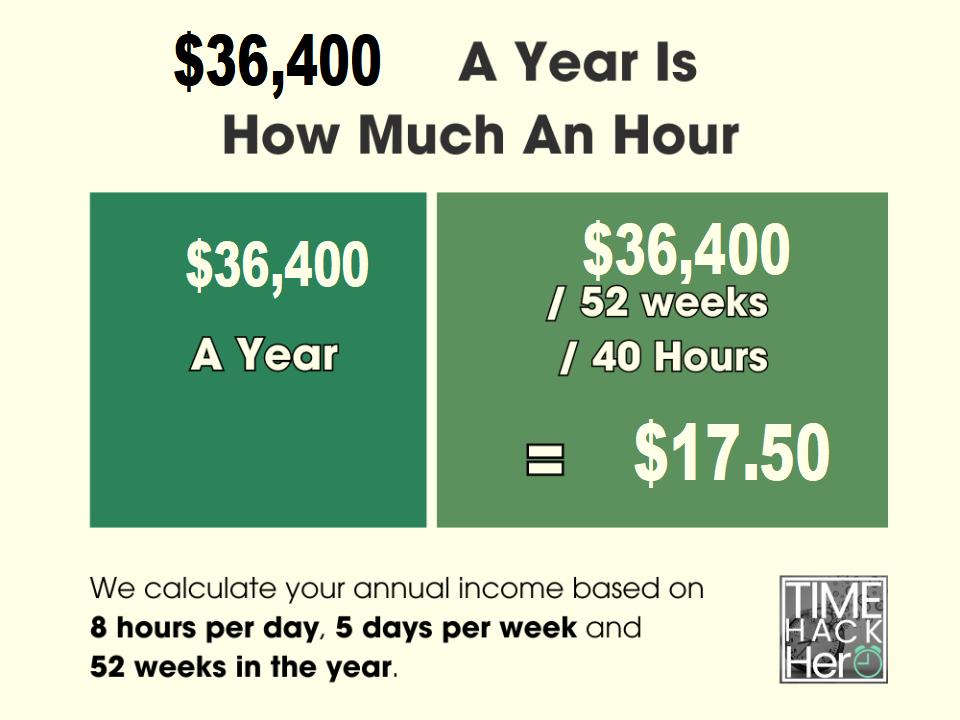

36400 A Year Is How Much An Hour

Alright, gearheads, let's tackle a question that comes up more often than you might think, especially when you're budgeting for that sweet new supercharger or figuring out if a job offer is worth your time under the hood: 36,400 a year – what's that hourly? This might seem simple, but a clear understanding of the calculations involved can be surprisingly useful, especially if you are working on freelance automotive repair projects and need to estimate your income or when evaluating job offers.

Purpose: More Than Just a Number

Why bother with this simple calculation? Well, knowing your equivalent hourly rate opens up a few doors:

- Budgeting: Planning that custom exhaust system build? Knowing your hourly rate lets you realistically estimate how much time you can dedicate to the project each month without going broke.

- Job Offers: Comparing a salaried position to freelance work requires understanding the hourly equivalent. Is that seemingly great salary actually paying less per hour than your side gig repairing transmissions?

- Negotiating: Armed with your hourly rate based on your current workload and income, you can confidently negotiate better rates for your automotive services.

- Tracking Expenses: For freelance mechanics, understanding the hourly earnings helps offset work expenses.

Key Specs and Main Parts: The Formula

The core of this calculation revolves around understanding the relationship between annual salary, work hours per week, and weeks worked per year. Here’s the breakdown:

- Annual Salary: This is the total amount of money you earn in a year before taxes and other deductions (in this case, $36,400).

- Work Hours Per Week: This is the number of hours you typically work in a standard week. The most common assumption is 40 hours.

- Weeks Worked Per Year: This is the number of weeks you actually work in a year. A standard year has 52 weeks. However, some employers offer paid time off (PTO), reducing the number of weeks worked. For simplicity, we'll initially assume a full 52 weeks.

The formula is straightforward:

Hourly Rate = Annual Salary / (Weeks Worked Per Year * Work Hours Per Week)

The Calculation: Plugging in the Numbers

Let's calculate the hourly rate for a $36,400 annual salary assuming a standard 40-hour workweek and 52 weeks worked per year.

Hourly Rate = $36,400 / (52 weeks * 40 hours/week)

Hourly Rate = $36,400 / 2080 hours

Hourly Rate = $17.50

So, an annual salary of $36,400 translates to an hourly rate of $17.50, assuming a standard 40-hour workweek and 52 weeks worked per year.

Real-World Use: Adjusting for Reality

That $17.50 is a good starting point, but real life rarely fits perfectly into neat little boxes. Here's how to adjust the calculation for different scenarios:

- Paid Time Off (PTO): If you receive PTO, you're not working those weeks, but you're still getting paid. Subtract the number of PTO weeks from 52. For example, if you have 2 weeks of PTO:

Weeks Worked = 52 - 2 = 50 weeks

Hourly Rate = $36,400 / (50 weeks * 40 hours/week) = $18.20 per hour - Overtime: If you regularly work overtime, consider factoring that into your calculation. Estimate your average weekly overtime hours. This will be an approximation.

- Taxes and Deductions: Remember, the hourly rate calculated above is your gross hourly rate. Taxes, insurance, and other deductions will reduce your net hourly rate (take-home pay).

- Freelance Expenses: As a freelance mechanic, you have expenses like tools, insurance, shop rent, and advertising. Deduct these expenses from your gross annual income *before* calculating your hourly rate to get a more accurate picture of your actual earnings.

Example: Freelance Mechanic

Let's say you're a freelance mechanic aiming to earn $36,400 per year. You work 40 hours per week, take 2 weeks of vacation, and have $5,000 in business expenses. First, calculate your net income:

Net Income = $36,400 - $5,000 = $31,400

Then, adjust for PTO:

Weeks Worked = 52 - 2 = 50 weeks

Finally, calculate the hourly rate:

Hourly Rate = $31,400 / (50 weeks * 40 hours/week) = $15.70 per hour

This means you'd need to charge around $15.70 per hour just to cover your expenses and achieve your desired net income. This is lower than the straight calculation, so consider if $36,400 annual is a reasonable income.

Troubleshooting: When the Numbers Don't Add Up

If your calculations seem off, double-check the following:

- Accuracy of Data: Ensure your annual salary, work hours per week, and weeks worked per year are accurate.

- Consistent Units: Make sure you're using consistent units (e.g., hours per week, not minutes per day).

- Hidden Costs: Don't forget to factor in any hidden costs associated with your work, such as commuting expenses or professional development fees.

- Tax Implications: If you're self-employed, remember to account for self-employment taxes, which can significantly impact your net income.

Scenario: A friend tells you they make $40,000 a year, working 30 hours a week. They also have 4 weeks PTO. That seems like a pretty good deal, right?

Weeks Worked = 52 - 4 = 48 weeks

Hourly Rate = $40,000 / (48 weeks * 30 hours/week) = $27.78 per hour

That is a good deal!

Safety: Handle Your Finances with Care

While this calculation seems harmless, inaccurate financial assessments can lead to problems. If you are planning to take out loans, invest in new tools, or take on extra responsibilities based on what appears to be a good salary, ensure that you account for all taxes, work expenses, and potential gaps in your schedule.

Always seek professional financial advice to better understand income taxes, insurance, and other financial considerations before making important decisions.

Remember, this basic calculation is a good starting point for understanding your hourly rate. By understanding how the number is derived, you can adjust it to account for many of the variables that are unique to your employment and financial life.