When Does Gap Insurance Kick In

Gap insurance, short for Guaranteed Asset Protection insurance, is designed to cover the difference between what you owe on your car loan and what your insurance company pays out if your car is totaled or stolen. Understanding when gap insurance kicks in is crucial to maximizing its benefits and avoiding unexpected financial burdens. In essence, gap insurance kicks in after your primary auto insurance has paid out its portion of the claim, and only if the payout is less than the outstanding balance on your loan or lease.

Why Understanding When Gap Insurance Kicks In Matters

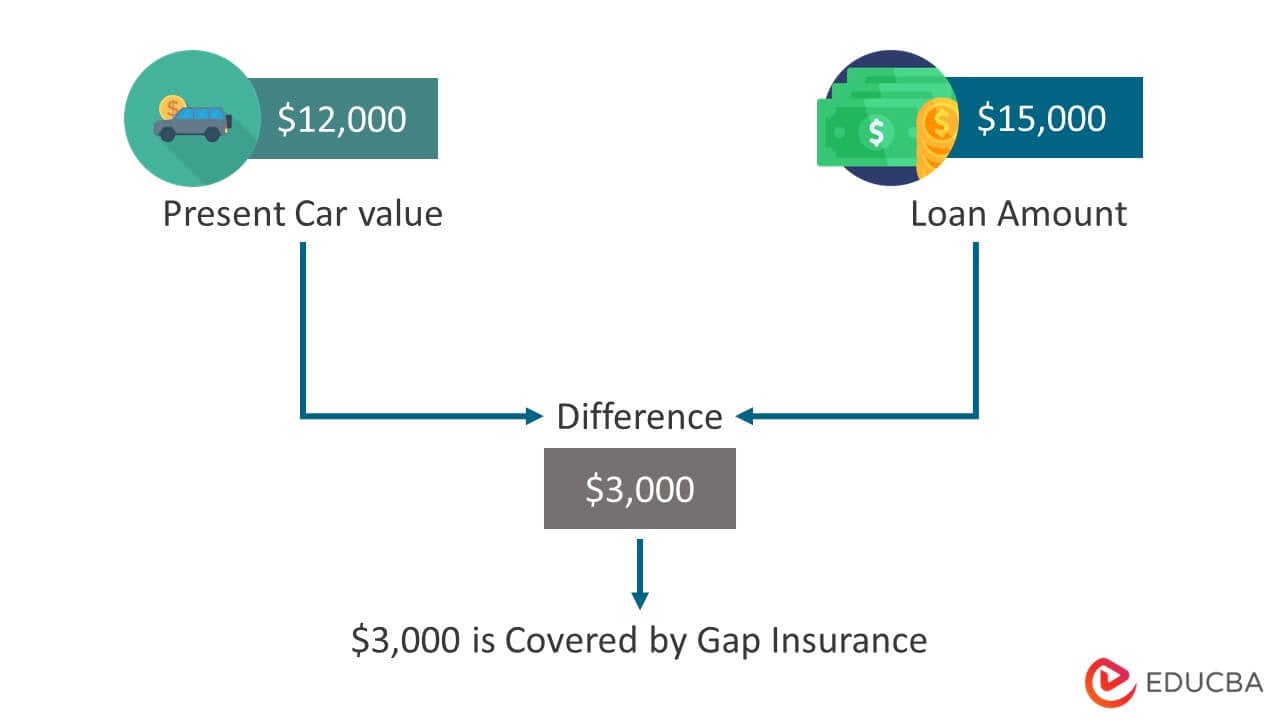

The importance of understanding the activation point of gap insurance stems from several key factors. Firstly, cars depreciate rapidly. The moment you drive a new car off the lot, its value begins to decrease. In the first few years, this depreciation can be significant. If your car is totaled or stolen early in your loan term, the amount you owe might be considerably more than the car's actual cash value (ACV), which is what your standard auto insurance covers. This difference, known as the "gap," is precisely what gap insurance is meant to address.

Secondly, without gap insurance, you could be left owing thousands of dollars on a car you no longer possess. Imagine you owe $25,000 on your car loan, but your insurance company only values the car at $20,000. Without gap insurance, you would be responsible for paying the remaining $5,000 to the lender. This can be a significant financial hardship, especially when you're also dealing with the loss of your vehicle and the need to secure replacement transportation.

Thirdly, some loan or lease agreements require gap insurance as a condition of the financing. This is especially common with leases, where the depreciation is often factored into the monthly payments. In such cases, understanding when the coverage activates is crucial to fulfilling your contractual obligations and avoiding penalties.

Finally, knowing the specifics of your gap insurance policy allows you to plan financially. It prevents unpleasant surprises and empowers you to make informed decisions about your vehicle financing and insurance coverage.

Specific Triggers for Gap Insurance Activation

While the general principle is that gap insurance kicks in after the primary insurance payout, several specific conditions must be met for the coverage to activate:

- The vehicle must be declared a total loss or stolen: Gap insurance only applies when your vehicle is deemed a total loss by your insurance company or when it is stolen and unrecovered. Minor damage, repairs, or mechanical issues are not covered.

- The primary insurance policy must pay out: Gap insurance is a secondary coverage. It only kicks in after your comprehensive or collision coverage has paid out the ACV of the vehicle. You must file a claim with your primary insurance provider first.

- The loan balance must exceed the ACV: The core purpose of gap insurance is to cover the difference between your loan balance and the ACV. If your loan balance is less than or equal to the ACV, gap insurance will not be needed.

- The gap coverage limits must not be exceeded: Gap insurance policies have coverage limits. If the difference between your loan balance and the ACV exceeds the policy's maximum payout, you will still be responsible for the remaining balance.

- The policy must be active and in good standing: Your gap insurance policy must be active and you must be current on your premium payments for the coverage to be valid.

How to Choose the Right Gap Insurance Policy

Selecting the right gap insurance policy involves several considerations to ensure it adequately protects you from potential financial losses. Here's a guide to help you make an informed decision:

- Compare quotes from multiple providers: Don't settle for the first offer you receive. Get quotes from different insurance companies, dealerships, and credit unions to compare coverage options and premiums.

- Understand the coverage limits: Make sure the policy's coverage limits are sufficient to cover the potential gap between your loan balance and the ACV of your vehicle. Consider the purchase price of your vehicle and its expected depreciation rate.

- Check for exclusions: Read the policy carefully to understand any exclusions that may limit coverage. Common exclusions include pre-existing damage, overdue loan payments, and modifications to the vehicle.

- Consider the deductible: Some gap insurance policies have a deductible. Understand how the deductible will affect your payout in the event of a claim.

- Evaluate the cancellation policy: Find out if you can cancel the policy and receive a refund if you pay off your loan early or refinance.

- Determine if it overlaps with other coverage: Check if your auto insurance policy or loan agreement already includes gap coverage. Avoid paying for redundant coverage.

- Assess the reputation of the provider: Research the insurance company's reputation for customer service and claims handling. Look for reviews and ratings from other customers.

Real-World Owner Experiences with Gap Insurance

Hearing from others who have used gap insurance can provide valuable insights into its real-world benefits and potential drawbacks. Many owners share stories of how gap insurance saved them from owing thousands of dollars after their vehicles were totaled. They emphasize the peace of mind that comes with knowing they are protected from financial hardship in the event of a loss.

However, some owners also express frustration with the claims process or policy exclusions. They highlight the importance of carefully reading the policy terms and understanding the coverage limits. Others regret purchasing gap insurance when it turned out they didn't need it, such as when they paid off their loan early or their vehicle depreciated less than expected.

Overall, the majority of owners who have used gap insurance report a positive experience. They view it as a valuable investment that provided financial protection during a difficult time. However, it's essential to weigh the potential benefits against the cost and individual circumstances to determine if gap insurance is the right choice for you.

Frequently Asked Questions About Gap Insurance

What is the difference between gap insurance and full coverage?

Full coverage typically refers to a combination of comprehensive and collision insurance, which covers damage to your vehicle from accidents, theft, vandalism, and other perils. Gap insurance, on the other hand, covers the difference between your loan balance and the vehicle's actual cash value. Full coverage pays for the value of the car; gap covers the deficiency.

Is gap insurance required?

Gap insurance is generally not required by law, but it may be required by your lender or leasing company as a condition of the financing agreement. It's important to check your loan or lease documents to determine if gap insurance is mandatory.

How long do I need gap insurance?

You typically only need gap insurance until your loan balance is less than the vehicle's actual cash value. You can track your loan balance and monitor the vehicle's depreciation to determine when to cancel the policy.

Can I cancel gap insurance?

Yes, you can usually cancel gap insurance at any time. However, you may only receive a partial refund of your premium, depending on the policy's terms and conditions. Check your policy or contact your insurance provider for more information.

Does gap insurance cover my deductible?

Some gap insurance policies may cover your primary insurance deductible, while others may not. Check the policy details to see if deductible coverage is included.

What if my car is repossessed?

Gap insurance typically does not cover repossession. Repossession is usually excluded from coverage because it results from failure to make loan payments, not a covered event like theft or total loss.

Where can I buy gap insurance?

You can purchase gap insurance from various sources, including your auto insurance company, your car dealership, your bank or credit union, and specialized gap insurance providers. Compare quotes and coverage options from different sources to find the best deal.

Does gap insurance cover negative equity from a previous car loan?

This depends on the specific policy. Some gap insurance policies cover negative equity rolled over from a previous loan, while others do not. Carefully review the policy terms to determine if this coverage is included.