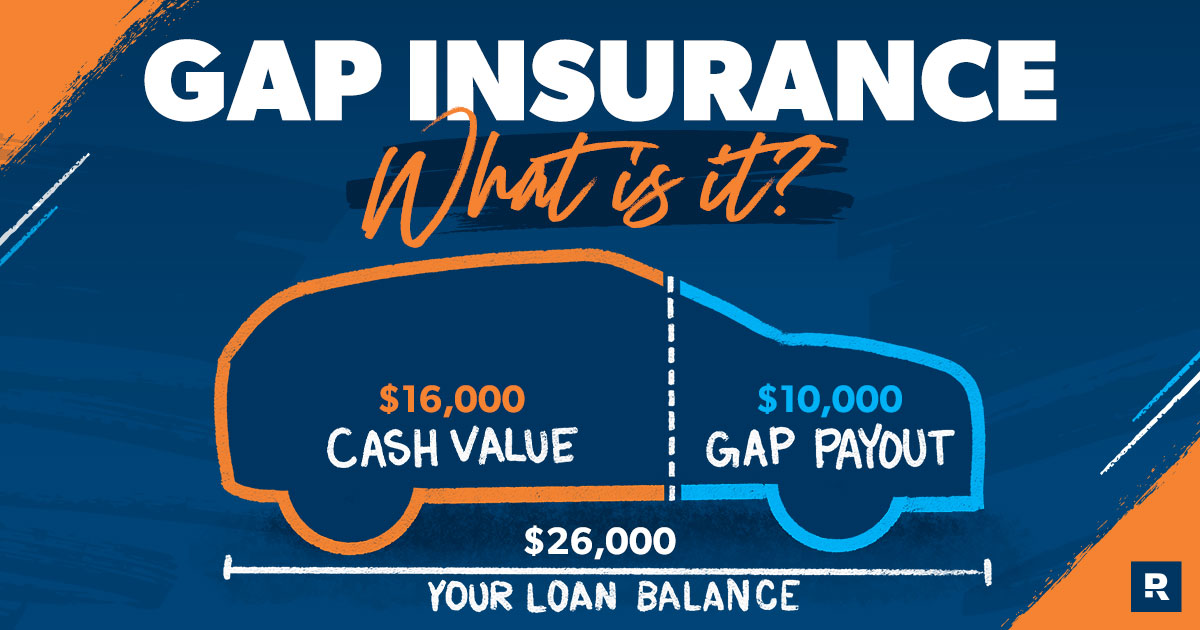

Buying a new or used car is exciting, but it also comes with financial responsibilities. While you're probably familiar with auto insurance, you might not know about Gap Insurance. The problem is, without it, you could find yourself owing a significant amount of money on a car that's been totaled or stolen. So, when do you need Gap Insurance? The answer is simple: you need it when the amount you owe on your car loan or lease is more than the car's actual cash value (ACV). This is crucial because your standard auto insurance only covers the ACV, leaving you to foot the bill for the remaining loan balance.

Symptoms You Might Need Gap Insurance

Here are some telltale signs that Gap Insurance might be a wise investment for you:

- You made a small down payment: The less you put down, the more you finance, and the greater the risk of being "upside down" on your loan.

- You have a long loan term (60 months or more): Longer loan terms mean slower equity build-up. It takes longer to pay down the principal, increasing the chance that you'll owe more than the car is worth, especially in the early years of the loan.

- You financed taxes, title, and other fees: Rolling these extra costs into your loan increases the initial loan amount, widening the gap between what you owe and the car's value.

- You bought a car that depreciates quickly: Some car models lose value faster than others. Research the depreciation rates of the specific vehicle you're considering. Luxury vehicles, in particular, tend to depreciate rapidly.

- You leased the vehicle: Leases typically have a significant difference between the vehicle's value and the amount you owe throughout the lease term. Gap coverage is often included, or required, in lease agreements.

- You're trading in a car with negative equity: If you rolled the negative equity from your old car into your new car loan, you're already starting with a larger loan balance and a higher risk of being upside down.

- The finance manager is strongly suggesting it: While sales pressure should always be met with careful consideration, their insistence might be a red flag that your loan terms are making you a higher-risk candidate for a gap. Listen to their reasoning, but do your own research!

The Root Cause: Depreciation and Loan Terms

The underlying cause of the need for Gap Insurance is the mismatch between the vehicle's depreciation rate and the rate at which you're paying down your loan. Cars are depreciating assets. They lose value over time, often quite rapidly in the first few years. This is especially true for new cars; they can lose a significant percentage of their value the moment you drive them off the lot.

Here's a simplified example: Let's say you buy a new car for $30,000. After one year, its ACV might only be $25,000 due to depreciation. If you only made a small down payment and your loan balance is still $28,000, you're $3,000 "upside down." If the car is totaled, your regular insurance will only pay out $25,000, leaving you to cover the remaining $3,000.

Longer loan terms exacerbate this problem. Spreading the loan payments over a longer period reduces the monthly payments, making the car more affordable. However, it also means you're paying more interest and building equity slower. This increases the likelihood of the loan balance exceeding the car's value.

Ignoring the Need: A Costly Mistake

What happens if you ignore the potential need for Gap Insurance and your car is totaled or stolen? The consequences can be financially devastating. You'll be left owing the difference between the ACV of the car (covered by your regular insurance) and the remaining loan balance. This could be thousands of dollars that you're still obligated to pay, even though you no longer have the car. Imagine paying off a loan for a car you can no longer drive! It can damage your credit score and make it difficult to obtain future loans.

Recommended Fixes: Gap Insurance and Smart Car Buying

The primary fix is to purchase Gap Insurance. Here's how to approach it:

- Shop around: Don't automatically accept the Gap Insurance offered by the dealership. Compare prices from different providers, including your existing auto insurance company. Sometimes, you can get a better deal bundling it with your current policy.

- Understand the coverage: Make sure you understand what the Gap Insurance policy covers and any exclusions. Check the maximum amount the policy will pay out, and ensure it’s adequate for your situation.

- Consider alternatives: Depending on your financial situation, you might consider increasing your down payment, opting for a shorter loan term, or purchasing a less expensive car to minimize the risk of being upside down.

Beyond Gap Insurance, practicing smart car buying habits is crucial:

- Make a larger down payment: This immediately reduces the loan amount and builds equity in the car. Aim for at least 20% down if possible.

- Choose a shorter loan term: A shorter loan term means higher monthly payments, but you'll pay less interest overall and build equity faster.

- Research vehicle depreciation: Before buying a car, research its predicted depreciation rate. Some cars hold their value better than others. Resources like Kelley Blue Book and Edmunds can help.

- Avoid rolling over negative equity: If you're trading in a car with negative equity, try to pay it off before buying a new car. Rolling it into the new loan will put you in a hole from the start.

Cost Estimates and Shop Advice

The cost of Gap Insurance can vary depending on several factors, including the car's value, the loan amount, the loan term, and the insurance provider. Generally, you can expect to pay anywhere from $200 to $700 for a Gap Insurance policy. Some dealerships include it in the financing package, while others offer it as an add-on.

Here's some advice when dealing with the dealership:

- Don't feel pressured: Take your time to research and compare options. Don't let the finance manager rush you into a decision.

- Negotiate the price: The price of Gap Insurance is often negotiable. Don't be afraid to haggle.

- Read the fine print: Carefully review the terms and conditions of the policy before signing anything.

- Get it in writing: Ensure that all agreed-upon terms, including the price of Gap Insurance, are clearly documented in writing.

While there aren't specific TSBs (Technical Service Bulletins) related directly to Gap Insurance, it's worthwhile to check online forums and communities specific to your vehicle's make and model. You might find discussions about depreciation trends or experiences with different Gap Insurance providers. This type of crowdsourced information can be valuable in making an informed decision.

In conclusion, Gap Insurance is a safety net designed to protect you from financial loss if your car is totaled or stolen and you owe more than it's worth. By understanding the factors that contribute to the need for Gap Insurance and taking proactive steps to mitigate the risk, you can ensure that you're adequately protected and avoid a potentially costly financial burden.