How Can I Buy Gap Insurance

So, you're thinking about getting Gap insurance. Smart move! For those of us who like to understand the mechanics behind every aspect of vehicle ownership, including insurance, let's break down the process step-by-step. This isn't just about blindly accepting a policy; it's about understanding why you might need it, what it covers, and how to navigate the purchase.

Purpose – Why Gap Insurance Matters

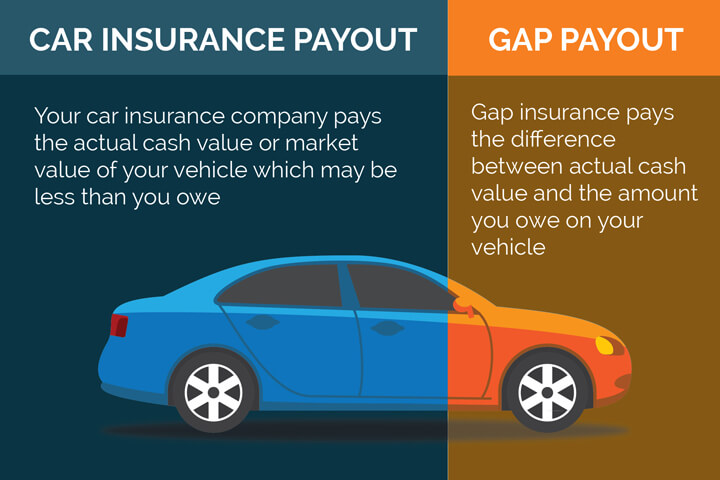

Let's face it, cars depreciate. Fast. Especially new vehicles. If your car is totaled or stolen (heaven forbid!), your regular auto insurance will only pay out the Actual Cash Value (ACV) of the vehicle at the time of the incident. The ACV takes into account depreciation. This is where the "gap" comes in. The "gap" is the difference between what you still owe on your loan and the ACV. Gap insurance, or Guaranteed Asset Protection insurance, covers this difference, potentially saving you thousands of dollars.

Imagine this scenario: You buy a brand new pickup truck for $50,000. You put $5,000 down and finance $45,000. A year later, disaster strikes, and the truck is totaled in an accident. Your regular insurance company assesses the ACV at $35,000 due to depreciation. You still owe $40,000 on the loan. Without Gap insurance, you're $5,000 out of pocket after the insurance payout. With Gap insurance, that $5,000 gap is covered (subject to policy limits, of course).

For experienced DIYers, modders, and informed car owners, understanding this financial protection is crucial. You invest time and money into your vehicle. Gap insurance is about protecting that investment against unforeseen circumstances beyond your control.

Key Specs and Main Parts of a Gap Insurance Policy

Think of a Gap insurance policy like a specialized tool in your garage. Knowing its specifications and key components is essential for proper usage.

- Eligibility Requirements: Not everyone qualifies. Typically, Gap insurance is offered for new vehicles or relatively new vehicles purchased within a certain timeframe (e.g., within the last 3 years). Your loan amount also plays a role. If you've put down a significant down payment (over 20%), the gap between loan balance and ACV is likely smaller, making Gap insurance less necessary.

- Coverage Amount: Policies have limits. They usually cover the difference between the ACV and the loan balance, up to a specific dollar amount (e.g., $50,000) or a percentage of the original loan amount (e.g., 25% over ACV). Read the fine print!

- Exclusions: Like any insurance policy, there are exclusions. Common exclusions include:

- Overdue loan payments: If you're behind on your payments, the policy may be voided.

- Refundable items: Items like extended warranties that can be refunded are typically not covered.

- Modifications and Add-ons: Unless specifically included in your policy, aftermarket modifications and add-ons likely won't be covered under Gap insurance. Consider adding riders to your primary auto insurance policy for these modifications instead.

- Accidents while intoxicated or under the influence: This is a standard exclusion in most insurance policies.

- Premium: The cost of the policy. This can be a one-time fee added to your loan or paid in installments. Shop around! Different providers offer different rates.

- Deductible (Sometimes): Some Gap policies may have a deductible, similar to your regular auto insurance.

How It Works: The Purchase Process

Buying Gap insurance isn't like buying a bolt-on performance part, but the research and comparison process are similar.

- At the Dealership: This is the most common point of sale. When you finance a new or used car at a dealership, they will almost certainly offer you Gap insurance. It's often rolled into your loan. While convenient, it's generally the most expensive option. Don't feel pressured to buy it on the spot! Take the time to compare prices.

- Through Your Auto Insurance Company: Many major auto insurance companies offer Gap insurance as an add-on to your existing policy. This is often a cheaper option than buying it at the dealership. Call your insurance agent or check their website.

- From a Standalone Gap Insurance Provider: Several companies specialize in Gap insurance. These providers can often offer competitive rates, but you'll need to do some digging to find reputable companies.

Regardless of where you purchase the policy, thoroughly read the terms and conditions. Understand the coverage limits, exclusions, and claims process.

Real-World Use – Basic Troubleshooting Tips

Let's say you need to file a Gap insurance claim. Here's what to expect:

- Report the Incident: First, report the total loss or theft to your primary auto insurance company.

- Settle with Your Primary Insurer: You'll need to settle with your primary insurer and receive their ACV payout.

- Contact Your Gap Insurance Provider: Once you have the settlement information from your primary insurer, contact your Gap insurance provider and file a claim.

- Provide Documentation: You'll need to provide documentation, including:

- Your primary auto insurance settlement statement.

- Your loan agreement.

- Proof of loan payoff amount (if applicable).

- Police report (if applicable).

- Review and Approval: The Gap insurance provider will review your claim and, if approved, pay the difference between the ACV and your loan balance, up to the policy limits.

Troubleshooting: If your claim is denied, understand why. Common reasons for denial include exceeding coverage limits, exclusions, or failure to provide necessary documentation. If you believe the denial is unjustified, contact the insurance company to request a review. You may need to provide additional documentation or clarification.

Safety – Highlight Risky Components

The "risky component" in this context isn't a physical part, but rather the potential for misunderstanding or misrepresentation. Here are some points to consider:

- The "Too Good to Be True" Deal: Be wary of Gap insurance policies that seem significantly cheaper than others. Read the fine print carefully! There may be hidden exclusions or limitations.

- Overlapping Coverage: Avoid buying Gap insurance if you already have a policy that covers the same loss, such as a loan/lease payoff insurance policy or comprehensive auto insurance with loan/lease coverage.

- Misunderstanding Exclusions: Make sure you understand what's NOT covered by the policy. Don't assume that everything is covered.

- Hidden Fees: Watch out for hidden fees or charges associated with the policy, especially if you're buying it at the dealership.

Remember, knowledge is power. By understanding how Gap insurance works, you can make an informed decision and protect yourself from potential financial loss.

We have access to sample Gap insurance policies that detail specific terms and conditions. This information isn't provided here due to its length and varying legal requirements, but if you're interested in reviewing a sample policy for educational purposes, let us know, and we can make it available.