How Do I Use Gap Insurance

Okay, let's talk about something that's not exactly glamorous but can be a financial lifesaver: Gap Insurance. Now, I know what you're thinking: "Insurance? Sounds boring." But trust me, understanding gap insurance, especially the financial mechanics behind it, is crucial for any informed car owner, especially if you're financing a vehicle or leasing. Consider this your advanced course in automotive financial protection.

Purpose: Why Gap Insurance Matters to the Informed Owner

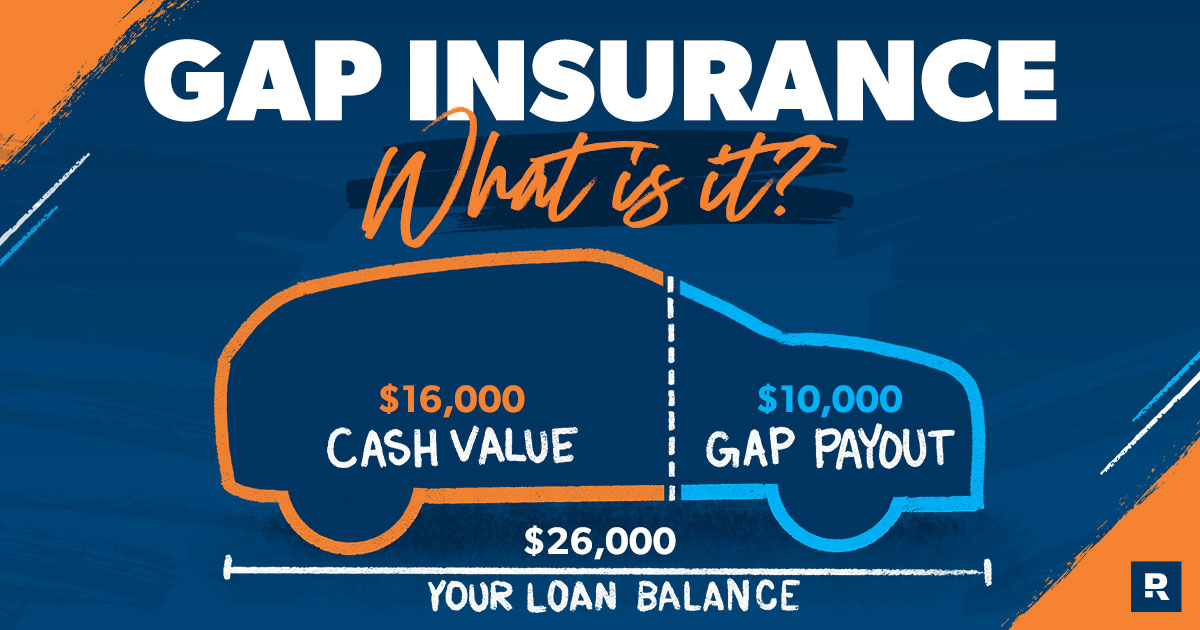

The primary purpose of gap insurance is to bridge the "gap" between what you owe on your car loan or lease and what your insurance company says the vehicle is actually worth if it's totaled or stolen. Let's say you bought a shiny new pickup and, a year later, through no fault of your own, it's involved in a major accident and declared a total loss. Your comprehensive or collision insurance will cover the actual cash value (ACV) of the truck at that point in time. However, vehicles depreciate rapidly, especially in the first few years. You might owe $30,000 on your loan, but your insurance company might only value the truck at $25,000. That leaves you $5,000 in the hole – that's the gap.

Gap insurance steps in to cover that difference, preventing you from having to pay off a loan for a vehicle you no longer possess. For modders and DIY mechanics, this is particularly important. You might have invested a lot of money in aftermarket parts, which often don't significantly increase the vehicle's insured value. The ACV will usually be based on the factory specification of the vehicle, not your custom work. Therefore, a larger gap between the loan and the ACV is likely. That's where gap insurance truly shines.

Key Specs and Main Components of a Gap Insurance Policy

Understanding the key specifications of your gap insurance policy is crucial. Here's what you need to pay attention to:

- Coverage Limit: This is the maximum amount that the policy will pay out to cover the gap. Ensure it's sufficient for your situation.

- Eligibility Requirements: Most gap insurance policies have eligibility requirements, such as a maximum loan-to-value ratio (the amount of the loan compared to the vehicle's value) or a maximum age or mileage for the vehicle.

- Deductible: Some gap insurance policies have a deductible, which is the amount you'll have to pay out of pocket before the insurance coverage kicks in.

- Exclusions: Gap insurance policies typically have exclusions, such as coverage for overdue payments, security deposits, or carry-over balances from previous loans.

- Cancellation: Find out how to cancel your gap insurance policy and if you're eligible for a refund of any unused premiums. Many policies allow for a pro-rated refund if you pay off your loan early.

The "main parts," so to speak, of gap insurance are essentially the contract itself, the claim process, and the payout. It's a relatively straightforward product, but understanding the details is vital.

Symbols and Legalese: Decoding the Policy Document

The "symbols" of gap insurance aren't literal icons, but rather the legal terms used in the policy document. Let's decode some of the common ones:

- ACV (Actual Cash Value): As mentioned before, this is the fair market value of the vehicle at the time of the loss, taking into account depreciation.

- Loan-to-Value (LTV): This is the ratio of the loan amount to the vehicle's value. A high LTV means you owe more than the vehicle is worth, increasing the need for gap insurance.

- Depreciation: The decrease in value of the vehicle over time.

- Total Loss: A vehicle that is damaged beyond repair or stolen and not recovered.

- Policy Period: The length of time the gap insurance coverage is active.

Understanding these terms will help you navigate the policy document and ensure you know what you're covered for and what you're not.

How Gap Insurance Works: The Claim Process

Let's break down how gap insurance actually works in a real-world scenario:

- Incident Occurs: Your vehicle is totaled or stolen.

- File Claim with Primary Insurer: You file a claim with your comprehensive or collision insurance company.

- Insurance Company Determines ACV: The insurance company assesses the damage and determines the ACV of the vehicle.

- Insurance Company Pays ACV: Your insurance company pays you the ACV, minus your deductible.

- Determine the "Gap": Calculate the difference between what you still owe on the loan and the ACV paid by your primary insurance.

- File a Claim with Gap Insurer: You file a claim with your gap insurance provider, providing them with documentation from your primary insurance company and your loan details.

- Gap Insurer Pays the Difference: The gap insurer reviews your claim and, if approved, pays the difference (up to the policy limit) to your lender.

Important Note: Make sure to keep meticulous records of all paperwork, including your loan agreement, insurance policy, and any communications with the insurance companies.

Real-World Use: Basic Troubleshooting Tips

Here are some troubleshooting tips to keep in mind regarding your gap insurance:

- Denied Claim: If your gap insurance claim is denied, carefully review the policy document to understand the reason for the denial. If you believe the denial is unjustified, you can appeal the decision.

- Policy Lapses: Ensure your gap insurance policy remains active by paying your premiums on time. A lapse in coverage could leave you unprotected.

- Selling the Vehicle: If you sell the vehicle before the loan is paid off, you may be able to cancel the gap insurance policy and receive a refund of any unused premiums.

- Loan Refinancing: If you refinance your car loan, check whether your gap insurance policy is still valid. You might need to purchase a new policy.

Safety Considerations

While gap insurance itself isn't inherently dangerous, there are some things to be aware of:

- Don't Overpay: Shop around for the best gap insurance rates. Dealerships often mark up the price significantly. Consider purchasing gap insurance from an independent provider.

- Read the Fine Print: As with any insurance policy, carefully read the fine print to understand the coverage limits, exclusions, and other important terms. Don't assume anything.

- Consider Alternatives: If you're putting a large down payment on your vehicle or have a short loan term, you might not need gap insurance. Weigh the costs and benefits carefully.

While not related to physical harm, financially, not understanding the policy and potentially being left with a significant debt for a totaled vehicle is the "risky component" to watch out for.

Think of gap insurance as a crucial safety net in the complex financial ecosystem of vehicle ownership. It is best to be informed before you need it. Knowing the specifications, the exclusions, and the claim process can make all the difference when things go wrong.

(File download information removed as per instructions.)