Gap Insurance What Does It Cover

Let's talk about something crucial for any car owner, especially those of us who like to tinker under the hood and understand the intricacies of our vehicles: Gap Insurance. It's not a mechanical component, but it's a vital part of financial protection for your ride. Think of it as a safety net that bridges a potentially significant financial gap – hence the name!

Purpose – Why Understanding Gap Insurance Matters

While you might be comfortable diagnosing engine knocking or replacing brake pads, understanding insurance policies can feel like navigating a dense legal forest. This guide aims to cut through the jargon and equip you with a clear understanding of Gap Insurance. This knowledge isn't about repairs in the traditional sense, but rather about preventing a major financial repair in the event of a total loss. It's about being financially prepared for the unexpected, something every savvy car owner should prioritize.

Knowing what Gap Insurance covers is particularly important if you:

- Purchased your vehicle new and expect significant depreciation.

- Financed your vehicle with a long-term loan.

- Made a small down payment.

- Leased your vehicle.

Understanding these aspects will help you assess if Gap Insurance is a worthwhile investment for your specific situation.

Key Specs and Main Parts: What Does Gap Insurance Actually Cover?

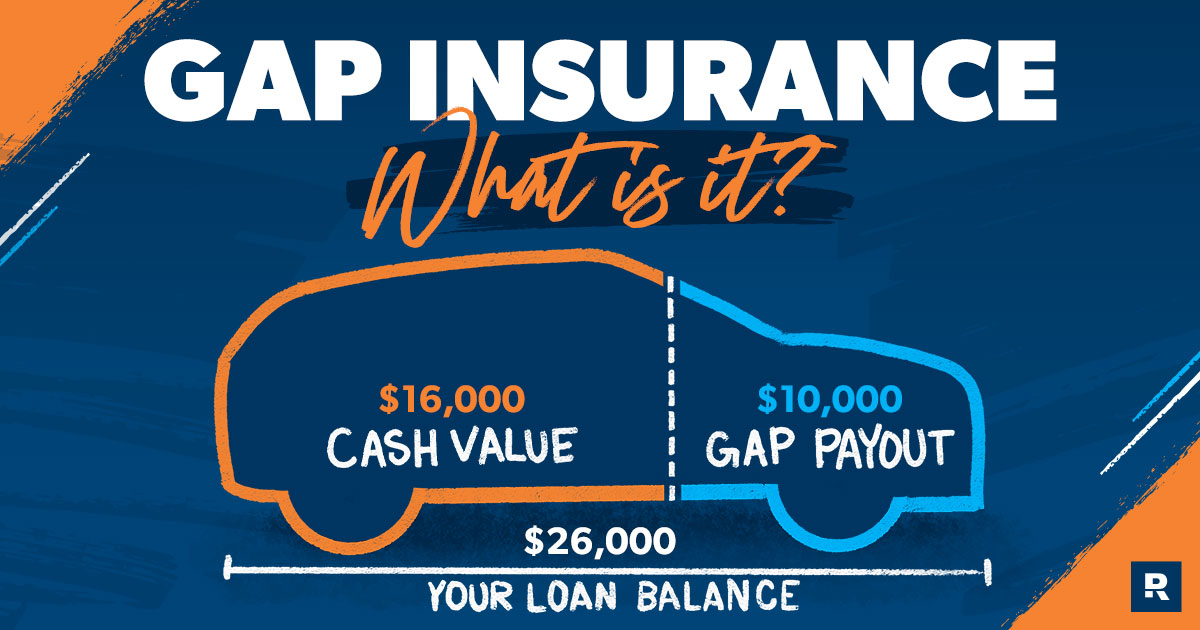

The core concept of Gap Insurance is simple: it covers the "gap" between what you owe on your vehicle and what your insurance company pays out if it's declared a total loss (e.g., due to an accident, theft, or natural disaster). Let's break down the key elements:

- Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of the loss, taking into account depreciation. Your standard collision or comprehensive insurance payout is based on the ACV.

- Outstanding Loan Balance: This is the amount you still owe to the lender (bank, credit union, etc.) for your vehicle.

- The "Gap": This is the difference between the outstanding loan balance and the ACV. This is what Gap Insurance is designed to cover.

- Deductible: Some Gap Insurance policies will also cover your primary insurance deductible.

It's crucial to note that Gap Insurance typically *doesn't* cover:

- Mechanical repairs.

- Wear and tear.

- Personal property inside the vehicle.

- Injuries sustained in an accident.

- Extended warranties or service contracts.

These items are typically handled by separate types of insurance or warranties.

Symbols: Decoding the Gap Insurance Landscape

While Gap Insurance doesn't have a literal diagram with lines and colors like a wiring schematic, understanding the "symbols" or key terms is just as crucial. Think of these terms as the different wires in an electrical circuit - each plays a specific role.

- Policy Limits: This is the maximum amount the Gap Insurance will pay out. Make sure it's sufficient to cover the potential gap between your loan balance and the ACV, especially if you have a long-term loan. This is your 'fuse' - making sure you don't overload the system.

- Exclusions: These are specific situations or events that the policy *doesn't* cover. Read these carefully to understand the limitations of your coverage. This is your 'grounding' wire, protecting against unforeseen issues not included.

- Premium: This is the cost of the Gap Insurance policy. Compare premiums from different providers to find the best value. This is your 'power source' for the coverage.

- Total Loss: This is when the insurance company determines that repairing the vehicle would cost more than its ACV.

- Involuntary Unemployment: Some Gap Insurance policies include coverage if you become involuntarily unemployed. This acts as a secondary 'breaker' to protect in certain financial hardships.

How It Works: The Mechanics of Gap Insurance

Let's walk through a scenario to illustrate how Gap Insurance works. Imagine you bought a new truck for $40,000 and financed it with a $35,000 loan. A year later, due to an accident, your truck is totaled. Your primary insurance company determines the ACV of the truck is now $28,000.

Here's the breakdown:

- Outstanding Loan Balance: $32,000 (after a year of payments).

- Actual Cash Value (ACV): $28,000.

- The "Gap": $32,000 - $28,000 = $4,000.

Without Gap Insurance, you would be responsible for paying the $4,000 difference to the lender, *even though you no longer have the truck*. With Gap Insurance, the policy would cover this $4,000 gap (minus any deductible, if applicable), saving you a significant financial burden.

The process typically involves filing a claim with your primary insurance company first. Once they declare the vehicle a total loss and pay out the ACV, you then file a claim with your Gap Insurance provider. They will verify the outstanding loan balance and the ACV payout, and then pay the remaining gap (up to the policy limits).

Real-World Use: Troubleshooting Your Gap Insurance

While you can't exactly "troubleshoot" Gap Insurance like you would a malfunctioning engine, there are some things to keep in mind:

- Review your policy regularly: Ensure you understand the coverage limits, exclusions, and claim filing process.

- Keep accurate records: Maintain copies of your loan documents, insurance policies, and any communication with your insurance providers.

- Be proactive after a total loss: Contact your Gap Insurance provider immediately after your primary insurance company declares the vehicle a total loss.

- Understand the cancellation policy: If you pay off your loan early or refinance, you may be able to cancel your Gap Insurance policy and receive a refund for the unused portion of the premium.

A common "troubleshooting" scenario involves confusion about what is and isn't covered. Remember, Gap Insurance is specifically for the difference between the loan balance and ACV. Don't expect it to cover unrelated issues like mechanical breakdowns.

Safety: Risks and Limitations

The biggest risk with Gap Insurance is assuming it covers everything. It's essential to understand its limitations. Specifically, pay attention to:

- Policy Limits: Ensure the policy limit is high enough to cover the potential gap.

- Exclusions: Be aware of any exclusions, such as vehicles used for commercial purposes or losses resulting from illegal activities.

- Total Loss Definition: Understand how the insurance company defines "total loss." Some policies may require the vehicle to be deemed a total loss by *both* your primary insurance company *and* the Gap Insurance provider.

- Loan Payoff: If your loan is paid off faster than anticipated, consider cancelling the policy to avoid paying for unnecessary coverage.

Consider Gap Insurance optional, but potentially very beneficial. It is not required by law, but it can provide peace of mind, especially when you have a new vehicle or a significant loan amount.

We understand that insurance can be complex. We have a file outlining sample terms and conditions of a typical GAP insurance plan to give you additional detail. This is for informational purposes only and is not a legal document. Please consult with your insurance provider before making any decisions. This file is available for download. Let us know if you'd like a copy.