72 Payments Is How Many Years

Alright, let's talk about something that might seem a bit outside the typical automotive realm, but the principle can be surprisingly relevant, especially when you're dealing with financing repairs, modifications, or even buying a new ride: "72 Payments Is How Many Years?". This isn't strictly car mechanics, but understanding the time value of money and loan structures is crucial for making informed decisions about your vehicle.

Purpose – Why This Matters to You

You might be wondering, "Why am I reading about loan terms on a DIY car repair site?" Here's why: Understanding loan terms helps you make smart financial decisions related to your car. Whether you're financing a new engine, paying off a hefty repair bill, or even just buying tires, knowing how loan lengths affect your total cost is essential. It prevents you from getting trapped in high-interest, long-term loans that ultimately cost you far more than the initial item or service. This understanding empowers you to budget effectively and avoid unnecessary financial strain.

Key Specs and Main Parts: The Loan Equation

The fundamental principle here is simple math. A loan is essentially a contract where you borrow money (the principal) and agree to repay it over a specified period (the term) with added interest (the interest rate). The longer the term, the smaller the monthly payments, *but* the more interest you'll pay over the life of the loan. Let's break down the key components:

- Loan Amount (Principal): The initial amount of money you borrow. This is the cash you need for that new turbocharger, engine rebuild, or paint job.

- Interest Rate: The percentage charged by the lender for the use of their money, expressed as an annual percentage rate (APR). It's the cost of borrowing, and it drastically affects the total amount you repay.

- Loan Term: The duration of the loan, usually expressed in months. 72 payments is a common loan term.

- Monthly Payment: The fixed amount you pay each month towards the principal and interest.

- Total Interest Paid: The total amount of interest you pay over the life of the loan. This is the real cost of the loan, often hidden by the low monthly payment.

Symbols and Terminology

While we're not using visual diagrams in the traditional sense, let's define some common terms that act as 'symbols' in loan calculations:

- P = Principal Loan Amount

- r = Monthly Interest Rate (Annual Rate / 12)

- n = Number of Months in Loan Term

- M = Monthly Payment

The formula for calculating the monthly payment (M) is:

M = P [ r(1+r)^n ] / [ (1+r)^n – 1]

This formula might look intimidating, but it's a standard calculation used by lenders and financial calculators. Don't worry about memorizing it; online loan calculators can handle the heavy lifting. The important thing is understanding what each variable represents and how it impacts the final payment.

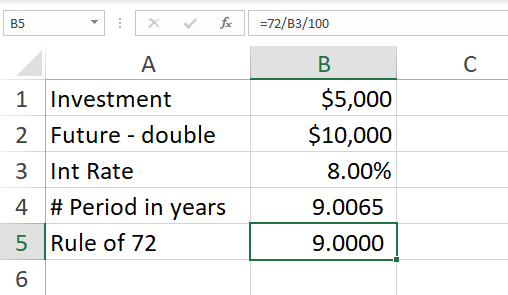

How It Works: The Math Behind 72 Payments

The question "72 Payments Is How Many Years?" is straightforward: 72 payments / 12 months per year = 6 years. A 72-month loan term is a fairly common length for auto loans, especially for newer or more expensive vehicles. It provides a lower monthly payment compared to shorter terms like 36 or 48 months, but it also significantly increases the total interest paid.

Let's illustrate with an example. Suppose you finance $10,000 for engine work with a 6% APR:

- Scenario 1: 36-month loan - Your monthly payment would be around $304.22, and you'd pay a total of $951.82 in interest.

- Scenario 2: 72-month loan - Your monthly payment would drop to about $165.61, *but* you'd pay a total of $1,924.01 in interest.

See the difference? While the 72-month loan has a much lower monthly payment, you end up paying almost twice as much in interest over the loan's life. This is a critical consideration when making financial decisions about your car.

Real-World Use: Troubleshooting Loan Decisions

Here are some basic troubleshooting tips when considering a loan for your car:

- Compare loan offers: Shop around for the best interest rates from different lenders (banks, credit unions, online lenders). A small difference in the interest rate can save you hundreds or even thousands of dollars over the loan term.

- Consider a shorter loan term: If you can afford the higher monthly payment, a shorter loan term will save you significantly on interest in the long run.

- Factor in other costs: Don't just focus on the monthly payment. Consider the loan origination fees, prepayment penalties (if any), and any other associated costs.

- Don't borrow more than you need: Resist the temptation to finance unnecessary extras. Only borrow the amount required for the essential repair or modification.

- Use online loan calculators: There are plenty of free online loan calculators that can help you estimate monthly payments and total interest paid for different loan scenarios.

- Assess your budget: Can you realistically afford the monthly payment, even if your income fluctuates? Consider unexpected expenses and create a realistic budget.

Safety: The Risky Components of Long-Term Debt

The biggest risk associated with long-term loans is getting into a situation where you can't afford the payments. This can lead to repossession of your vehicle, damage to your credit score, and significant financial stress. Here's why long terms can be risky:

- Depreciation: Cars depreciate in value over time. With a long-term loan, you might owe more on the car than it's worth ("underwater" or "upside down" on the loan). If you need to sell the car, you'll have to come up with the difference between the sale price and the loan balance.

- Unexpected Repairs: As your car ages, it's more likely to require repairs. If you already have a tight budget due to the loan payment, unexpected repair bills can be a financial disaster.

- Interest Rate Fluctuations (Variable Rate Loans): While most auto loans are fixed-rate, some may have variable interest rates. If interest rates rise, your monthly payment will increase, potentially straining your budget.

- Opportunity Cost: The money you spend on interest could be used for other investments or savings. Paying off a loan quickly frees up cash flow for other financial goals.

Refinancing Considerations

If you already have a long-term loan, consider refinancing to a shorter term at a lower interest rate if possible. This can save you money on interest and help you pay off the loan faster. Compare offers from multiple lenders.

In conclusion, understanding loan terms and their impact on your overall financial well-being is essential for any car owner, especially those involved in DIY repairs and modifications. A 72-month loan provides lower monthly payments but significantly increases the total interest paid. Make informed decisions, compare offers, and prioritize your financial health alongside your automotive passion.

Remember, being informed about your finances is just as important as knowing how to change your oil or rebuild an engine. Armed with this knowledge, you can make sound decisions that keep you on the road without breaking the bank.

And yes, we have additional resources and worksheets available to help you crunch the numbers and make the best decision for your situation. Contact us for access to these resources.