How Car Lease Works In Usa

Alright, let's crack open the hood and dive into the inner workings of a car lease in the USA. Think of this explanation as a detailed schematic, helping you understand the flow of money, contracts, and vehicle ownership when you opt to lease instead of buy. This isn't just theoretical; knowing how a lease functions can empower you to negotiate better deals, understand your obligations, and make informed decisions at the end of your lease term.

Purpose of Understanding the Lease Agreement

Why bother understanding the complexities of a car lease? Just like understanding a wiring diagram helps you diagnose electrical issues, understanding a lease agreement prevents costly surprises. It's especially relevant if you're considering modifications or have particular usage patterns. Knowing the intricacies of the contract empowers you to make informed decisions about:

- Negotiation: Armed with knowledge, you can challenge unfavorable terms.

- Modification Limits: Understand what modifications, if any, are permissible during the lease.

- Wear and Tear: Avoid excessive wear and tear charges at lease end.

- Early Termination: Calculating the costs if you need to end the lease prematurely.

- Buyout Options: Evaluating whether purchasing the vehicle at lease end is a good deal.

Key Specs and Main Parts of a Car Lease

A car lease isn't just renting; it's a complex financial instrument. Here's a breakdown of the core components, which we can visualize as key circuit components:

The Lessor (Usually the Dealership's Financing Arm)

This is the "owner" of the vehicle – think of them as the power source in a circuit. They provide the vehicle for your use based on the agreed-upon terms. They essentially retain the title of the car throughout the lease period.

The Lessee (You, the Driver)

You're the "load" on the circuit. You get to use the vehicle for a specified period, but you don't own it. You're responsible for maintaining the vehicle and adhering to the lease terms.

The Capitalized Cost (Cap Cost)

This is the negotiated price of the car you're leasing. Think of this as the starting value of the vehicle. There are two parts to this: the gross capitalized cost and the net capitalized cost. The gross cap cost is the sticker price of the car plus any fees, taxes, and add-ons. The net cap cost is the gross cap cost minus any down payment, trade-in value, or rebates. A lower net cap cost is generally better for the lessee, as it reduces the monthly payment.

The Residual Value

This is the estimated value of the vehicle at the end of the lease term, as determined by the lessor (usually based on industry guides like ALG or Black Book). This is a critical factor in calculating your monthly payments. A higher residual value results in lower monthly payments because you're essentially only paying for the depreciation of the vehicle *below* this predicted value.

The Money Factor (Lease Rate)

This is essentially the interest rate on the lease, expressed as a decimal. To find the approximate annual percentage rate (APR), multiply the money factor by 2400. For example, a money factor of 0.0025 equates to an APR of 6%. Lower is always better, of course.

Lease Term

The duration of the lease, typically expressed in months (e.g., 24, 36, or 48 months). The shorter the term, the faster the depreciation and potentially higher the monthly payments (though you may pay less overall interest).

Mileage Allowance

The maximum number of miles you can drive the vehicle during the lease term. Exceeding this allowance results in per-mile charges at lease end. These charges can add up quickly, so carefully estimate your driving needs.

Monthly Payment

The amount you pay each month, calculated based on the capitalized cost, residual value, money factor, and lease term. This is the primary expense you'll focus on during the lease.

How It Works: The Financial Flow

Let's trace the flow of money and ownership:

- Negotiation: You negotiate the cap cost of the vehicle.

- Calculation: The lessor calculates the depreciation (cap cost - residual value).

- Interest: The money factor is applied to the depreciation and residual value to determine the interest component of your payment.

- Monthly Payment: The depreciation and interest are combined, then divided by the lease term to arrive at your monthly payment, plus any applicable taxes and fees.

- Usage: You drive the vehicle, adhering to the mileage allowance and maintaining it according to the lease agreement.

- Lease End: You have several options: return the vehicle, purchase the vehicle at the residual value (plus any applicable taxes and fees), or lease another vehicle.

Real-World Use: Basic Troubleshooting Tips

Here's where your DIY skills come in handy:

- High Mileage: Estimate your mileage accurately. If you consistently exceed your allowance, consider purchasing a higher mileage lease upfront or negotiating a lower per-mile charge.

- Wear and Tear: Take care of the vehicle. Minor scratches and dings are usually acceptable, but excessive damage can result in hefty charges. Consider getting a pre-inspection before turning in the vehicle to identify and address any potential issues.

- Negotiation Leverage: Don't be afraid to negotiate the cap cost and money factor. Shop around at different dealerships and compare offers. A lower money factor and a reduced cap cost can significantly lower your monthly payment.

- Early Termination Costs: Understand the penalties for early termination. They can be substantial. Usually, you'll be responsible for the remaining lease payments, plus any early termination fees. Sometimes, rolling the negative equity into a new lease is an option, but be aware of the long-term financial implications.

Safety: Risky Components

Just like with any mechanical system, certain aspects of a lease agreement can be particularly risky:

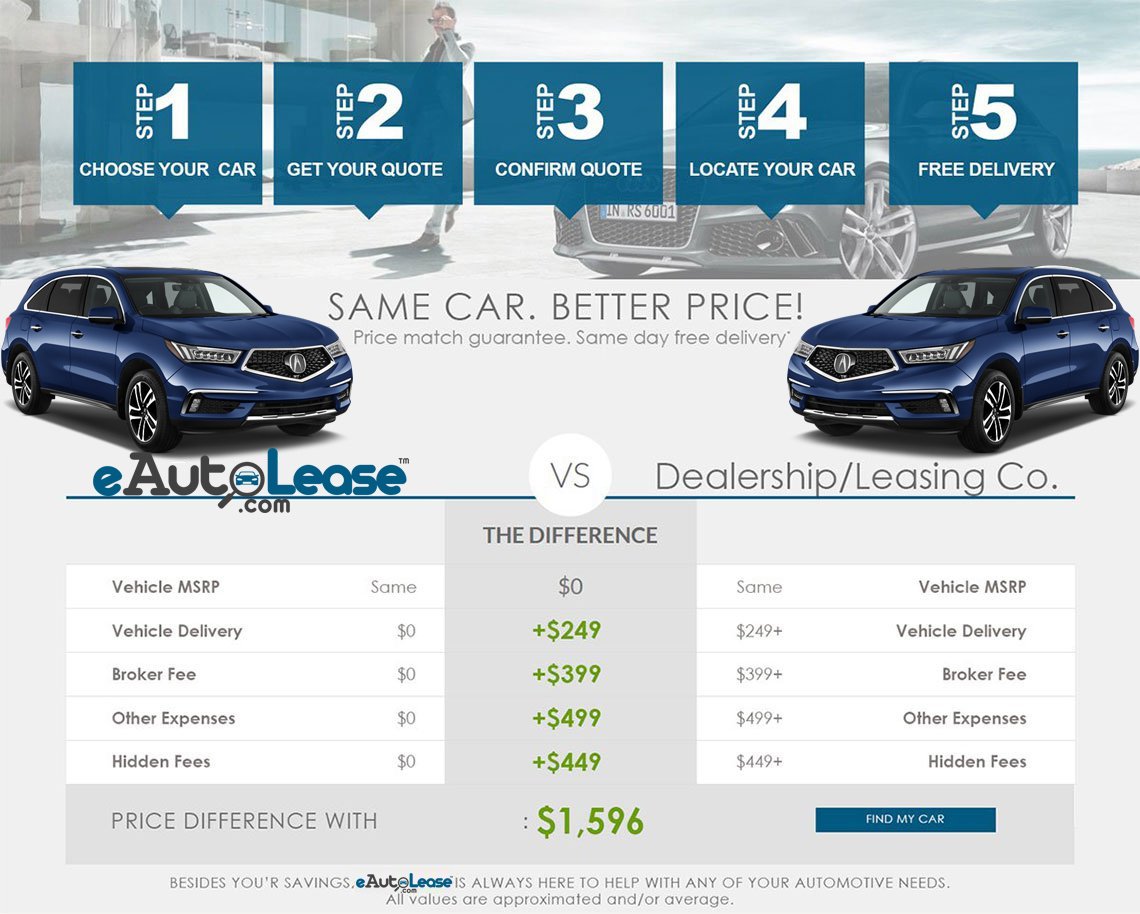

- Hidden Fees: Be wary of hidden fees and charges. Carefully review the lease agreement before signing. Question any fees you don't understand.

- High Money Factor: A high money factor can significantly increase the overall cost of the lease. Always compare the APR equivalent to the money factor with current interest rates.

- Unrealistic Residual Value: An artificially inflated residual value may lower your monthly payments, but it could make purchasing the vehicle at lease end a bad deal. Research the actual market value of the vehicle before making a decision.

- Modification Restrictions: Understand the limitations on modifications. Any alterations, even seemingly minor ones, could void the warranty or result in charges at lease end. Don't assume anything; get it in writing.

Leasing can be a good option if you prioritize driving a new car every few years and don't want the hassle of ownership. However, it's essential to understand the intricacies of the lease agreement to make an informed decision and avoid costly surprises.

We have a detailed schematic of a sample car lease agreement available for download, which includes all the terms and calculations discussed here. This document can serve as a valuable reference as you navigate the leasing process. Understanding these key aspects and paying close attention to the fine print will enable you to make the right choice for your needs.