When Should You Buy Gap Insurance

The showroom gleams. The leather smells divine. You've finally signed the papers and are driving off in your dream car. But lurking beneath the surface of that joyous moment is a financial risk many overlook: the potential for significant loss if your new car is totaled or stolen. This is where Gap Insurance, or Guaranteed Asset Protection, comes into play. But when is it *really* worth the investment? This guide will delve into the mechanics of gap insurance, exploring when it's a wise purchase and when it might be an unnecessary expense.

Understanding the Gap: A Scenario

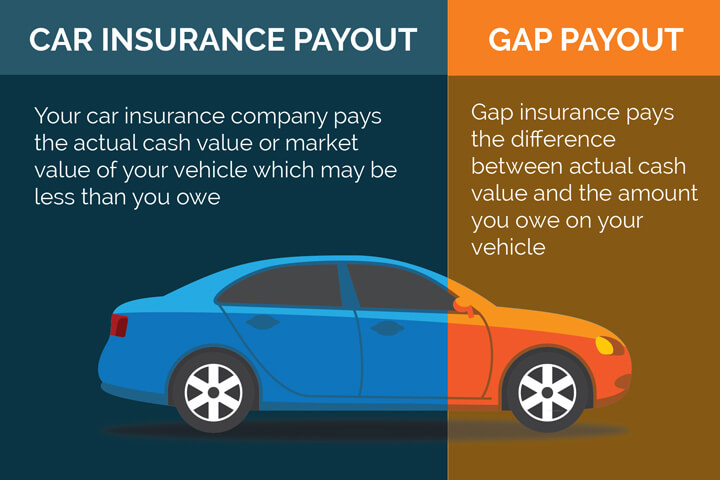

Imagine this: You purchase a brand-new SUV for $40,000. Two years later, through depreciation and wear and tear, its market value has decreased to $25,000. Unfortunately, you're involved in an accident, and the SUV is deemed a total loss. Your standard auto insurance covers the current market value, $25,000. However, you still owe $33,000 on your auto loan. This leaves you with an $8,000 "gap" between what your insurance pays and what you owe. This is precisely the situation gap insurance is designed to address.

Think of it like this: you’re buying a house, and the market takes a sudden dive. Your house’s value decreases. If you sell, you will lose money. Gap insurance works similarly. It's a financial safety net designed to cover the difference between your loan balance and the actual cash value (ACV) of your vehicle if it's totaled or stolen.

How Gap Insurance Works: The Mechanical Breakdown

Gap insurance doesn't replace your standard auto insurance; rather, it supplements it. It kicks in after your primary insurance has paid out the ACV of your vehicle. Let's break down the process:

- Total Loss Event: Your vehicle is declared a total loss due to an accident, theft, or other covered event.

- Primary Insurance Payout: Your standard auto insurance company assesses the ACV of your vehicle at the time of the loss and issues a payout. This payout is based on factors like the vehicle's age, mileage, condition, and prevailing market prices.

- Gap Insurance Activation: You file a claim with your gap insurance provider. They will coordinate with your primary insurance company to determine the ACV payout and your outstanding loan balance.

- Gap Coverage Calculation: The gap insurance provider calculates the difference between your loan balance (including any outstanding deductible from your primary insurance) and the ACV payout. This difference, up to the policy's coverage limit, is then paid to your lender to settle the remaining loan balance.

It's important to understand the fine print. Most gap insurance policies have coverage limits (e.g., a maximum payout of $50,000 or a percentage of the vehicle's original MSRP). They also typically exclude certain charges, such as extended warranties, negative equity rolled over from a previous loan, and overdue payments. Make sure to read the policy carefully to understand its limitations.

Pros and Cons of Gap Insurance

Pros:

- Financial Protection: The primary advantage is the peace of mind of knowing you won't be stuck owing money on a car you can no longer drive. This can be especially crucial if you're on a tight budget.

- Debt Relief: Avoids the burden of paying off a substantial loan balance after a total loss, preventing potential financial hardship.

- Quicker Path to a New Car: By eliminating the outstanding debt, gap insurance allows you to start fresh and purchase a replacement vehicle sooner.

Cons:

- Cost: Gap insurance adds to the overall cost of vehicle ownership. Premiums can vary depending on the provider and coverage level.

- Potential Overlap with Other Coverage: Some insurance policies, particularly those offered by manufacturers, may include similar coverage or debt forgiveness clauses, potentially making gap insurance redundant.

- Not Always Necessary: If you make a substantial down payment or have a short loan term, the risk of a significant gap between the loan balance and ACV may be minimal.

Use Cases: When Gap Insurance Makes Sense

Here are situations where gap insurance is generally a smart decision:

- Large Down Payment: If you've made a small down payment (less than 20%) on a new or used vehicle, the risk of negative equity increases. The more you finance, the more you will depreciate.

- Long Loan Term: With longer loan terms (e.g., 60 months or more), the rate of depreciation often exceeds the rate at which you're paying down the loan, increasing the likelihood of a gap.

- High Depreciation Vehicles: Certain makes and models depreciate more rapidly than others. Research the depreciation rates of the vehicles you're considering. Luxury cars, SUVs, and trucks often depreciate more quickly.

- Leased Vehicles: Gap insurance is almost always included in lease agreements because leasing involves only paying for the vehicle’s predicted depreciation. You don't own any assets.

- Rollover Equity: If you rolled negative equity from a previous car loan into your current loan, you're starting with a higher debt balance, increasing the need for gap coverage.

Manufacturer Examples and Availability

Many auto manufacturers and dealerships offer gap insurance as part of their financing packages. For example:

- Ford: Ford Credit offers "Guaranteed Asset Protection" (GAP) as an add-on to their financing options.

- Toyota: Toyota Financial Services provides "Guaranteed Auto Protection" (GAP) plans.

- Other Manufacturers: Most major manufacturers, including Honda, Nissan, and Chevrolet, offer similar GAP programs through their financing arms.

You can also purchase gap insurance from independent insurance companies or credit unions. Comparing quotes from different sources is essential to ensure you're getting the best value.

Alternatives to Gap Insurance

While gap insurance is a common solution, there are alternative approaches to mitigating the risk of negative equity:

- Larger Down Payment: As mentioned earlier, a larger down payment reduces the initial loan amount, decreasing the likelihood of a gap.

- Shorter Loan Term: Opting for a shorter loan term allows you to pay off the loan more quickly, keeping pace with depreciation.

- Consider Used Vehicles: New cars depreciate rapidly in the first few years. Buying a slightly used vehicle can help avoid the steepest depreciation curve.

- Refinancing: If you find yourself underwater on your auto loan, refinancing at a lower interest rate or with a longer term might help reduce the gap. However, be cautious about extending the loan term excessively, as this could increase your overall interest payments.

Real-World Insights and Recommendations

The decision of whether to purchase gap insurance is a personal one, depending on your individual financial situation and risk tolerance. However, here are some final insights based on real-world use:

- Assess Your Risk Profile: Consider factors like your down payment, loan term, vehicle type, and driving habits. If you're in a high-risk category (e.g., long loan term, high-depreciation vehicle), gap insurance is worth serious consideration.

- Shop Around for the Best Rate: Don't automatically accept the gap insurance offered by the dealership. Compare quotes from multiple providers to find the most competitive price.

- Understand the Policy's Exclusions: Read the fine print carefully to understand what the policy covers and excludes. Pay attention to coverage limits and any exclusions for specific types of losses.

- Don't Duplicate Coverage: If you already have similar coverage through your primary insurance policy or another source, gap insurance may be redundant.

- Re-evaluate Your Coverage Needs: As you pay down your loan, the need for gap insurance diminishes. You may be able to cancel the policy and receive a partial refund if you determine that it's no longer necessary.

Ultimately, gap insurance is a tool for managing risk. By carefully evaluating your individual circumstances and understanding the mechanics of how it works, you can make an informed decision about whether it's the right choice for you. It might just provide the financial security you need to enjoy that new car without the worry of a potentially devastating financial loss.