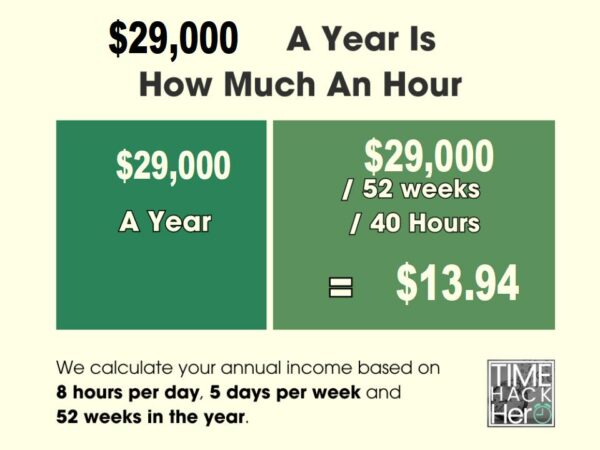

29000 A Year Is How Much An Hour

Alright, let's break down what a $29,000 annual salary translates to on an hourly basis. This isn't about philosophical musings on the value of time, but a practical exercise, much like calculating gear ratios or torque requirements for a specific engine modification. Knowing your effective hourly wage helps in budgeting, evaluating job offers, understanding your worth, and even deciding if that late-night wrenching session on your project car is actually more expensive than just taking it to a pro. We're going to dive into the math, but more importantly, we'll explore the factors that can affect your *real* hourly earnings, just like understanding the parasitic losses in a drivetrain affects the power delivered to your wheels.

The Basic Calculation: Stripping It Down to the Core

The fundamental formula is pretty straightforward. We start with your gross annual salary, the $29,000 in our case, and divide it by the number of hours you work in a year. Now, here's where assumptions come in, much like assuming a certain friction coefficient when calculating braking distances.

Key Specs and Main Parts (of the Calculation):

- Annual Salary (Sannual): $29,000 (the given value).

- Hours Worked Per Week (Hweekly): This is crucial. The standard assumption is 40 hours. But, are you *really* working only 40 hours? This is where we get into the weeds.

- Weeks Worked Per Year (Wannual): Again, a standard assumption is 52 weeks. But, factor in vacation time, sick days, and holidays. Let's assume 2 weeks of vacation and 1 week of holidays, bringing this down to 49 weeks.

The Formula:

Hourly Wage (Whourly) = Sannual / (Hweekly * Wannual)

Applying the Numbers:

Using the 40 hours/week and 49 weeks/year figures:

Whourly = $29,000 / (40 * 49) = $29,000 / 1960 = $14.79 (approximately)

So, based on these assumptions, $29,000 a year is roughly equivalent to $14.79 per hour.

Beyond the Simple Math: Factoring in the Real World

That $14.79 is a starting point, the theoretical horsepower figure before you account for drivetrain losses. To get a more accurate picture, we need to consider additional factors that affect your net take-home pay.

Taxes: The Inevitable Cut

Taxes are like the friction in your engine; they reduce your usable output. Federal income tax, state income tax (if applicable), Social Security, and Medicare all take a chunk out of your gross pay. The exact amount depends on your filing status (single, married, etc.), deductions, and exemptions. A rough estimate for combined taxes could be around 20-30%, but this can vary greatly. Understanding your tax bracket is like understanding the compression ratio of your engine – critical for performance!

Benefits: The Often-Overlooked Value

Benefits are the hidden horsepower boosters. Employer-sponsored health insurance, retirement contributions (like a 401(k) match), paid time off, life insurance, and disability insurance all have a monetary value. Estimating the value of these benefits is crucial. Think of them as upgrades – turbocharger, performance exhaust – that contribute to the overall value. A good benefits package can easily be worth several dollars per hour.

Other Deductions: Fine-Tuning the Calculation

Other deductions, like union dues or contributions to a health savings account (HSA), further refine your hourly wage calculation. These are like adjusting the air-fuel mixture; they affect the final output.

How It Works: A Step-by-Step Guide

- Calculate Gross Annual Hours: Multiply your average weekly hours by the number of weeks you work per year.

- Divide Annual Salary by Gross Annual Hours: This gives you your gross hourly wage.

- Estimate Taxes: Use a tax calculator or consult a tax professional to estimate your federal and state income tax burden.

- Factor in Benefits: Determine the monetary value of your employer-provided benefits. You might need to contact your HR department for specifics.

- Calculate Net Hourly Wage: Subtract taxes and other deductions from your gross hourly wage, then add the value of your benefits. This gives you a much more accurate picture of your *real* hourly earnings.

Real-World Use: Troubleshooting Your Financial "Engine"

Knowing your effective hourly wage can help you make informed financial decisions:

- Job Offers: Compare job offers based on total compensation (salary + benefits) rather than just salary alone.

- Budgeting: Track your spending and identify areas where you can cut back.

- Negotiating: Use your hourly wage as leverage when negotiating a raise or a new job offer.

- Side Hustles: Evaluate the profitability of side gigs or freelance work. Is that extra project car rebuild *really* worth the time investment considering your hourly wage?

Basic Troubleshooting Tips:

- Low Net Hourly Wage: If your net hourly wage is lower than you expect, review your deductions and benefits. Are you taking advantage of all available tax deductions and employer-sponsored programs?

- Inaccurate Assumptions: Revisit your assumptions about hours worked per week and weeks worked per year. Are you consistently working overtime without compensation?

- Benefit Optimization: Ensure you're maximizing your benefits. Are you contributing enough to your 401(k) to receive the full employer match?

Safety: The "Red Flags" in Your Paycheck

Just like checking for oil leaks and worn hoses under the hood, review your pay stubs regularly to identify potential problems:

- Incorrect Deductions: Verify that all deductions are accurate and authorized.

- Wage Theft: Be aware of wage theft practices, such as unpaid overtime or illegal deductions.

- Misclassification: Ensure you're properly classified as an employee or independent contractor. Misclassification can result in lost benefits and unpaid taxes.

Risky Components: The biggest "risky component" is a lack of transparency. Always understand how your pay is calculated and don't hesitate to ask questions if something doesn't seem right. Just like you wouldn't drive a car with a flickering check engine light, don't ignore red flags in your paycheck.

Conclusion

Calculating your hourly wage from a $29,000 annual salary is more than just a simple math problem. It's about understanding the various factors that affect your net take-home pay and making informed financial decisions. By considering taxes, benefits, and other deductions, you can get a much more accurate picture of your *real* hourly earnings and use that information to your advantage.