How Can I Get Gap Insurance

Okay, so you're thinking about Guaranteed Asset Protection (GAP) insurance. Smart move. It's not the flashiest topic, but understanding how to get it – and why you might need it – is crucial, especially for those of us who appreciate the nuances of car ownership, from modifications to depreciation. Think of it as a safety net for your finances, not your ride. Let's dive in.

Purpose of GAP Insurance

The core purpose of GAP insurance is to cover the "gap" between what you still owe on your car loan and what your insurance company will pay out if your car is totaled or stolen and not recovered. This is particularly relevant if you've:

- Made a small down payment.

- Financed for a long term (5 years or more).

- Bought a car that depreciates quickly.

- Rolled negative equity from a previous loan into your current loan.

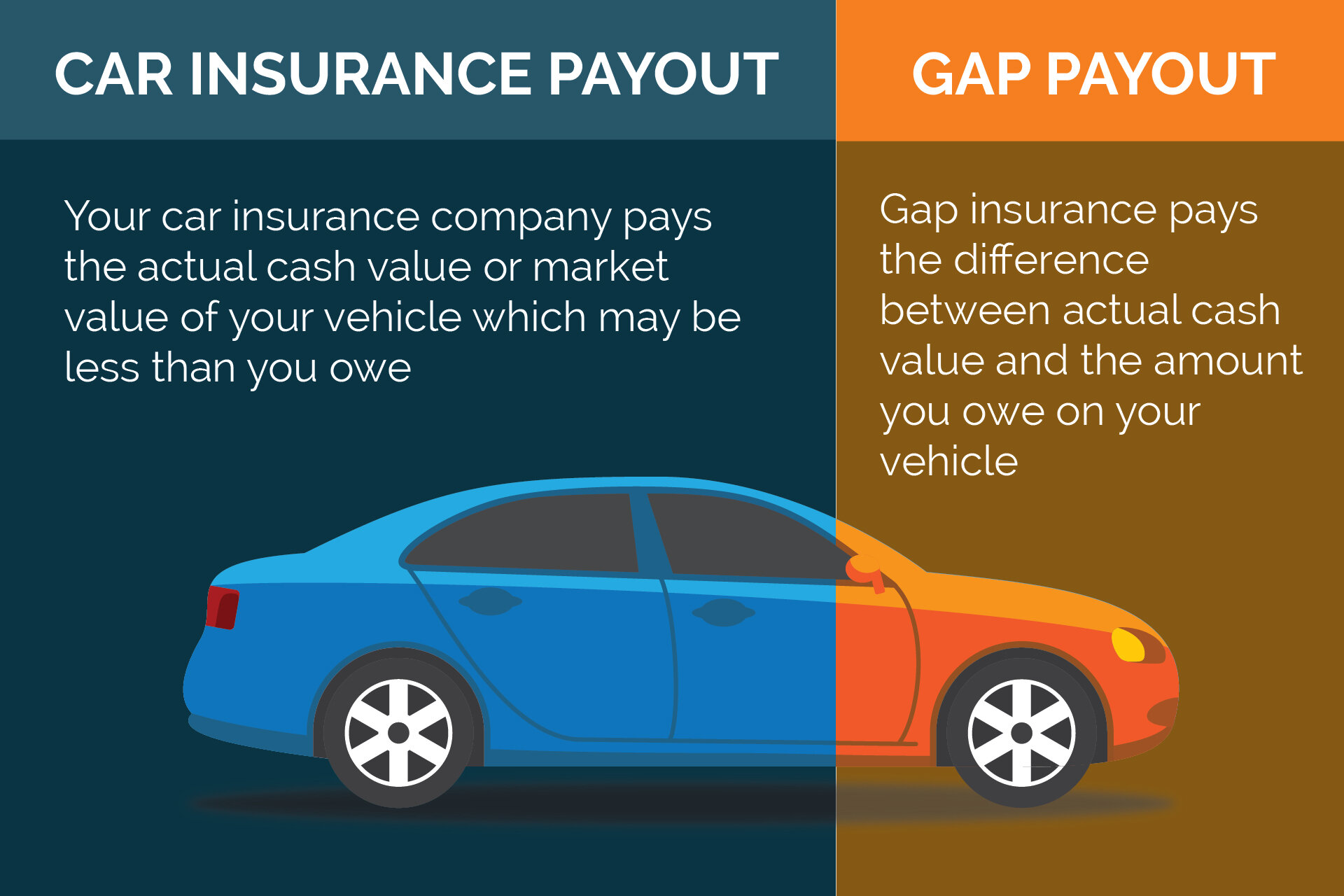

Why is this important? Standard auto insurance only covers the actual cash value (ACV) of your vehicle at the time of the loss. The ACV factors in depreciation. Imagine you buy a brand-new car for $30,000. Two years later, it's totaled. The insurance company determines the ACV is $20,000. You still owe $25,000 on your loan. Without GAP insurance, you're stuck paying that $5,000 difference. GAP insurance bridges that gap, preventing you from owing money on a car you no longer have.

Key Specs and Main Parts of a GAP Insurance Policy

Unlike car parts, GAP insurance "specs" relate more to the terms and conditions of the policy itself. Think of these as the important measurements and ratings you need to consider:

- Eligibility Requirements: Most GAP policies have restrictions on the type of vehicle covered (e.g., some exclude commercial vehicles), the age of the vehicle, and the loan amount.

- Coverage Limits: GAP insurance typically has a maximum payout amount, both in terms of the total coverage and the maximum difference it will cover between the loan balance and the ACV.

- Deductibles: Some GAP policies have deductibles, although they're often lower than your standard auto insurance deductible.

- Exclusions: GAP insurance typically doesn't cover things like mechanical repairs, extended warranties, or carry-over debt from previous loans beyond a certain limit, even if those items were included in your loan. It only covers the difference between the ACV and the loan balance.

- Premium: The cost of the GAP insurance. This can be a one-time fee paid upfront or added to your monthly loan payments.

Main "parts" of the policy, conceptually, include:

- The Covered Loan: The specific auto loan the GAP insurance is attached to.

- The Insured Vehicle: The specific vehicle tied to the loan and covered by the GAP insurance.

- The Insurer: The company providing the GAP insurance coverage.

- The Beneficiary: Typically, the lender who holds the auto loan. They receive the GAP insurance payout to cover the remaining loan balance.

Symbols and Terminology

GAP insurance documentation doesn't use diagrams like you'd see for an engine rebuild, but understanding the terms used is crucial. Here's a breakdown:

- ACV (Actual Cash Value): As mentioned before, this is the fair market value of your vehicle at the time of the loss, taking depreciation into account. It's determined by the insurance company.

- Loan Balance: The outstanding amount you owe on your auto loan at the time of the loss.

- Total Loss: When your vehicle is damaged beyond repair or stolen and not recovered, as determined by your auto insurance company.

- Claim: A formal request to the GAP insurance provider to pay out benefits after a covered loss.

- Premium: The price you pay for the GAP insurance coverage.

- Insured: You, the borrower, are the insured party under the GAP insurance policy.

- Exclusions: Circumstances or losses not covered by the GAP insurance policy.

There aren't really "lines" or "colors" to interpret like in a wiring diagram. It's all about understanding the written terms of the policy.

How GAP Insurance Works

The process is relatively straightforward:

- Purchase GAP Insurance: You can buy GAP insurance from several sources: your car dealership when you finance your vehicle, your auto insurance company, or a third-party provider.

- Total Loss Event: Your vehicle is declared a total loss by your standard auto insurance company due to an accident, theft, or other covered event.

- Auto Insurance Payout: Your auto insurance company pays out the ACV of the vehicle to you or, more likely, directly to your lender.

- GAP Insurance Claim: You file a claim with your GAP insurance provider, providing documentation such as the police report, the auto insurance settlement, and your loan documents.

- GAP Insurance Payout: The GAP insurance provider calculates the difference between your loan balance and the ACV paid by your auto insurance. They then pay that difference (up to the policy limits) to your lender.

Real-World Use - Basic Troubleshooting Tips

GAP insurance isn't something you "fix," but you *can* avoid issues:

- Read the Fine Print: This is critical. Understand the exclusions, coverage limits, and claim procedures before you need to use it.

- Keep Accurate Records: Maintain copies of your GAP insurance policy, loan documents, and auto insurance policy.

- Check Your Coverage: Periodically review your GAP insurance policy, especially if you refinance your auto loan. Ensure the coverage is still adequate.

- Document Everything: If your car is totaled, meticulously document all communication with your auto insurance company and the GAP insurance provider.

- Address Denials Promptly: If your GAP insurance claim is denied, understand the reason for the denial and take appropriate action, such as providing additional documentation or appealing the decision.

Troubleshooting Common GAP Insurance Problems:

Problem: Claim denied due to exceeding coverage limits. Solution: Understand the maximum coverage limit of your GAP policy before needing it. If your loan balance significantly exceeds the ACV and the GAP coverage limit, you might still be responsible for a portion of the debt.

Problem: Claim denied because the vehicle wasn't eligible for GAP insurance. Solution: Verify your vehicle's eligibility for GAP insurance before purchasing the policy. Some policies exclude certain types of vehicles, such as commercial vehicles or those with a high mileage at the time of purchase.

Safety Considerations

There aren't "risky components" in the same way as with a car's mechanical systems, but there are potential financial risks:

- Overlapping Coverage: Don't buy GAP insurance if you already have loan/lease payoff coverage as part of your standard auto insurance policy. This would be redundant.

- Unnecessary Purchase: If you make a large down payment or finance for a short term, the "gap" between your loan balance and the ACV might be minimal, making GAP insurance unnecessary. Evaluate your situation carefully.

- Scams: Be wary of overly aggressive sales tactics or suspiciously low prices. Purchase GAP insurance from reputable sources.

- Opportunity Cost: The money you spend on GAP insurance could be used for other financial goals, such as paying down other debt or investing. Consider the opportunity cost before purchasing GAP insurance.

Finding and Comparing Policies

The best way to get GAP insurance is to shop around. Here are some options to compare and consider:

- Dealership: Often offered during the car buying process. Convenient, but can be more expensive.

- Your Current Auto Insurer: Some major insurers offer GAP insurance as an add-on to your existing policy.

- Banks and Credit Unions: If you financed your car through a bank or credit union, they might offer GAP insurance.

- Online Providers: Several online companies specialize in GAP insurance. Make sure they are reputable.

Before buying, compare premiums, coverage limits, deductibles (if any), and exclusions. Read online reviews to assess the provider's customer service and claim handling process.

Remember, GAP insurance is about financial security. Understanding how it works and shopping around will help you make an informed decision. It's about protecting yourself, not modifying your ride – although knowing your financial liabilities is just as important as knowing your 0-60 time!