How Do I Buy Gap Insurance

Okay, let's talk about Guaranteed Asset Protection, or GAP insurance. It's not exactly a wrench, a diagnostic tool, or a tuning module, but it's an essential piece of protection for your vehicle, especially if you're financing it. Think of it as a safety net that catches you when your regular insurance doesn't quite cover the full cost of replacing your car after a total loss. This article will break down how to buy GAP insurance, covering everything from understanding its purpose to navigating the purchase process. We'll use some familiar terminology and relate it to your existing car knowledge.

Purpose: Why GAP Insurance Matters

Imagine you've just spent months perfecting your car. You’ve installed that new turbo kit, upgraded the suspension, and meticulously customized the interior. Then, disaster strikes – an accident renders your car a total loss. Your comprehensive/collision insurance kicks in, but it only covers the actual cash value (ACV) of the vehicle at the time of the accident. This is where things can get ugly.

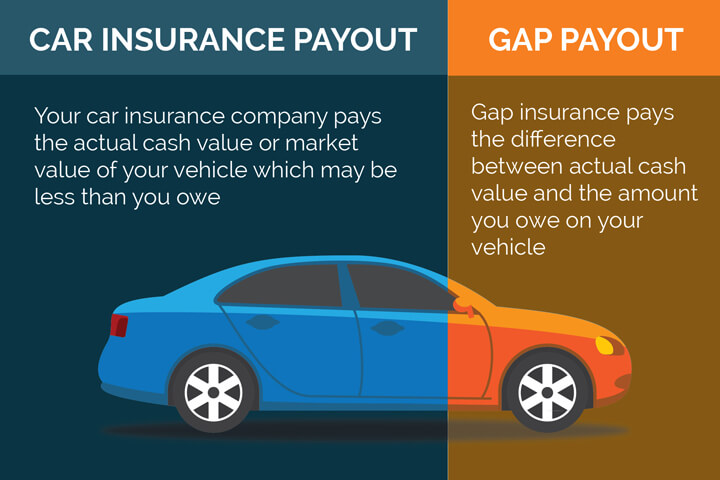

ACV is the market value of your car, taking into account depreciation. If you owe more on your car loan than the ACV, you're "upside down" or "underwater" on your loan. GAP insurance bridges this "gap" between what you owe on your loan and what your insurance company pays out. Without it, you're stuck paying off a loan for a car you no longer have.

This is crucial for several reasons:

- New Cars: New vehicles depreciate rapidly in the first few years.

- Long-Term Loans: Longer loan terms mean slower principal repayment, increasing the risk of being upside down.

- Low Down Payments: Smaller down payments mean you finance a larger portion of the car's value, increasing the potential gap.

- Rollover Debt: If you rolled over debt from a previous car loan into your current loan, you're likely starting out upside down.

- Customization Costs: Standard insurance typically doesn’t fully cover aftermarket modifications, GAP Insurance further helps offset loss beyond base model value.

Key Specs and Main Parts of a GAP Insurance Policy

Think of a GAP insurance policy as a schematic diagram of financial protection. It has several key components to understand:

- Coverage Amount: The maximum amount the policy will pay out. Usually capped at a percentage of the vehicle's MSRP or loan balance.

- Deductible: Some GAP policies have a deductible, just like your regular car insurance.

- Covered Losses: GAP insurance typically covers total losses due to accidents, theft, fire, or natural disasters.

- Exclusions: Policies often exclude things like mechanical breakdowns, cosmetic damage, or losses due to negligence (e.g., driving under the influence).

- Premium: The cost of the GAP insurance policy. This can be a one-time fee or included in your monthly loan payment.

- Eligibility Requirements: Policies often require that you have comprehensive and collision coverage on your primary auto insurance policy. They may also have limitations on the age or mileage of the vehicle.

Understanding the Purchase Process: A Step-by-Step Guide

Buying GAP insurance is a relatively straightforward process, but it's essential to do your homework.

1. Assess Your Needs

Before diving in, figure out if you actually need it. Ask yourself:

- What is the loan balance on your car?

- What is the approximate market value (ACV) of your car? You can check resources like Kelley Blue Book or Edmunds.

- Is there a significant difference between the two? If so, GAP insurance is probably a good idea.

2. Explore Your Options

You have several options for purchasing GAP insurance:

- Dealership: Often offered at the time of car purchase. This is convenient but can be more expensive.

- Lender: Your bank or credit union may offer GAP insurance.

- Independent Insurance Companies: Several companies specialize in GAP insurance. Shopping around can save you money.

3. Compare Quotes

Don't just take the first offer you get. Get quotes from multiple sources and compare the following:

- Premium Cost: The total cost of the policy.

- Coverage Amount: The maximum payout.

- Deductible (if any): The amount you'll pay out of pocket.

- Exclusions: What's not covered.

- Reputation of the Provider: Check reviews and ratings of the insurance company.

4. Read the Fine Print

This is crucial. Just like reading the service manual before tearing down an engine, understand the terms and conditions of the policy. Pay attention to any exclusions, limitations, or cancellation policies.

5. Make the Purchase

Once you've chosen a policy, complete the application process and pay the premium. Make sure to keep a copy of the policy for your records.

Real-World Use: Basic "Troubleshooting" and Considerations

GAP insurance is passive protection, but here are some things to keep in mind:

- File a Claim Promptly: If your car is totaled, file a claim with your primary auto insurance company first. Once that claim is settled, contact your GAP insurance provider.

- Provide Documentation: You'll need to provide documentation from your primary insurance company, the loan documents, and possibly other information.

- Policy Limits: Be aware of the policy's coverage limits. If the gap between your loan balance and the ACV exceeds the policy's maximum payout, you'll still be responsible for the difference.

- Cancellation: If you pay off your car loan early, you may be able to cancel your GAP insurance and receive a prorated refund. Check your policy for details.

Safety: Potential Risks and Considerations

GAP insurance is generally safe, but here are a few potential pitfalls to avoid:

- Overpaying: Dealership GAP insurance can be significantly more expensive than options from lenders or independent companies. Shop around!

- Duplication of Coverage: Some auto insurance policies include a "loan/lease payoff" provision, which is similar to GAP insurance. Check your existing policy before buying GAP.

- Misunderstanding the Coverage: Don't assume that GAP insurance covers everything. Understand the exclusions and limitations of the policy.

Crucially, GAP insurance is designed to cover the difference between the ACV and what is still owed on the loan. It is not meant to cover things like the down payment, extended warranties, or prior unpaid balances.

Conclusion

GAP insurance is a valuable tool to protect yourself from financial loss if your car is totaled and you owe more than it's worth. By understanding its purpose, exploring your options, and reading the fine print, you can make an informed decision about whether or not it's right for you. Just like choosing the right tools for a complex repair, selecting the right insurance coverage is essential for protecting your investment.

Consider GAP Insurance as a safeguard against potential financial setbacks, enabling you to pursue your automotive passions with greater peace of mind. While it doesn't directly affect your car's performance or appearance, it can be instrumental in preventing a financial breakdown in the event of a total loss.