Car Loan What Do I Need

Alright folks, let's dive into something that’s probably touched every one of us at some point: car loans. Understanding the nuts and bolts of a car loan is just as crucial as knowing how to change your oil. We’re not just talking about monthly payments; we're talking about the whole system, the documentation, the legal obligations – everything that comes together to put you behind the wheel of your dream (or practical) machine.

Purpose: Deciphering the Loan Agreement

Think of a car loan agreement as the blueprint of your vehicle's financial life. This isn't just some paperwork to file away. This "diagram," if you will, matters because it outlines your responsibilities, the lender's rights, and the conditions under which you're borrowing money. Understanding it helps you avoid costly mistakes, plan your finances effectively, and even negotiate better terms in the future. Whether you’re looking to refinance, pay off early, or simply understand the fine print, knowing what's really going on is power.

Key Specs and Main Parts of a Car Loan

A car loan agreement consists of several key components that define the terms and conditions of the loan. Let's break them down:

- Principal: This is the initial amount of money you borrow to purchase the vehicle. It's the base on which interest is calculated.

- Interest Rate (APR): The Annual Percentage Rate (APR) represents the true cost of borrowing, including the interest rate and any associated fees. This is the number to focus on when comparing loans. A lower APR means less you'll pay in total.

- Loan Term: This is the length of time you have to repay the loan, usually expressed in months (e.g., 36 months, 60 months, 72 months). Shorter terms mean higher monthly payments but lower overall interest paid.

- Monthly Payment: The fixed amount you pay each month to cover both the principal and interest.

- Finance Charge: The total amount of interest you will pay over the life of the loan.

- Loan Origination Fees: Fees charged by the lender for processing the loan. These can sometimes be negotiated.

- Prepayment Penalties: Some loans may include penalties if you pay off the loan early. Avoid these if possible! They can significantly increase the cost if you decide to refinance or pay off your loan ahead of schedule.

- Collateral: In this case, your car itself. If you fail to make payments, the lender has the right to repossess the vehicle.

- Insurance Requirements: The loan agreement will specify the types and amounts of insurance coverage you must maintain on the vehicle.

- Late Payment Fees: Penalties for failing to make your payments on time.

Understanding Key Terms

- Amortization: The process of gradually paying off the loan principal over time. Early in the loan, a larger portion of your payment goes towards interest; later, more goes towards the principal.

- Equity: The difference between the value of your car and the amount you still owe on the loan. As you pay down the loan, your equity increases.

- Loan-to-Value (LTV) Ratio: The ratio of the loan amount to the value of the vehicle. A lower LTV ratio generally means lower risk for the lender, and potentially better loan terms for you.

Symbols: Deciphering the Fine Print

While a car loan agreement doesn’t have literal "symbols" in the way a wiring diagram does, the layout and presentation contain important cues. Think of it more like reading a map:

- Legal Jargon: Pay close attention to bolded or italicized sections. These often highlight critical clauses regarding your obligations and the lender's rights.

- Fine Print: Don't skip the small print! This is where those pesky prepayment penalties or other less-than-desirable terms might be hidden. Read everything carefully.

- Numeric Tables: These tables typically display your payment schedule, breaking down each payment into principal and interest. This is a good place to understand the amortization process.

- Definitions: Look for sections that define key terms used throughout the agreement. Understanding these definitions is crucial for avoiding misunderstandings.

How It Works: The Mechanics of a Car Loan

The car loan process is relatively straightforward, but understanding each step is important. First, you apply for a loan from a bank, credit union, or dealership. The lender will assess your creditworthiness based on your credit score and history. A higher credit score generally results in a lower interest rate. They will also consider your income and debt-to-income ratio to determine your ability to repay the loan. If approved, you'll receive a loan offer outlining the terms and conditions. Once you agree to the terms and sign the loan agreement, the lender will disburse the funds, allowing you to purchase the car. You then make monthly payments until the loan is paid off.

The interest rate is calculated based on several factors, including your credit score, the loan term, and the prevailing market interest rates. As mentioned earlier, the APR (Annual Percentage Rate) is the best indicator of the true cost of borrowing, as it includes both the interest rate and any fees. The amortization schedule shows how much of each payment goes toward the principal and interest. In the early stages of the loan, a larger portion of your payment goes toward interest, while in the later stages, more goes toward the principal.

Real-World Use: Basic Troubleshooting Tips

Knowing the ins and outs of your car loan agreement can save you a lot of headaches. Here are a few troubleshooting tips:

- Payment Issues: If you're struggling to make payments, contact your lender immediately. They may be willing to work with you on a temporary payment plan or offer other options to avoid default. Don't wait until you're already behind.

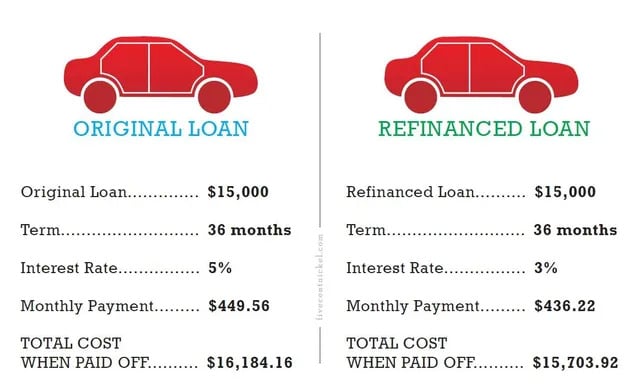

- Refinancing: If interest rates have dropped, or your credit score has improved, consider refinancing your car loan to potentially lower your monthly payments or shorten the loan term.

- Early Payoff: If you have the financial means, paying off your car loan early can save you a significant amount of money on interest. Just make sure to check for prepayment penalties first.

- Understanding Fees: Always scrutinize your loan statements for any unexpected fees or charges. If you don't understand something, contact your lender for clarification.

- Dispute Resolution: If you have a dispute with your lender, document everything in writing and follow their established dispute resolution process.

Safety: Risks and Red Flags

A car loan is a significant financial commitment, so it's crucial to be aware of the potential risks involved. Be especially wary of:

- High-Pressure Sales Tactics: Don't be rushed into making a decision. Take your time to review the loan agreement carefully and compare offers from multiple lenders.

- Hidden Fees: Be on the lookout for hidden fees or charges that are not clearly disclosed in the loan agreement.

- Excessive Interest Rates: If the interest rate seems too high, it probably is. Shop around for better rates and consider improving your credit score before applying for a loan.

- Loans with Unreasonable Terms: Avoid loans with excessively long terms or balloon payments, as these can lead to financial trouble down the road.

- Co-signers: Understand the risks involved in co-signing a car loan for someone else. You will be responsible for the debt if the borrower defaults.

- Title Loans: Avoid these like the plague! They are predatory loans with extremely high interest rates that can quickly lead to repossession of your vehicle.

Remember that your credit score is your financial engine. Protect it by making timely payments on all your debts and avoiding excessive borrowing.

We've covered a lot here. It's important to remember that a car loan agreement is a legally binding document. It is always wise to seek professional financial advice if you have any questions or concerns. Taking the time to understand the terms and conditions of your car loan can help you make informed decisions and avoid costly mistakes.

We have a detailed car loan agreement template (think of it as your printable diagram) available for download. It outlines all the key sections and clauses you should pay attention to. Use it as a reference when reviewing your own loan agreements or when negotiating loan terms with a lender. This diagram will help you stay informed and in control of your financial future.