Gap Insurance How Does It Work

Let's talk about Guaranteed Asset Protection (GAP) insurance. If you're the kind of person who likes to understand the ins and outs of your vehicle, this is essential knowledge. It's not a mechanical component you can tinker with, but understanding GAP insurance is crucial for protecting your investment in your ride, especially if you've financed it.

Purpose of Understanding GAP Insurance

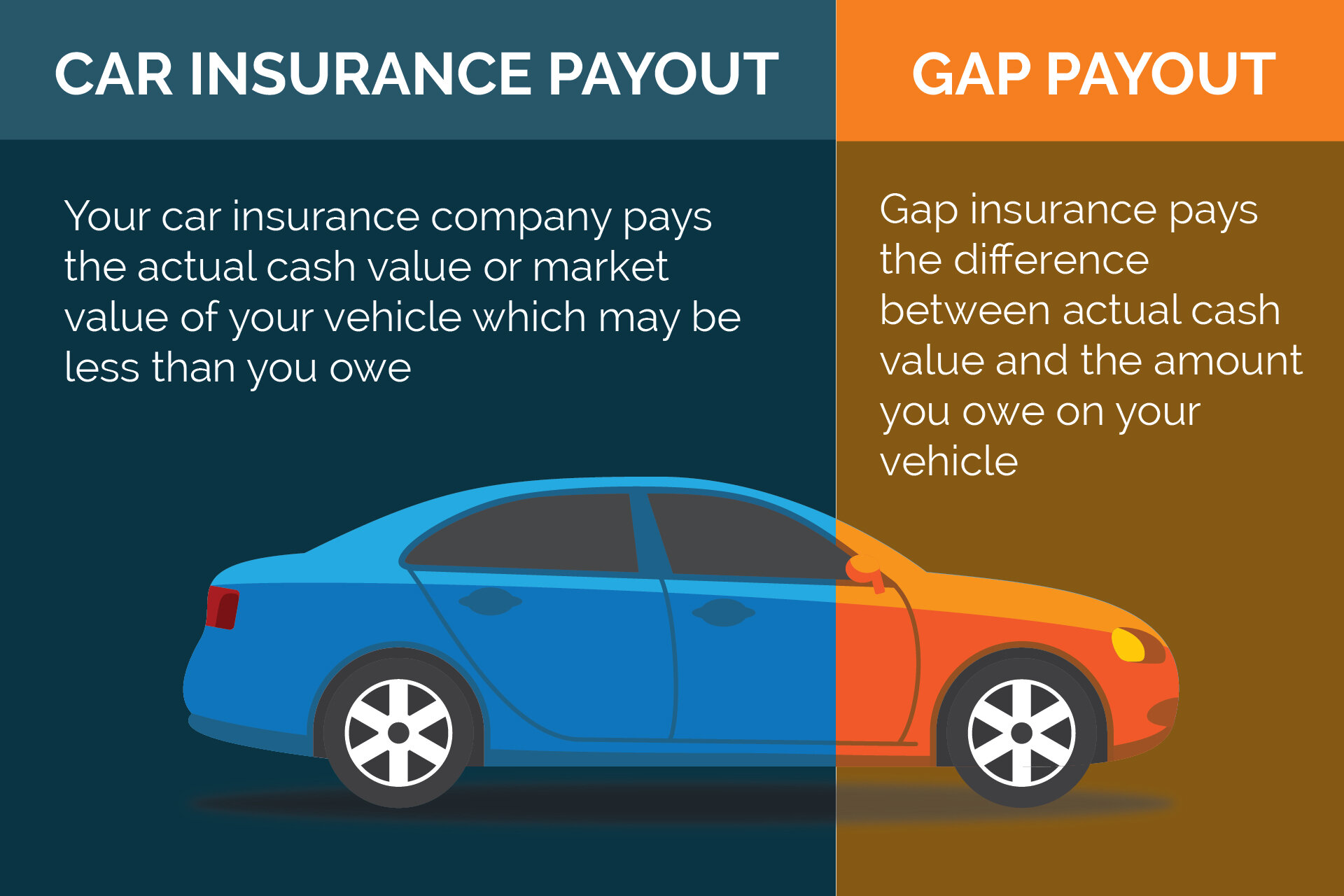

Think of GAP insurance as a financial safety net. It's designed to cover the "gap" between what you owe on your car loan and what your car is actually worth if it's totaled or stolen. Why is this important? Cars depreciate – lose value – quickly. Especially in the first few years. If something unfortunate happens, your standard auto insurance will only pay out the Actual Cash Value (ACV) of the vehicle at the time of the incident. This might be significantly less than the outstanding balance on your loan. That's where GAP insurance steps in.

Understanding how GAP insurance works empowers you to make informed decisions. Should you buy it? Is it offered at a fair price? Knowing the details allows you to negotiate effectively and avoid potentially crippling financial burdens.

Key Specs and Main Parts of a GAP Insurance Policy

While GAP insurance isn't a tangible "part," it's helpful to think of it as a contract with specific terms and conditions. Here are the key elements:

- Loan Balance: The amount you still owe on your car loan. This is the ceiling of what GAP insurance *might* cover.

- Actual Cash Value (ACV): The fair market value of your car at the time of the incident, as determined by your primary auto insurance company. This is typically based on factors like age, mileage, condition, and comparable sales in your area. Resources like Kelley Blue Book and Edmunds are often used to determine ACV.

- GAP Coverage Limit: The maximum amount the GAP insurance policy will pay out. Most policies have a limit, often $50,000 or less. Make sure this limit is sufficient to cover the potential gap between your loan balance and ACV, especially if you financed a significant portion of the vehicle's purchase price.

- Deductible: Some GAP policies have a deductible, similar to your regular auto insurance. This is the amount you'll pay out-of-pocket before the GAP insurance kicks in.

- Exclusions: These are specific situations that the GAP insurance policy won't cover. Common exclusions include:

- Overdue Loan Payments: If you're behind on your loan payments, the GAP insurance may be invalidated.

- Modifications Not Covered by Primary Insurance: If your car has modifications that aren't covered by your regular auto insurance, the GAP insurance likely won't cover the depreciated value of those modifications either. Think aftermarket turbos, body kits, or sound systems.

- Refundable Items: Things like extended warranties or service contracts that you can get a refund for are typically excluded.

- Rolled-Over Debt: If you rolled debt from a previous car loan into your current loan, the GAP insurance might not cover the portion of the loan that represents the rolled-over debt.

- Premium: The cost of the GAP insurance policy. This can be a one-time fee added to your loan or a monthly payment.

How GAP Insurance Works: A Step-by-Step Explanation

Let's break down the process with an example:

- You purchase a car and finance it: Let's say you buy a car for $30,000 and finance the entire amount.

- You purchase GAP insurance: You decide to purchase GAP insurance for added protection.

- The car is totaled or stolen: A year later, your car is involved in an accident and is deemed a total loss by your primary insurance company.

- Primary insurance pays out the ACV: Your primary insurance company determines the ACV of your car to be $20,000 due to depreciation.

- Calculate the "gap": The gap between what you owe ($28,000 - after making payments) and the ACV ($20,000) is $8,000.

- GAP insurance kicks in (subject to policy terms): Assuming your GAP policy has a sufficient coverage limit and no exclusions apply, it will cover the $8,000 gap, minus any deductible.

- You're off the hook for the remaining balance: Without GAP insurance, you would have been responsible for paying the $8,000 difference out of pocket.

The formula is simple:

Loan Balance – Actual Cash Value (ACV) = Potential GAP Coverage

Real-World Use: Basic Troubleshooting

GAP insurance "troubleshooting" is less about fixing something and more about ensuring you have the right coverage and understanding the process if you need to use it. Here are some key points:

- Know your loan balance: Regularly check your loan statements to know the outstanding balance. This is your *exposure*.

- Research ACV trends: Understand how your car model depreciates. Websites like Kelley Blue Book can provide estimated values.

- Review your GAP policy documents: Don't just file them away. Understand the coverage limit, deductible, and exclusions.

- When filing a claim:

- Contact your primary insurance company immediately after an incident.

- Gather all necessary documents, including your police report, insurance claim information, loan documents, and GAP insurance policy.

- Be prepared to provide documentation to both your primary insurance company and the GAP insurance provider.

- Be patient. The claims process can take time.

Safety Considerations

While GAP insurance itself doesn't pose any physical safety risks, it's essential to avoid making risky financial decisions that could lead to needing it. For example:

- Avoid excessive loan amounts: Financing more than you can comfortably afford increases your risk of negative equity (owing more than the car is worth).

- Consider a larger down payment: A larger down payment reduces the loan amount and the potential gap.

- Be mindful of loan terms: Longer loan terms mean slower principal repayment and a greater chance of being upside-down on your loan, which means you owe more than the car's value.

The most "risky" component is arguably the loan itself. A large loan on a rapidly depreciating asset (your car) creates the need for GAP insurance in the first place. Think of GAP insurance as a mitigation tool for the risk inherent in financing a vehicle.

We have a detailed diagram illustrating the GAP insurance claim process, from the initial accident to the final payout. This visual aid can help solidify your understanding of the steps involved and the key players. Contact us to request the file.