Business Vehicle Trade-in Worksheet 2020

Trading in a vehicle used for business purposes involves specific considerations compared to a personal vehicle trade-in. Understanding the tax implications and properly documenting the transaction is crucial. While the year 2020 has passed, the principles behind a business vehicle trade-in worksheet remain relevant and serve as a valuable template for any year. This article will guide you through the process, highlighting key areas and providing a framework for your calculations.

Understanding Business Vehicle Trade-Ins

When you use a vehicle for business, you're likely claiming deductions for depreciation and expenses. Trading in that vehicle can impact your tax liability. The core concept revolves around determining whether you have a gain or a loss on the trade-in, which then affects how you report the transaction to the IRS. A business vehicle trade-in worksheet helps you organize all the necessary information to make these calculations accurately.

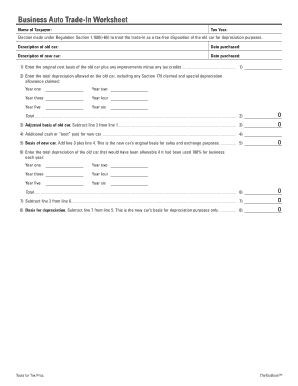

Key Components of a Business Vehicle Trade-In Worksheet

A comprehensive worksheet should include the following sections:

- Vehicle Information: Make, model, year, VIN.

- Original Purchase Information: Purchase date, purchase price, sales tax paid, and any related expenses incurred at the time of purchase (e.g., registration fees).

- Depreciation Details: Total accumulated depreciation claimed over the vehicle's life. This is arguably the most important figure.

- Trade-In Value: The agreed-upon value of the vehicle offered by the dealership.

- Adjusted Basis: This is your original cost basis (purchase price + related expenses) minus accumulated depreciation.

- Gain or Loss Calculation: Trade-in value minus adjusted basis. A positive result indicates a gain; a negative result indicates a loss.

- New Vehicle Information: Purchase price of the new vehicle, sales tax, and any related expenses.

- Business Use Percentage: The percentage of time the vehicle was used for business purposes. This figure is critical for calculating deductible expenses and depreciation.

Step-by-Step Guide to Completing the Worksheet

Let's break down how to fill out each section of the worksheet. Remember to keep thorough records to support your calculations.

1. Gathering Vehicle and Purchase Information

Start by gathering the basic details about your old vehicle. This includes the make, model, year, and Vehicle Identification Number (VIN). Then, locate your original purchase documents. You'll need the purchase date, the purchase price before taxes, and the amount of sales tax you paid. Also, include any expenses directly related to the purchase, such as registration fees or dealer preparation fees. These all contribute to your initial cost basis.

2. Calculating Accumulated Depreciation

This is where things can get a bit more complex. You need to determine the total amount of depreciation you've claimed on the vehicle over its years of service. This information is usually found on your previous tax returns, specifically Form 4562 (Depreciation and Amortization). Make sure you’re using the correct depreciation method (e.g., straight-line, accelerated depreciation) as this significantly impacts the total amount.

Important Note: If you used the standard mileage rate in any year, you’ll need to adjust the basis of the vehicle for depreciation deemed to have been taken. The IRS provides deemed depreciation rates for each year the standard mileage rate is used. Make sure you account for this!

3. Determining Adjusted Basis

The adjusted basis is your original cost basis (purchase price + related expenses) minus the accumulated depreciation. This figure represents your vehicle's value for tax purposes at the time of the trade-in.

Formula: Adjusted Basis = Original Cost Basis - Accumulated Depreciation

4. Calculating Gain or Loss on the Trade-In

This is a crucial step. Subtract your adjusted basis from the trade-in value you received from the dealership. If the result is positive, you have a gain. If the result is negative, you have a loss.

Formula: Gain or Loss = Trade-In Value - Adjusted Basis

5. Understanding the Tax Implications of a Gain or Loss

The tax implications of a gain or loss on a business vehicle trade-in can be complex and depend on the specific circumstances. Here's a general overview:

- Gain: If you have a gain, it's generally treated as ordinary income to the extent of any depreciation previously taken. This is known as depreciation recapture. Any remaining gain might be treated as a Section 1245 gain. Consulting with a tax professional is highly recommended.

- Loss: In most cases, you cannot deduct a loss on a trade-in. The loss is typically factored into the basis of the new vehicle. This means you'll recover the loss through future depreciation deductions on the new vehicle.

Section 179 Deduction: If you claimed a Section 179 deduction on the original vehicle, the rules can be even more complicated. Seek professional tax advice.

6. Documenting the Transaction

Thorough documentation is essential. Keep copies of the following:

- The trade-in agreement with the dealership

- The purchase agreement for the new vehicle

- Your depreciation schedules from previous tax returns

- Any records of expenses related to the purchase and operation of the vehicle

Example Scenario

Let's say you purchased a van in 2017 for $30,000 and claimed $18,000 in depreciation over the years. Your adjusted basis is $12,000 ($30,000 - $18,000). You trade it in for $15,000. You have a gain of $3,000 ($15,000 - $12,000). This gain would likely be treated as ordinary income to the extent of the depreciation taken ($18,000, but capped at the $3,000 gain).

Why Use a Business Vehicle Trade-In Worksheet?

Using a dedicated worksheet offers several benefits:

- Organization: It provides a structured way to gather and organize all the relevant information.

- Accuracy: It helps you calculate the gain or loss accurately, minimizing the risk of errors on your tax return.

- Tax Planning: It allows you to anticipate the tax implications of the trade-in and plan accordingly.

- Audit Trail: It provides a clear audit trail in case the IRS ever questions your deductions.

Finding a Suitable Worksheet

While you can create your own business vehicle trade-in worksheet, many templates are available online. Search for "business vehicle trade-in worksheet template" or "IRS Form 4562 worksheet." Look for templates that include all the sections mentioned earlier in this article. You can adapt a personal vehicle worksheet, but ensure it has sections for accumulated depreciation and business use percentage.

Disclaimer

This article provides general information and should not be considered tax advice. Tax laws are complex and can change frequently. It's essential to consult with a qualified tax professional to discuss your specific situation and ensure you're complying with all applicable regulations. Incorrectly reporting a business vehicle trade-in can lead to penalties and interest.

Conclusion

Trading in a business vehicle requires careful planning and accurate calculations. A well-structured business vehicle trade-in worksheet is an invaluable tool for navigating the process. By understanding the key components, following the steps outlined in this article, and seeking professional tax advice when needed, you can ensure a smooth and tax-efficient transaction. Remember to keep meticulous records, as documentation is key to supporting your tax filings. While this guidance focuses on the principles applicable even beyond 2020, always refer to the most current IRS guidelines and regulations for the specific tax year in question.