How Do I Pay My Car Payment

Alright, let's talk about something every car owner deals with: making that car payment. While it might seem simple, understanding the process and the options available can save you time, money, and potentially a headache down the road. Think of this guide as a technical walkthrough of your car payment ecosystem, similar to understanding the intricate workings of your engine. We'll dive into the various methods, their pros and cons, and even some troubleshooting tips for when things don't go quite right.

Purpose: More Than Just Avoiding Repossession

Why bother understanding the ins and outs of paying your car loan? Beyond the obvious (avoiding repossession!), a solid grasp of your options can lead to better financial management. Knowing how your payment is applied, understanding principal vs. interest, and spotting potential issues early can save you money in the long run. It's not unlike understanding your car's ECU; the more you know, the better equipped you are to diagnose and address problems. And, let's be honest, feeling in control of your finances is a pretty good feeling.

Key Specs and Main Parts of the Car Loan Payment System

Think of your car loan payment system as having several key components working together:

1. The Loan Agreement

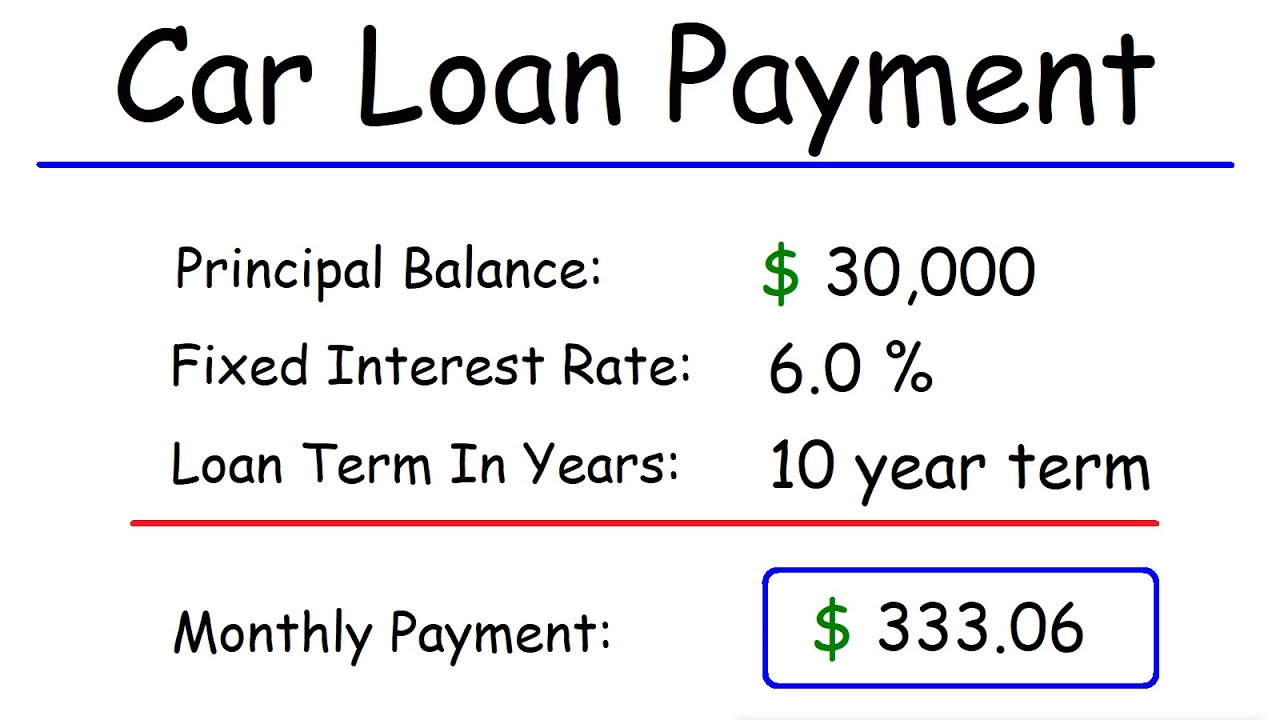

This is the foundational document. It outlines the Annual Percentage Rate (APR), the loan term (length of the loan in months), the principal amount (the original amount borrowed), the monthly payment amount, any late fees, and the lender's policies. Think of it as the blueprint for your entire loan process. Always read it carefully *before* signing.

2. The Lender

This is the financial institution (bank, credit union, or financing company) that provided the loan. They are responsible for processing your payments and keeping track of your loan balance.

3. Your Bank Account

This is the source of your funds for making payments. Understanding your account balance, transaction history, and any associated fees is crucial for avoiding overdrafts and other problems.

4. Payment Methods

This is where things get interesting. We'll explore the various ways to pay, each with its own pros and cons:

- Online Payment Portal: Most lenders offer a website or app where you can make payments online.

- Automatic Payments (ACH): Setting up automatic withdrawals from your bank account.

- Mail-in Check or Money Order: The traditional method, still available in most cases.

- Phone Payment: Calling the lender and making a payment over the phone (usually with a fee).

- In-Person Payment: Visiting a branch of the lender to make a payment in person.

5. Payment Processing

This is the behind-the-scenes magic where your payment is received, verified, and applied to your loan balance. This involves transferring funds, updating records, and calculating interest accrual. The timing of this processing can significantly impact your loan's amortization.

Symbols and Key Terms: Decoding the Car Loan Landscape

Just like understanding wiring diagrams requires knowing the symbols, navigating car loan payments requires understanding some key terms:

- Principal: The original amount of the loan. Each payment reduces the principal.

- Interest: The cost of borrowing money. A portion of each payment goes towards interest.

- APR (Annual Percentage Rate): The annual rate charged for borrowing, expressed as a percentage. This includes interest and any other fees.

- Amortization: The process of gradually paying off a loan through regular payments. Early in the loan, a larger portion of the payment goes towards interest; later, a larger portion goes towards principal.

- Due Date: The date by which your payment must be received to avoid late fees.

- Grace Period: A period after the due date during which you can make a payment without incurring a late fee (if offered by the lender).

- Late Fee: A penalty charged for making a payment after the due date (or after the grace period).

- NSF Fee (Non-Sufficient Funds): A fee charged by your bank (and possibly the lender) if your payment is returned due to insufficient funds in your account.

- Prepayment Penalty: A fee charged for paying off the loan early (not common, but worth checking your loan agreement).

- Escrow: An account held by the lender to pay for property taxes and insurance (usually associated with home loans, but *rarely* seen with auto loans).

There aren't specific "symbols" like in a wiring diagram, but understanding these terms is crucial for "reading" your loan agreement and payment statements.

How It Works: The Flow of Funds

Let's trace the path of a typical car payment:

- You Initiate Payment: You choose your payment method (online, automatic, mail, etc.) and authorize the transfer of funds.

- Funds are Transferred: The funds are moved from your bank account to the lender's account. This may involve electronic transfers (ACH), checks, or credit/debit card processing.

- Payment is Processed: The lender receives the funds and applies them to your loan balance. This involves updating their records to reflect the new payment amount.

- Interest is Calculated: The lender calculates the interest that has accrued since your last payment.

- Payment is Allocated: The lender allocates your payment to cover interest first, and then the remaining amount is applied to the principal. This is a key concept of amortization.

- Loan Balance is Updated: The lender updates your loan balance to reflect the reduction in principal.

- Confirmation is Sent: You typically receive a confirmation of your payment, either online, by email, or by mail.

Real-World Use: Troubleshooting Common Car Payment Issues

Even with the best intentions, things can sometimes go wrong. Here are some troubleshooting tips:

- Late Payment: Contact the lender immediately. Explain the situation and see if they will waive the late fee (especially if it's a one-time occurrence). Set up automatic payments to avoid future late payments.

- NSF (Non-Sufficient Funds): Contact both your bank and the lender. Pay the amount due immediately using a different method (e.g., credit card or wire transfer). Monitor your bank account balance more closely.

- Payment Not Showing Up: Check your bank statement to confirm that the payment was processed. Contact the lender with proof of payment (e.g., a copy of the cancelled check or a screenshot of the online transaction).

- Unexpected Fees: Review your loan agreement to understand the fees you may be charged. Contact the lender to dispute any unauthorized or incorrect fees.

- Difficulty Making Payments: If you're struggling to make payments, contact the lender as soon as possible. They may be able to offer options such as a temporary payment deferral or a loan modification. *Don't wait until you're already behind!*

Safety: Avoiding Predatory Lending and Scams

While paying your car loan is generally safe, be aware of potential risks:

- Predatory Lending: Be wary of lenders offering loans with extremely high APRs or unfavorable terms. Always shop around and compare offers before committing to a loan.

- Payment Scams: Be cautious of unsolicited calls or emails claiming to be from your lender, especially if they ask for personal information or demand immediate payment via unusual methods (e.g., gift cards). Verify the lender's contact information independently.

- Unsecured Websites: When making online payments, ensure that the website is secure (look for "https" in the address bar and a padlock icon).

- Automatic Payments: While convenient, monitor your bank account regularly to ensure that the correct amount is being withdrawn and that there are sufficient funds to cover the payments.

Remember, just like maintaining your car, managing your car loan requires diligence and attention to detail. By understanding the process and being proactive, you can ensure a smooth and financially sound journey.

We have a detailed car loan payment diagram available for download, which visually illustrates the flow of funds and key components we've discussed. Contact us to get the file.