Gap Insurance What Does It Mean

So, you're interested in Gap Insurance, huh? Good on you for digging deeper. It's one of those things you hope you never need, but when you do, it can be a real lifesaver. Think of me as your experienced mechanic buddy, breaking down the ins and outs of Gap Insurance, so you understand exactly what it is, how it works, and whether it's right for you.

Purpose: Bridging the Value Gap

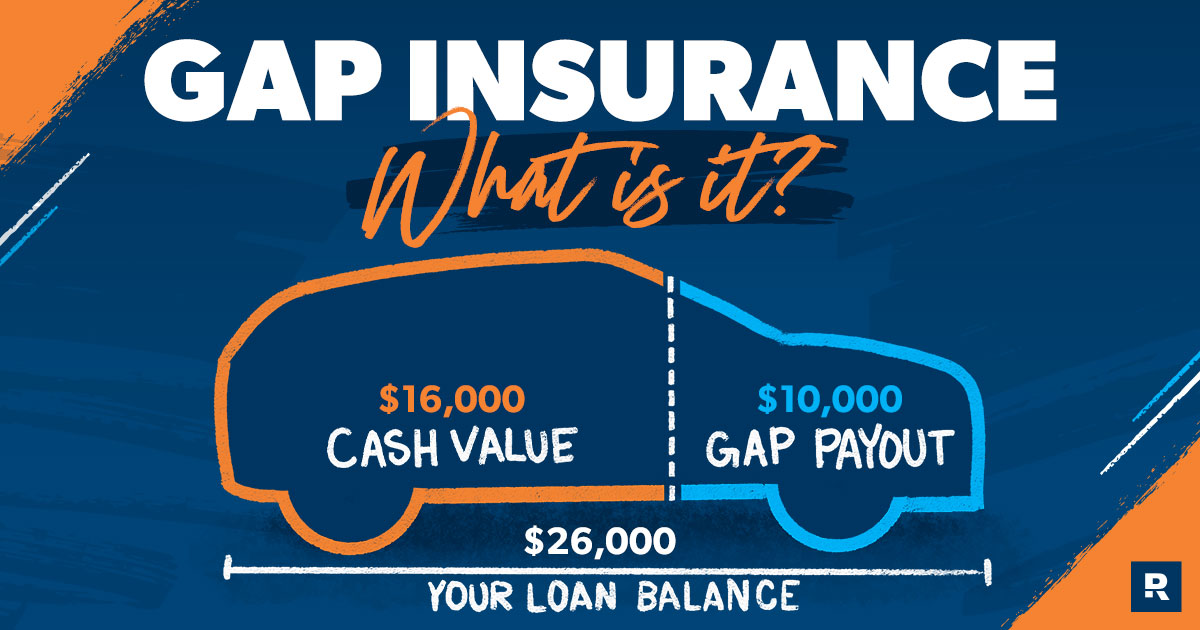

The primary purpose of Gap Insurance, or Guaranteed Asset Protection insurance, is to cover the "gap" between what you owe on your car loan or lease and what the insurance company says your car is actually worth if it's totaled or stolen and not recovered. That difference can be significant, especially in the first few years of ownership when depreciation is at its highest.

Why does this matter? Imagine you bought a tricked-out SUV for $40,000. Two years later, thanks to depreciation and maybe a few fender-benders (reported or not), your insurance company deems the vehicle worth only $25,000 after a major accident. However, you still owe $30,000 on your loan. Without Gap Insurance, you'd be on the hook for that remaining $5,000 on a car you no longer have! Gap Insurance steps in to cover that difference, preventing a major financial headache.

Key Specs and Main Parts of a Gap Insurance Policy

While Gap Insurance isn't a tangible component like a spark plug or a brake rotor, understanding its key specs and 'parts' is crucial. It’s essentially a contract with very specific terms and conditions.

- Loan/Lease Payoff Amount: This is the outstanding balance on your auto loan or lease at the time of the incident.

- Actual Cash Value (ACV): The insurance company's determination of the vehicle's fair market value immediately before the total loss. This takes into account depreciation, mileage, condition, and market factors. Determining ACV is often a point of contention, so understanding the factors involved is vital.

- Gap Coverage Limit: This is the maximum amount your Gap Insurance policy will pay out. Policies typically have a cap (e.g., $50,000 or 25% of the vehicle's original MSRP), so make sure it's adequate for your situation.

- Deductible: Some Gap Insurance policies have a deductible, although many do not. If there is a deductible, it's subtracted from the Gap Insurance payout.

- Exclusions: This is a critical section. Gap Insurance policies always have exclusions. Common exclusions include:

- Overdue loan payments: If you're behind on your loan, your claim may be denied.

- Finance charges rolled into the loan: Some policies won't cover these.

- Theft by a family member: Unfortunately, this is a common exclusion.

- Modifications and aftermarket parts: This is big for you modders! Most Gap Insurance policies *will not* cover the value of aftermarket modifications. Always check the fine print.

- Policy Term: The length of time your Gap Insurance coverage is active. It usually aligns with the duration of your loan or lease.

Symbols – Interpreting the Fine Print (Think of it as a Schematic!)

While Gap Insurance doesn't involve physical schematics, understanding the "symbols" of the insurance world – namely the terms and conditions – is equally important. These terms are often written in dense legal jargon, but let's break down some common "symbols":

- "Total Loss": This typically means the vehicle is damaged beyond economical repair, as determined by the primary insurance company.

- "Named Insured": This refers to the individual or individuals covered by the Gap Insurance policy.

- "Policyholder": Usually the same as the Named Insured, the person who purchased the policy.

- "Material Misrepresentation": This refers to providing false or misleading information when applying for Gap Insurance. It can void your policy.

- Fine Print Lines: Any small print on the document with tons of information in it, make sure to check this for policy limitations

Think of the policy document as a complex diagram. The headings are your major components, and each paragraph represents a connection or function. Read it carefully to understand the entire system!

How It Works: A Step-by-Step Process

Here's how Gap Insurance typically works in the event of a total loss:

- Vehicle is Totaled: Your car is declared a total loss by your primary auto insurance company.

- Insurance Payout: Your primary insurer pays out the ACV of the vehicle, minus your deductible.

- Gap Insurance Claim: You file a claim with your Gap Insurance provider, providing documentation such as the primary insurance settlement, loan/lease agreement, and proof of purchase.

- Gap Insurance Calculation: The Gap Insurance company calculates the difference between the loan/lease payoff amount and the ACV paid by your primary insurer.

- Gap Insurance Payout: The Gap Insurance provider pays the difference (up to the policy limit), covering the "gap."

- Loan/Lease Closure: Your loan or lease is paid off.

Real-World Use: Basic Troubleshooting Tips

While you can't exactly "troubleshoot" Gap Insurance like you would a misfiring engine, you can take steps to prevent issues:

- Read the Policy Carefully: This is the most important step. Understand the terms, conditions, exclusions, and coverage limits before you need to use the policy.

- Maintain Accurate Records: Keep copies of your loan/lease agreement, primary insurance policy, and Gap Insurance policy in a safe place.

- Shop Around for the Best Deal: Gap Insurance is offered by dealerships, lenders, and insurance companies. Compare prices and coverage options.

- Consider Refinancing: If your car is depreciating rapidly and you're concerned about the gap, consider refinancing your loan to lower your outstanding balance.

- Question the ACV: If you disagree with the insurance company's ACV valuation, challenge it. Provide evidence of comparable vehicles selling for higher prices.

Safety: Highlight Risky Components (Policy Red Flags)

Just like working on a car, understanding the "risky components" of a Gap Insurance policy is essential:

- High Depreciation Vehicles: These vehicles are more likely to result in a significant gap.

- Long Loan Terms: Longer loan terms mean slower equity buildup, increasing the risk of a gap.

- Rolled-In Costs: Rolling negative equity from a previous car loan or adding optional extras to your new loan increases the initial loan amount and the likelihood of a gap.

- High Loan-to-Value Ratio: Putting little or no money down on your car purchase increases the loan-to-value ratio and the potential for a gap.

- "No Haggle" Pricing: Sometimes dealerships pad their pricing, and if you don't haggle on the price of the car, you have less wiggle room if something happens and you need to make a claim.

These factors don't necessarily mean you shouldn't buy a car, but they should make you seriously consider Gap Insurance.

Like a complex diagram that helps you fix your car, understanding the ins and outs of Gap Insurance can protect you from financial disaster. This article has hopefully provided you with a good foundation. Remember, always read the fine print and ask questions!

We have a sample Gap Insurance policy diagram available for download to further your understanding. It visually represents the payout process and key components of a typical policy.