How Do I Go About Leasing A Car

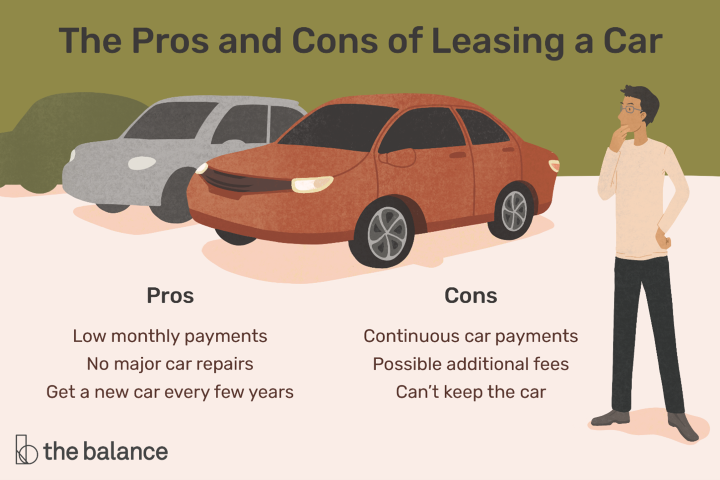

So, you’re thinking about leasing a car? Excellent choice. It’s a different beast than buying, with its own set of advantages and disadvantages. Think of it as renting a very complex machine for a specific period. As an experienced DIYer, you're used to understanding the intricate workings of things; this guide will help you navigate the leasing process with confidence, like you're diagnosing an engine issue armed with a detailed schematic.

Purpose of Understanding the Leasing Process

Why bother diving into the nitty-gritty of leasing? Just like understanding a car's wiring diagram helps you troubleshoot electrical problems, grasping the leasing process allows you to:

- Negotiate a better deal: Knowledge is power. The more you understand the terms, the better you can haggle.

- Avoid hidden fees and surprises: Leasing agreements are dense. Understanding them prevents unexpected costs down the line.

- Make an informed decision: Leasing isn't right for everyone. Understanding the commitment helps you decide if it aligns with your needs.

Key Specs and Main Parts of a Lease Agreement

A lease agreement is essentially a detailed contract. Here are the crucial elements:

Capitalized Cost (Cap Cost)

This is the agreed-upon price of the vehicle. Think of it as the starting point for calculating your monthly payments. It's negotiable, just like the purchase price of a car. Aim to lower this as much as possible.

Capitalized Cost Reduction

This is any down payment, trade-in value, or manufacturer rebate that lowers the cap cost. While it lowers your monthly payment, remember that you won't get this money back at the end of the lease. It’s essentially upfront depreciation. Consider this: are there better places to put this money? High yield savings account? Paying down debts?

Residual Value

This is the estimated value of the car at the end of the lease term, determined by the leasing company. A higher residual value typically results in lower monthly payments. However, it can also mean you're paying less in depreciation during the lease term. It's a bet the leasing company is making, and it directly affects your cost.

Money Factor

This is essentially the interest rate you're paying on the lease. It's usually expressed as a small decimal (e.g., 0.0025). To get the approximate annual interest rate, multiply the money factor by 2400. So, 0.0025 * 2400 = 6% APR.

Lease Term

The length of the lease, usually expressed in months (e.g., 24, 36, 48 months). Shorter terms usually have higher monthly payments but less overall cost (less interest paid). Longer terms have lower monthly payments but more overall cost.

Mileage Allowance

The number of miles you're allowed to drive per year. Exceeding this allowance results in a per-mile charge at the end of the lease. Be realistic about your driving habits! Overestimate rather than underestimate.

Acquisition Fee

This is a fee charged by the leasing company to initiate the lease. It's usually non-negotiable.

Disposition Fee

This is a fee charged by the leasing company at the end of the lease when you return the vehicle. It covers the cost of preparing the car for resale. It may be waived if you lease another vehicle from the same company.

Symbols and Their Meaning (Lease Jargon)

The world of leasing is filled with jargon, but understanding it is key. Here's a breakdown:

- APR: Annual Percentage Rate. The true annual cost of borrowing money, including fees, expressed as a percentage.

- MSRP: Manufacturer's Suggested Retail Price. The sticker price of the car, before any discounts or negotiations.

- Lessee: You, the person leasing the car.

- Lessor: The leasing company (usually a bank or financial institution).

- GAP Insurance: Guaranteed Auto Protection insurance. Covers the difference between the car's value and the outstanding lease balance if the car is stolen or totaled. Highly recommended!

How It Works: The Lease Calculation

The monthly lease payment is primarily determined by the difference between the capitalized cost and the residual value, plus the rent charge (interest). Here's a simplified breakdown:

- Calculate Depreciation: (Cap Cost - Residual Value) / Lease Term = Monthly Depreciation

- Calculate Rent Charge: (Cap Cost + Residual Value) * Money Factor = Monthly Rent Charge

- Monthly Payment (Before Taxes): Monthly Depreciation + Monthly Rent Charge

This is a simplified calculation. The actual calculation can be more complex and may include other fees.

Real-World Use: Troubleshooting Leasing Issues

Like any machine, things can go wrong with a lease. Here's how to troubleshoot common issues:

- High Mileage Penalty: If you anticipate exceeding your mileage allowance, negotiate for a higher allowance before signing the lease. It's much cheaper to negotiate up front than to pay the per-mile charge at the end. Alternatively, if you *know* you will go over mileage, consider a short-term lease (24 months) rather than 36.

- Excess Wear and Tear: Leasing companies have strict standards for acceptable wear and tear. To avoid charges at the end of the lease, repair any significant damage (dents, scratches, upholstery tears) before returning the vehicle. Get an inspection by a third party before returning the car to the dealership.

- Early Termination: Terminating a lease early can be very expensive. You'll typically be responsible for the remaining lease payments, plus any early termination fees. Avoid this if possible.

- Negotiating the Cap Cost: Just like buying, negotiate the cap cost. Do your research on the car's market value. Don't be afraid to walk away if the dealer won't budge.

Safety Considerations

Leasing itself isn't inherently dangerous, but there are some financial risks to be aware of:

- Avoid Overspending: It's easy to get caught up in the allure of a new car and agree to a lease you can't afford. Stick to your budget.

- Read the Fine Print: Carefully review the lease agreement before signing. Don't be afraid to ask questions. If something seems unclear, get it in writing.

- Be Wary of Hidden Fees: Dealers may try to sneak in additional fees or charges. Be vigilant and question anything that seems suspicious. Specifically look for add-ons you don't need or want, such as fabric protection or paint sealant.

- Understand GAP Insurance: As mentioned above, GAP insurance protects you if the car is stolen or totaled. Make sure you understand how it works and whether you need it.

Leasing a car can be a great option if you understand the process and do your due diligence. Armed with this knowledge, you can approach the dealership with confidence and negotiate a lease that works for you.

We have a sample lease agreement diagram available for download. Contact us if you need it, and we'll be happy to provide it. It will allow you to visualize all the key aspects of the negotiation process. Good luck!