How Do I Get Gap Insurance

So, you're thinking about GAP insurance, huh? Smart move. It's like a seatbelt for your finances when dealing with a totaled vehicle. Now, you might be thinking, "Insurance is insurance, right?" Not quite. GAP insurance (and getting it) is a specific process designed to protect you from a particular type of financial loss, and understanding the ins and outs is crucial, especially for us gearheads who know the value of our rides, and how quickly they can depreciate.

Purpose: Why You Need to Understand GAP Insurance

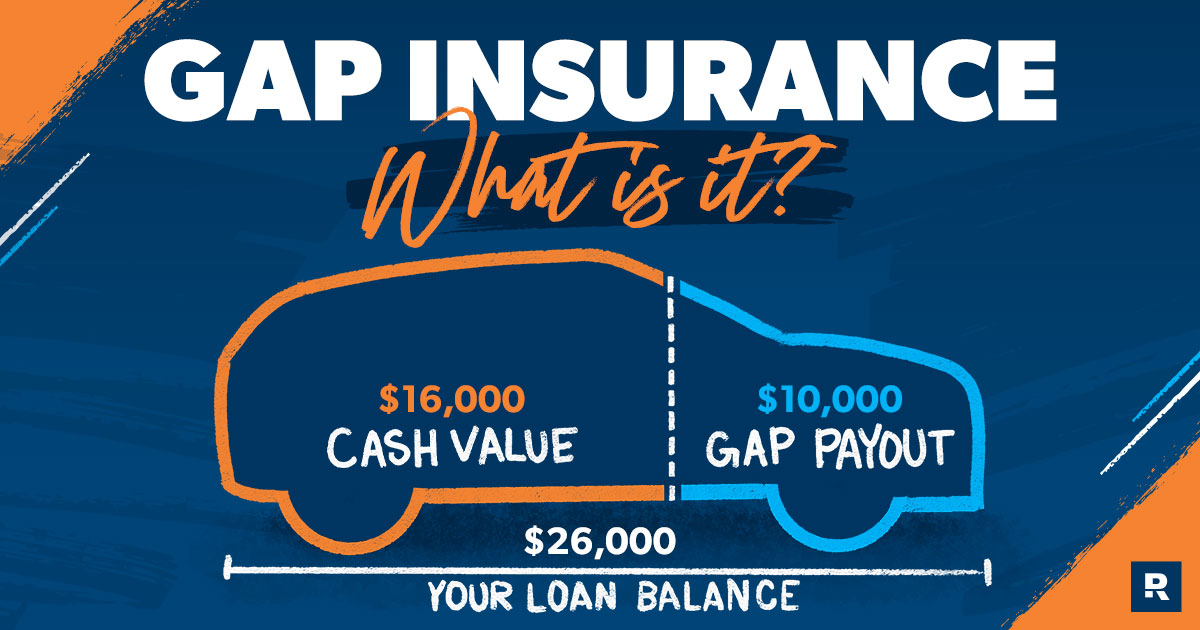

Think of GAP insurance as a safety net. Its primary purpose is to cover the "gap" between what you owe on your car loan (the outstanding loan balance) and what your car is actually worth (the actual cash value (ACV)) at the time it's totaled or stolen. This is hugely important because new cars, especially those with aftermarket modifications, tend to depreciate rapidly. Your standard auto insurance will only pay out the ACV, which might be significantly less than what you still owe the bank. Without GAP insurance, you're stuck paying off a loan for a car you no longer have. Let's say you owe $25,000 on your car, but it's only worth $20,000 when it's totaled. Your regular insurance will pay $20,000, leaving you on the hook for $5,000. GAP insurance would cover that $5,000.

Key Specs and Main Considerations

Before diving into getting GAP insurance, let's clarify a few key terms and considerations:

- Loan-to-Value (LTV) Ratio: This is the amount of your loan compared to the car's value. A high LTV ratio (e.g., borrowing more than the car is worth) makes GAP insurance even more crucial. This often happens when you roll over negative equity from a previous car loan into the new loan.

- Depreciation Rate: How quickly your car loses value. Some makes and models depreciate faster than others, impacting the potential "gap." Modifications, while they might increase the car's personal value to you, often don't increase its ACV according to insurance companies.

- Deductible: Some GAP insurance policies have a deductible, just like your regular car insurance. Know the amount and how it applies.

- Policy Limits: GAP insurance policies have maximum payout limits. Make sure the limit is high enough to cover the potential gap between your loan balance and the car's ACV.

- Eligibility: Not everyone qualifies for GAP insurance. There are typically requirements regarding the age of the vehicle and the loan term.

The GAP Insurance Acquisition Process: A Step-by-Step Guide

Now, let's break down the steps to acquiring GAP insurance:

- Assess Your Need: Calculate your LTV ratio. If you put down a small down payment (or none at all), have a long loan term, or rolled over negative equity, GAP insurance is likely a good idea.

- Research Providers: You have several options for obtaining GAP insurance:

- Dealership: Often offered when you buy the car. Convenient, but can be more expensive.

- Lender: Banks and credit unions often offer GAP insurance as part of the loan package.

- Independent Insurance Companies: Can often provide more competitive rates. Do some comparison shopping.

- Compare Quotes: Get quotes from multiple providers. Compare the premiums, deductibles, policy limits, and coverage terms. Don't just look at the price; understand what you're getting.

- Read the Fine Print: This is crucial. Understand the exclusions (situations where the policy won't pay out). Common exclusions include:

- Delinquent Loan Payments: If your loan is in default, the policy may not pay out.

- Modifications Not Disclosed: If you've made significant modifications to your car that you haven't disclosed to your insurance company (and they're relevant to the accident), the GAP insurance claim could be denied.

- Repairs Not Approved: Some policies require you to get approval for repairs before they're made.

- Policy Exclusions: These could be anything from using the vehicle for commercial purposes, or illegal activities.

- Purchase the Policy: Once you've chosen a provider, purchase the policy. Make sure you receive a copy of the policy documents and understand the terms and conditions.

- Keep Records: Keep a copy of your GAP insurance policy, your car loan agreement, and your regular car insurance policy in a safe place.

How GAP Insurance Works: The Claim Process

Hopefully, you'll never need to use your GAP insurance, but if you do, here's how the claim process typically works:

- Report the Incident: Immediately report the accident or theft to your regular car insurance company and the police.

- File a Claim with Your Primary Insurance: Your regular insurance company will determine if the car is a total loss and will pay out the ACV.

- Contact Your GAP Insurance Provider: Once you have the settlement offer from your primary insurance, contact your GAP insurance provider.

- Provide Documentation: You'll need to provide documentation, including:

- Your regular insurance settlement offer.

- Your car loan agreement.

- Your GAP insurance policy.

- The police report.

- The GAP Insurance Provider Evaluates the Claim: The GAP insurance provider will evaluate the claim and determine the amount they will pay out, based on the "gap" between your loan balance and the ACV.

- Payment: The GAP insurance provider will typically pay the lender directly, reducing your outstanding loan balance.

Real-World Use: Basic Troubleshooting Tips

Here are a few common scenarios and troubleshooting tips:

- Claim Denied: If your GAP insurance claim is denied, find out the reason. Common reasons include non-payment of premiums, exclusions in the policy, or inaccurate information provided during the application process. You may be able to appeal the decision.

- Disagreement on ACV: If you disagree with the ACV determined by your regular insurance company, you can challenge it. Provide evidence of the car's value, such as recent sales of similar vehicles or appraisals. This can indirectly affect your GAP insurance payout.

- Policy Lapsed: Make sure you keep your GAP insurance policy active by paying your premiums on time. A lapsed policy won't cover any losses.

Safety Considerations

While GAP insurance itself isn't inherently dangerous, it's crucial to avoid these pitfalls:

- Over-Insuring: Don't buy GAP insurance if you're already well-protected by a large down payment or a short loan term. It's a waste of money.

- Assuming Full Coverage: GAP insurance only covers the "gap." It doesn't cover things like your deductible on your regular insurance policy, or any penalties you might incur for early loan repayment.

- Neglecting Regular Insurance: GAP insurance is secondary to your primary car insurance. Make sure you have adequate liability coverage and collision/comprehensive coverage.

Final Thoughts

GAP insurance is a valuable tool for protecting yourself from financial loss when dealing with a totaled vehicle, especially if you have a high LTV ratio or a car that depreciates quickly. By understanding the purpose, key terms, acquisition process, claim process, and potential pitfalls, you can make an informed decision about whether GAP insurance is right for you. Remember to shop around, read the fine print, and keep accurate records. Think of it as another layer of protection for your investment. Happy motoring!