How Do I Get A Car Loan

So, you're looking to get a car loan? Excellent! Think of this as another modification project, but instead of wrenching on an engine, you're tuning your finances to acquire the machine you need. This isn't just about signing some papers; it's about understanding the inner workings of the lending process, negotiating effectively, and ultimately, securing the best possible deal. For a DIYer like you, who's comfortable diagnosing complex systems, understanding the ins and outs of car loans should be a breeze. We'll break down the process step-by-step, just like we would if we were tackling a tricky wiring diagram.

Purpose: Understanding the Car Loan System

Why bother digging into the details of car loans? Well, knowledge is power, especially when your hard-earned cash is on the line. Understanding the "diagram" of a car loan empowers you to:

- Secure the Best Interest Rate: Recognizing factors influencing interest rates allows you to optimize your application and negotiate effectively.

- Avoid Hidden Fees: Understanding loan terms helps you identify and avoid potentially costly hidden fees and charges.

- Budget Effectively: Accurately predicting your monthly payments and total loan cost helps you manage your budget responsibly.

- Negotiate with Confidence: Informed buyers have more leverage in negotiations with dealerships and lenders.

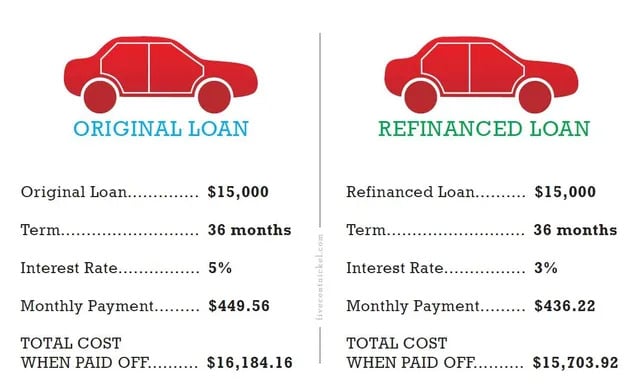

- Refinance Strategically: Knowing the loan landscape positions you to refinance your loan if better opportunities arise in the future.

Key Specs and Main Parts of a Car Loan

Like any complex system, a car loan has key components that work together. Let's define them:

Main Parts:

- Principal: This is the amount of money you borrow to purchase the vehicle. Think of it as the raw material you need for your project.

- Interest Rate (APR): The Annual Percentage Rate is the cost of borrowing money, expressed as a yearly percentage. It includes the nominal interest rate plus any fees or charges. This is a crucial spec to watch – a seemingly small difference can have a big impact over the life of the loan.

- Loan Term: The length of time you have to repay the loan, typically expressed in months (e.g., 36 months, 60 months, 72 months). A longer term means lower monthly payments but higher total interest paid.

- Monthly Payment: The fixed amount you pay each month to cover the principal and interest.

- Down Payment: The amount of money you pay upfront towards the purchase of the vehicle. A larger down payment reduces the loan principal and can lower your monthly payments and interest rate.

- Fees: These can include origination fees (charged by the lender for processing the loan), application fees, and prepayment penalties (charges for paying off the loan early – often a red flag).

Key Specs & Factors:

- Credit Score: A numerical representation of your creditworthiness. A higher credit score generally qualifies you for lower interest rates. Think of it as the quality of your financial "engine."

- Debt-to-Income Ratio (DTI): The percentage of your gross monthly income that goes towards debt payments. Lenders use DTI to assess your ability to repay the loan.

- Loan-to-Value Ratio (LTV): The ratio of the loan amount to the vehicle's value. A lower LTV (achieved through a larger down payment) typically results in better loan terms.

- Vehicle Type (New vs. Used): Interest rates for new cars are generally lower than for used cars because new cars are considered less risky assets.

- Collateral: The vehicle itself serves as collateral for the loan. If you default on the loan, the lender can repossess the car.

Symbols and Flow: Understanding the Loan Process

While there aren't literal diagrams with lines and arrows for car loans, we can think of the process as a flow chart:

- Pre-Approval (Green Light): Start by getting pre-approved for a loan from a bank, credit union, or online lender. This gives you a realistic idea of how much you can borrow and at what interest rate. This is like checking the specifications before you order parts – you want to make sure everything fits.

- Vehicle Selection (Part Identification): Choose the car you want. Consider your needs, budget, and preferences. Research the vehicle's value using resources like Kelley Blue Book or Edmunds.

- Negotiation (Bargaining for Components): Negotiate the price of the car with the dealer. Don't be afraid to walk away if you're not happy with the deal. Remember, the sticker price is just a starting point.

- Loan Application (Assembly Process): Submit a formal loan application with your chosen lender. Provide all necessary documentation, such as proof of income, employment history, and identification.

- Underwriting (Quality Control): The lender will review your application and assess your creditworthiness. They'll verify your information and determine if you qualify for the loan. This is where your financial "engine" gets put to the test.

- Loan Approval (Final Inspection): If your application is approved, the lender will issue a loan agreement outlining the terms and conditions of the loan.

- Closing (Final Assembly): Review the loan agreement carefully and ensure you understand all the terms before signing. Once you sign, the loan is finalized, and you take possession of the car.

- Repayment (Scheduled Maintenance): Make your monthly payments on time to avoid late fees and damage to your credit score. Consider setting up automatic payments to ensure timely repayment.

How It Works: The Mechanics of a Car Loan

The core principle is simple: you borrow money, and you repay it with interest over time. However, the details can be complex. Here's a breakdown:

- Amortization: This is the process of gradually paying off the loan principal over time. Each monthly payment includes a portion of the principal and a portion of the interest. In the early stages of the loan, a larger portion of your payment goes towards interest, while later payments allocate more towards the principal. You can find amortization schedules online or request one from your lender.

- Interest Calculation: Interest is typically calculated on a daily basis, using the outstanding principal balance. This means that the faster you pay down the principal, the less interest you'll pay overall.

- Credit Impact: Your payment history is reported to credit bureaus. Making timely payments builds positive credit, while late or missed payments can negatively impact your credit score.

Real-World Use: Basic Troubleshooting Tips

Just like with your car, problems can arise with your loan. Here are some common issues and troubleshooting tips:

- High Interest Rate: If you're offered a high interest rate, shop around for quotes from multiple lenders. Improve your credit score by paying down existing debt and correcting any errors on your credit report. Consider a co-signer with good credit.

- Unexpected Fees: Scrutinize the loan agreement for any hidden fees. Question any charges you don't understand. Never be afraid to walk away if you feel something is off.

- Difficulty Making Payments: If you're struggling to make payments, contact your lender immediately. They may be able to offer temporary relief, such as a deferment or forbearance. Consider refinancing the loan to a lower interest rate or a longer term.

- Negative Equity: If the value of your car is less than the outstanding loan balance, you're said to have negative equity (being "upside down"). This can make it difficult to trade in or sell your car. To avoid this, make a larger down payment and choose a shorter loan term.

Safety: Risky Components and Practices

Just like there are dangerous components under the hood of your car, there are risky elements in car loans:

- Predatory Lending: Be wary of lenders who offer loans with excessively high interest rates, hidden fees, or unfair terms. These lenders often target borrowers with poor credit.

- Long Loan Terms: While longer loan terms can lower your monthly payments, they can also significantly increase the total amount of interest you pay over the life of the loan.

- Add-Ons: Dealers may try to sell you add-ons, such as extended warranties or gap insurance. Evaluate the value of these products carefully before agreeing to purchase them.

- Prepayment Penalties: Avoid loans with prepayment penalties, as these can make it difficult to pay off the loan early and save on interest.

- Ignoring the Fine Print: Read the loan agreement carefully and understand all the terms before signing. Don't be afraid to ask questions. If something doesn't make sense, get clarification.

Remember, securing a car loan is a significant financial decision. By understanding the system, negotiating effectively, and avoiding common pitfalls, you can drive away with the car you need and a loan that fits your budget.

We have a detailed loan comparison chart available for download. This chart outlines key factors, such as APR ranges, loan terms, and lender fees, allowing you to compare different loan options side-by-side. Just like having a torque spec sheet, this chart can help you ensure your decisions are within tolerance.