How Do I Contact Gap Insurance

Let's talk about something a little less hands-on than engine tuning, but just as crucial for protecting your investment: Gap Insurance. While we usually dive deep into manifolds and suspension, understanding how to navigate the claims process for your Gap insurance is vital if the unthinkable happens and your car is totaled or stolen.

Purpose: Protecting Your Investment

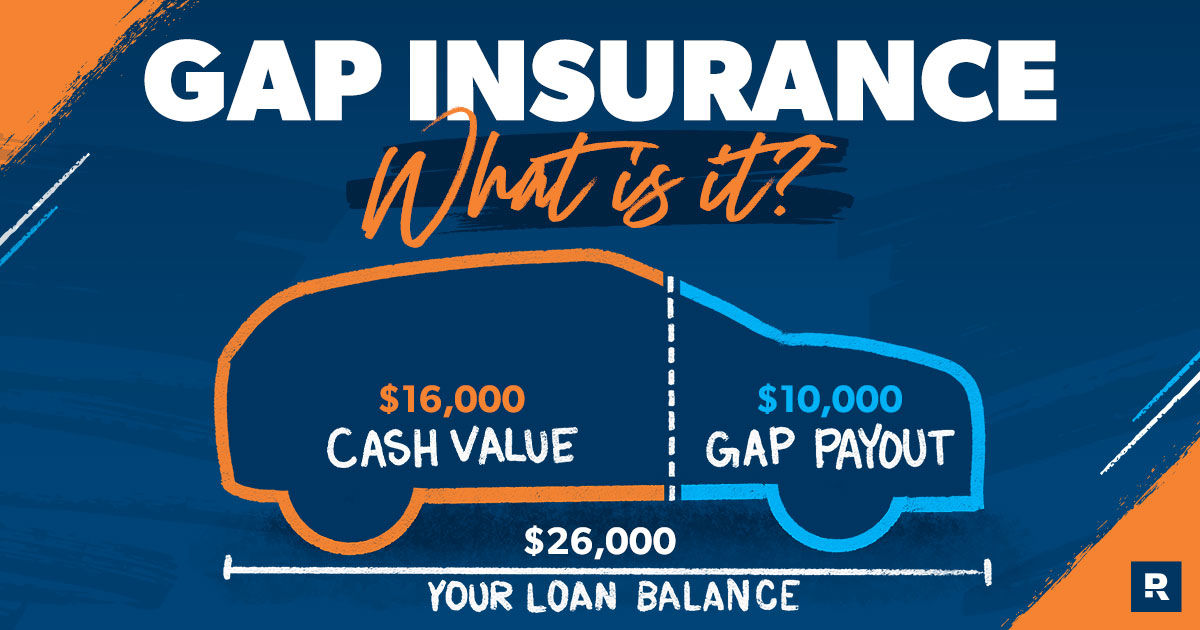

Why are we even discussing contacting Gap insurance? Because unlike your standard auto insurance which covers the actual cash value (ACV) of your vehicle at the time of the incident, Gap insurance covers the "gap" between that ACV and what you still owe on your loan or lease. Think of it as financial security against depreciation.

Imagine this: You buy a car for $30,000, financing the entire amount. Two years later, thanks to depreciation (that inevitable decline in value), your car is worth only $20,000. If it's totaled and you still owe $25,000, your standard insurance pays $20,000, leaving you $5,000 short. Gap insurance is designed to cover that $5,000 (minus any deductible stipulated in your Gap policy).

This article isn't about selling you Gap insurance; it's about empowering you to effectively use it if and when the need arises. Knowing *how* to contact them *quickly and correctly* can significantly speed up the claims process.

Key Specs and Main Information You'll Need

Before you even think about filing a claim, gather these essential pieces of information. Think of it as prepping your tools before tackling a complex engine rebuild:

- Your Gap Insurance Policy Number: This is the most important piece of information. It’s like the key to unlocking your coverage. It’s usually found on your insurance card or policy documents.

- Vehicle Information (VIN, Make, Model, Year): This is your vehicle's unique identifier. Have your vehicle registration handy.

- Loan/Lease Agreement: This document outlines the terms of your loan or lease, including the outstanding balance and any applicable fees.

- Primary Auto Insurance Information: This includes your auto insurance policy number, claim number (if applicable), and contact information for your insurance company.

- Total Loss Settlement Letter from Your Auto Insurance: This letter officially confirms that your vehicle has been declared a total loss and outlines the settlement amount they are offering. This is critical; Gap insurance cannot process your claim without it.

- Contact Information for the Gap Insurance Provider: Find the phone number, email address, and mailing address for the Gap insurance company. This is usually listed on your policy documents.

Contact Methods: Navigating the Channels

Contacting your Gap insurance provider typically involves several avenues. Understanding these is like knowing the different torque specs for various bolts – crucial for a smooth process.

- Phone: The most direct method. Have all your documentation ready when you call. Be prepared to answer questions about the incident, your vehicle, and your loan/lease. Jot down the name of the representative you speak with, the date and time of the call, and any reference numbers provided.

- Email: A good option for sending documents and keeping a written record of your communication. Ensure your emails are professional and include all relevant information.

- Mail: Slower, but necessary for sending original documents if requested. Use certified mail with return receipt requested for proof of delivery.

- Online Portal: Some Gap insurance providers offer online portals where you can file claims, upload documents, and track the progress of your claim.

How It Works: The Claims Process Explained

Understanding the claims process is like understanding the flow of electricity through your car's wiring harness. It's a sequence of steps that must be followed correctly:

- Report the Loss to Your Primary Auto Insurance: This is the first and most crucial step. Your auto insurance company will investigate the incident and determine if your vehicle is a total loss.

- Receive the Total Loss Settlement Letter: Once your auto insurance declares your vehicle a total loss, they will send you a settlement letter outlining the amount they are offering to cover the actual cash value of your vehicle.

- Contact Your Gap Insurance Provider: Once you have the settlement letter from your primary insurance, you can contact your Gap insurance provider to initiate the claim process.

- Provide Required Documentation: You will need to provide all the documents listed earlier (Gap insurance policy, vehicle information, loan/lease agreement, primary auto insurance information, and the total loss settlement letter).

- Review and Approval: The Gap insurance provider will review your documentation and verify the information. They will then calculate the amount they owe based on the "gap" between the ACV and your outstanding loan balance.

- Payment: Once your claim is approved, the Gap insurance provider will typically pay the difference directly to your lender.

Real-World Use: Basic Troubleshooting Tips

Sometimes things don't go smoothly. Here are some common issues and how to address them:

- Delay in Processing: If your claim is taking longer than expected, contact your Gap insurance provider to inquire about the status. Keep a record of all your communication.

- Disagreement on the Gap Amount: If you disagree with the amount the Gap insurance provider is offering, review your loan/lease agreement and compare it to the ACV determined by your primary insurance. Contact the Gap insurance provider to discuss your concerns.

- Missing Documentation: Ensure you have provided all the required documentation. If you are missing any documents, contact your lender or primary insurance provider to obtain them.

- Policy Exclusions: Be aware of any exclusions in your Gap insurance policy. Some policies may exclude certain types of losses or fees.

Example: Let's say your primary insurance values your totaled car at $15,000, and you still owe $20,000 on the loan. Your Gap policy has a $1,000 deductible. The Gap insurance should cover $4,000 ($20,000 - $15,000 - $1,000). Make sure their calculations match yours! If not, respectfully challenge their figures with supporting documentation.

Safety: Preventing Issues and Protecting Yourself

While dealing with insurance claims isn't physically dangerous, it's important to protect yourself from potential financial risks:

- Read Your Policy Carefully: Understand the terms and conditions of your Gap insurance policy, including any exclusions or limitations.

- Keep Accurate Records: Maintain copies of all your documents and communication related to your Gap insurance policy and claims.

- Beware of Scams: Be cautious of unsolicited offers or requests for personal information. Always verify the identity of anyone claiming to represent your Gap insurance provider.

Crucially, understand that Gap insurance is designed to cover the difference between the ACV and the loan balance. It doesn't cover things like missed payments or negative equity rolled over from a previous loan, unless explicitly stated in your policy.

This information provides a solid foundation for understanding how to contact and navigate the Gap insurance claims process. Remember to stay organized, be persistent, and advocate for yourself. It's your financial well-being at stake.