How Can I Purchase Gap Insurance

So, you're thinking about getting GAP insurance, huh? Smart move. For those of us who like to tinker with our rides, understanding the financial implications of a total loss is just as important as knowing how to swap out a turbocharger. This isn't about engine specs; it's about protecting your investment. Let’s break down how to purchase GAP insurance, the key factors involved, and what you should keep in mind during the process.

Purpose: Why GAP Insurance Matters

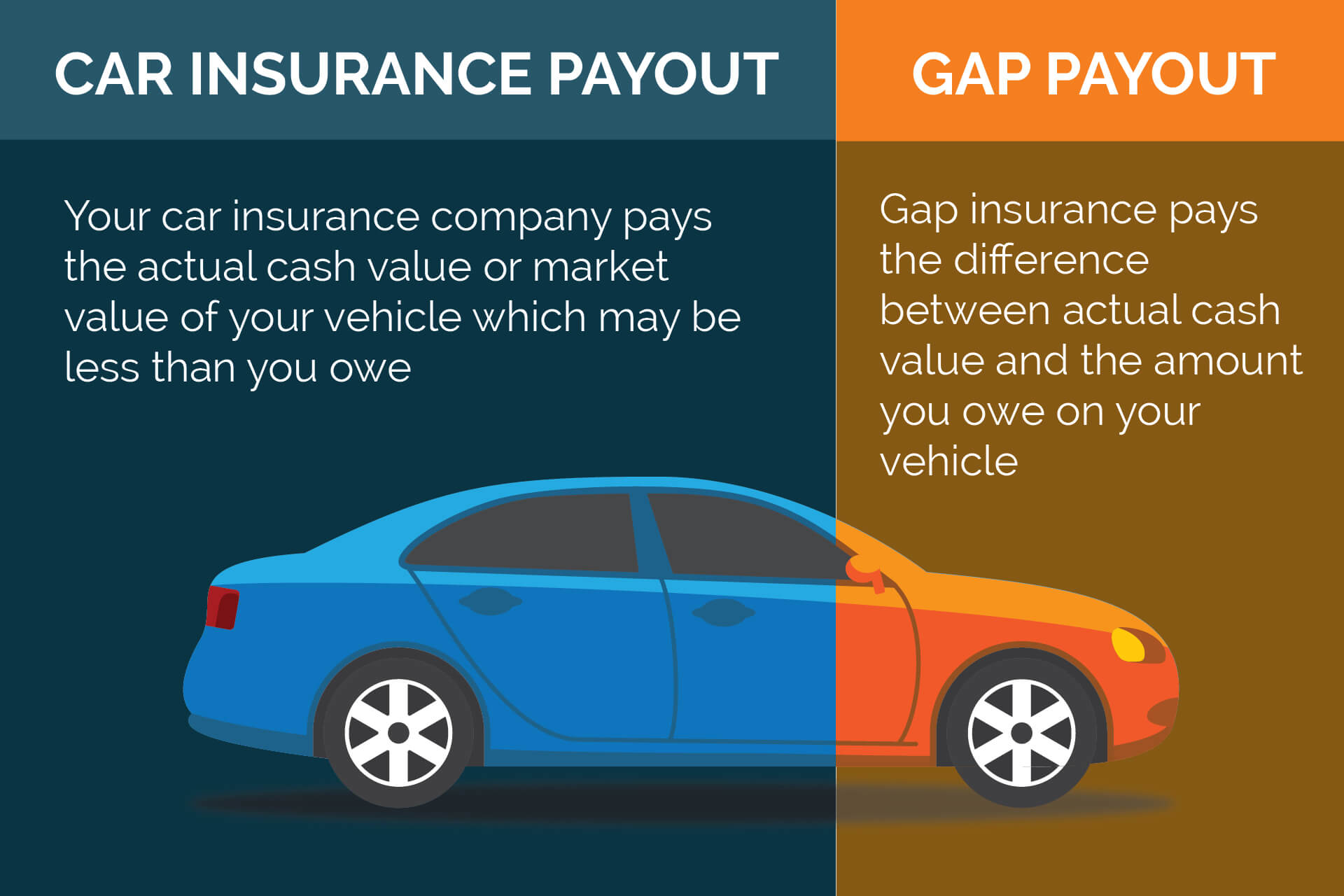

Think of GAP insurance as a financial safety net. It’s designed to cover the difference, or “gap,” between what you still owe on your car loan and what your insurance company pays out if your vehicle is totaled. This could happen in an accident, due to theft, or even some natural disasters. Let's say you owe $20,000 on your loan, but your car is only worth $15,000 at the time of the incident (its Actual Cash Value or ACV). Without GAP insurance, you'd be on the hook for that $5,000 difference. Ouch!

For those of us who tend to modify our vehicles – adding aftermarket parts, performance upgrades, or even just cosmetic enhancements – this is especially critical. Standard insurance often only covers the value of the vehicle before these modifications. GAP insurance won't directly cover the cost of your custom upgrades, but it will at least ensure that the base loan is covered, preventing you from paying for a car you no longer have.

Key Specs and Main Considerations for GAP Insurance

When considering GAP insurance, there are several key specifications to keep in mind:

- Eligibility: Most GAP insurance policies have eligibility requirements. These often include the age of the vehicle (usually new or relatively new), the loan term (how long you have to pay it off), and the loan-to-value (LTV) ratio. LTV refers to the amount of the loan compared to the car's value. If your loan is significantly higher than the car's worth, you're a good candidate for GAP insurance.

- Coverage Limits: GAP insurance policies have coverage limits, which dictate the maximum amount the insurer will pay. Make sure this limit is sufficient to cover the potential gap between your loan balance and the vehicle's ACV.

- Exclusions: GAP insurance typically excludes certain situations. These may include overdue loan payments, negative equity rolled over from a previous loan (meaning you’re still paying off an old car when you bought your new one), and certain types of losses (like repossessions). Read the fine print carefully.

- Cost: The cost of GAP insurance varies depending on the provider, the vehicle's value, and the loan terms. It's usually a one-time fee or a monthly payment added to your car loan.

- Deductibles: Some GAP policies have deductibles, similar to your regular auto insurance. Understand the deductible amount and how it affects the coverage.

Where to Purchase GAP Insurance

You have several options for purchasing GAP insurance:

- Your Car Dealership: This is the most common place people get GAP insurance. Dealers often offer it as an add-on when you're financing your vehicle. However, dealer-provided GAP insurance can sometimes be more expensive than other options, so it's essential to compare prices.

- Your Bank or Credit Union: Banks and credit unions often offer GAP insurance as part of their auto loan packages. Their rates may be competitive, so it's worth checking with your financial institution.

- Insurance Companies: Some major insurance companies offer GAP insurance as a standalone product or as an add-on to your existing auto insurance policy. This can be a convenient option if you prefer to keep all your insurance coverage with one provider.

- Standalone GAP Insurance Providers: There are specialized companies that focus solely on GAP insurance. These providers may offer more flexible coverage options and potentially lower prices than dealerships.

How It Works: The Purchase Process

The process of purchasing GAP insurance generally involves these steps:

- Research and Compare: Get quotes from multiple sources (dealership, bank, insurance company, standalone providers). Compare the coverage limits, exclusions, and costs.

- Assess Your Needs: Determine if GAP insurance is right for you. Consider factors like your down payment, loan term, and the vehicle's depreciation rate. If you put down a large down payment, or have a short loan, the gap might be smaller.

- Review the Policy: Carefully review the policy terms and conditions. Pay attention to the coverage limits, exclusions, and cancellation policy.

- Complete the Application: Fill out the application accurately and provide any required documentation. This typically includes your car loan agreement and vehicle information.

- Make Payment: Pay the premium for the GAP insurance policy. This may be a one-time payment or a monthly payment added to your car loan.

- Receive Confirmation: Obtain written confirmation of your GAP insurance coverage. Keep this documentation in a safe place, along with your car loan agreement and auto insurance policy.

Real-World Use: Troubleshooting and Considerations

Here are some troubleshooting tips and considerations when dealing with GAP insurance:

- Total Loss Claim: If your vehicle is declared a total loss, contact your auto insurance company and your GAP insurance provider immediately. Follow their claim procedures carefully.

- Documentation: Gather all necessary documentation, including the police report, insurance claim settlement, car loan agreement, and GAP insurance policy.

- Review the Settlement Offer: Carefully review the settlement offer from your auto insurance company. This will determine the amount that the GAP insurance will need to cover.

- Negotiate if Necessary: If you believe the insurance company's valuation of your vehicle is too low, try to negotiate a higher settlement. Provide evidence such as comparable sales listings.

- Cancellation: If you pay off your car loan early, or refinance, you may be eligible to cancel your GAP insurance policy and receive a pro-rated refund. Contact your provider to inquire about the cancellation process.

Let's consider a scenario: You bought a car for $30,000 and added $5,000 in aftermarket parts, bringing the total investment to $35,000. After two years, the vehicle is totaled. Your primary insurance values the car at $22,000 (based on the stock vehicle's value, ignoring your modifications) and you still owe $25,000 on the loan. GAP insurance would cover the $3,000 difference, preventing you from owing money on a car you can no longer drive. While the GAP insurance doesn't cover the $5,000 you put into aftermarket parts, it's still preferable to being $8,000 in the hole.

Safety: Potential Pitfalls

While GAP insurance is a valuable tool, there are potential risks to be aware of:

- Overlapping Coverage: Avoid purchasing GAP insurance if you already have loan/lease payoff coverage in your auto insurance policy. This would result in paying for duplicate coverage.

- High-Interest Loans: If you have a high-interest car loan, the amount you owe may decrease slowly, increasing the risk of a significant gap between the loan balance and the vehicle's value. Consider refinancing to lower your interest rate.

- Overpaying for GAP Insurance: Shop around for the best rates and avoid unnecessary add-ons. Dealerships may try to bundle GAP insurance with other products, which can increase the overall cost.

Important Note: GAP insurance is not a substitute for comprehensive and collision coverage. It only covers the gap between your loan balance and the vehicle's value after the primary insurance has paid out.

Final Thoughts

Buying a car is a big deal, and protecting your investment is crucial. GAP insurance offers peace of mind, especially if you have a high loan balance or a vehicle that depreciates quickly. Do your research, compare quotes, and understand the terms and conditions before making a purchase. Don't be afraid to ask questions and negotiate the price. Just like properly tuning your engine, understanding the nuances of GAP insurance can save you a lot of headaches (and money) down the road.

We have a detailed comparison sheet of major GAP insurance providers, which includes their coverage details and typical rates. Contact us if you'd like a copy. This can help you make an informed decision based on your specific situation.