Gap Insurance And How It Works

Alright, let's talk about GAP insurance – Guaranteed Asset Protection. It's not exactly horsepower or suspension tuning, but understanding it is crucial for protecting your investment, especially on newer vehicles. We’re going to break down exactly how it works, why you might need it, and what to consider when shopping for it.

Purpose of Understanding GAP Insurance

Why bother understanding GAP insurance? Simple:

- Protection: Prevents financial burden in case of total loss or theft.

- Informed Decisions: Enables you to determine if it's right for your car purchase.

- Cost Saving: Helps evaluate coverage and potentially save money.

Key Specs and Main Parts of a GAP Insurance Policy

Think of a GAP insurance policy like a finely-tuned engine. It has specific components that work together. Here's the breakdown:

- Insured Vehicle: This is the vehicle covered by the GAP insurance. It's crucial to know the make, model, and VIN. The policy will typically specify these details exactly.

- Loan/Lease Amount: This is the initial amount you borrowed or leased. It's the starting point for calculating any potential GAP coverage payout.

- Actual Cash Value (ACV): The ACV is what your insurance company deems your vehicle worth *at the time of the total loss*. This takes depreciation into account. It's a critical figure, and often a point of contention in insurance claims.

- Insurance Settlement: This is the amount your primary auto insurance pays out in the event of a total loss.

- GAP Coverage Limit: This is the maximum amount the GAP insurance will cover. Pay close attention to this! It should be enough to cover the potential difference between your loan balance and the ACV, plus any deductible you might have on your primary insurance.

- Deductible (Sometimes): Some GAP insurance policies have a deductible, though it's less common.

- Covered Incidents: The policy clearly defines what events trigger coverage (total loss due to accident, theft, etc.). Always read the fine print.

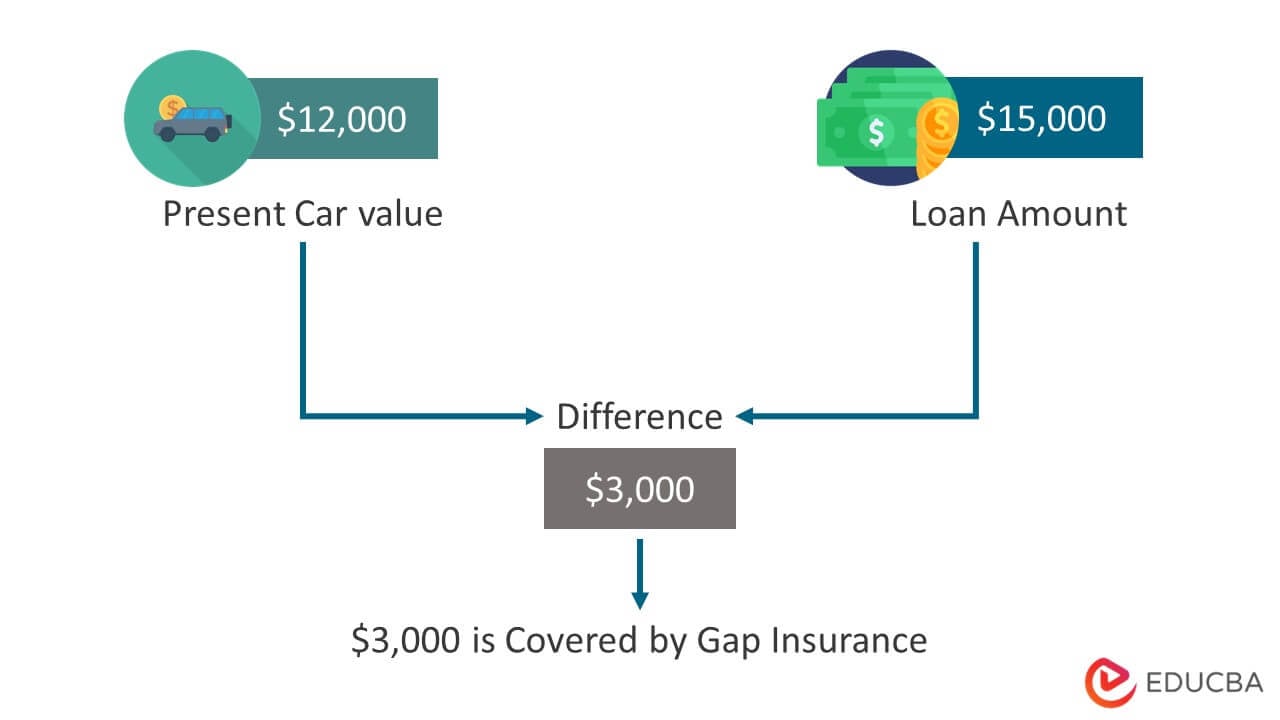

The formula at the heart of GAP insurance is this:

GAP Payout = (Loan/Lease Balance - Insurance Settlement) - Deductible (if any)

Essentially, it covers the "gap" between what you owe and what the car is worth (plus deductible). If the gap is negative (meaning the insurance payout is more than you owe), there is no GAP payout.

How GAP Insurance Works

Let's walk through a scenario to illustrate how it works. Imagine you buy a new SUV for $40,000 and finance the entire amount. A year later, you're involved in an accident and the vehicle is totaled. Your primary insurance company determines the ACV of your SUV is now $30,000. They pay you that amount. However, you still owe $35,000 on your loan.

Without GAP insurance, you're on the hook for the remaining $5,000. Ouch.

With GAP insurance, assuming the policy limits are sufficient, the GAP insurer would step in and cover that $5,000 difference (less any deductible, if applicable).

The key is understanding that cars depreciate – often significantly – in the first few years. This is especially true for new vehicles. Loan terms also play a role; longer loan terms mean you'll be "upside down" (owe more than the car is worth) for a longer period.

When is GAP Insurance a Good Idea?

- New Vehicles: As mentioned, depreciation hits new cars hard.

- Long Loan Terms: The longer your loan, the more likely you are to be upside down.

- High Loan-to-Value Ratio: If you put little or no money down, you're borrowing more, increasing the potential gap.

- Leasing: GAP insurance is often included in lease agreements. If not, it's strongly recommended.

Real-World Use: Basic Troubleshooting Tips

Even with GAP insurance, things can sometimes get tricky. Here are some basic troubleshooting tips:

- Review Your Policy: Know your coverage limits, deductible (if any), and exclusions.

- Dispute ACV: If you believe the insurance company's ACV is too low, gather evidence (comparable sales) to support your claim.

- File Claims Promptly: Don't delay in filing both your primary insurance claim and your GAP insurance claim.

- Document Everything: Keep records of all communication with the insurance companies.

- Understand Exclusions: GAP insurance typically doesn't cover things like mechanical failures, unpaid loan balances due to late payments, or carry-over debt from a previous loan.

Example Exclusion: Let’s say you wreck your car while driving under the influence. Your primary insurance might still cover the total loss, but your GAP insurance policy almost certainly will not cover the "gap." Always read the policy's exclusions.

Safety Considerations

While GAP insurance itself isn't dangerous like a faulty brake line, misunderstanding it can lead to financial risk. Here's what to keep in mind:

- Don't Overpay: Shop around for GAP insurance. Dealerships often mark up the price significantly. You can often get it cheaper through your own insurance company or a credit union.

- Understand the Limits: Make sure the coverage limit is sufficient to cover the potential gap.

- Read the Fine Print: As with any insurance policy, understand the terms and conditions, including exclusions.

- Cancel if Necessary: If you pay off your loan early, you can often cancel your GAP insurance and receive a pro-rated refund.

Like understanding the limitations of your tools, knowing the boundaries of your GAP insurance policy is vital.

Accessing the Diagram

While a physical diagram of a GAP insurance policy doesn't really exist in the same way a wiring diagram does, think of this article as a functional diagram. We’ve covered the essential components, how they interact, and how to troubleshoot common issues. Think of it as a schematic for understanding the financial protection GAP insurance offers.

We have a detailed checklist for evaluating your need for GAP insurance. It includes prompts to calculate depreciation, compare loan balances, and assess your risk tolerance.

If you want it, just say "I would like the checklist" and I will provide it.