How Do I Use My Gap Insurance

Alright, you've got gap insurance. That's smart – a safety net many overlook. But knowing *that* you have it is only half the battle. Understanding *how to use* it, when it comes into play, and what the process looks like is crucial. Consider this your deep dive into the mechanics of gap insurance, designed to help you navigate the claims process with confidence, should the need ever arise.

Purpose of Understanding Gap Insurance Usage

Think of this as understanding the schematic for a critical component in your financial toolkit. You probably wouldn't dive into rebuilding an engine without understanding its diagrams, and this is no different. Understanding the process allows you to:

Protect Yourself Financially: Gap insurance is designed to prevent you from being upside down on your loan after a total loss. Knowing how to use it correctly ensures this protection is in place.

Navigate the Claims Process Efficiently: Understanding the steps involved will save you time and frustration when filing a claim.

Identify Potential Issues: Being aware of the requirements and limitations of your policy can help you avoid potential claim denials.

Make Informed Decisions: If you're ever faced with a total loss situation, this knowledge will empower you to make informed decisions about your finances and your next vehicle.

Key Concepts and Main Parts of a Gap Insurance Claim

Before we dive into the process, let's define some key terms. These are the "parts" of the gap insurance system that you need to be familiar with:

- Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of the total loss, determined by your primary auto insurance company. It factors in depreciation, mileage, and condition.

- Total Loss: When your vehicle is damaged beyond repair, as determined by your primary auto insurance company. The cost to repair exceeds a certain percentage (often 70-80%) of the vehicle's ACV.

- Loan/Lease Balance: The remaining amount you owe on your auto loan or lease at the time of the total loss.

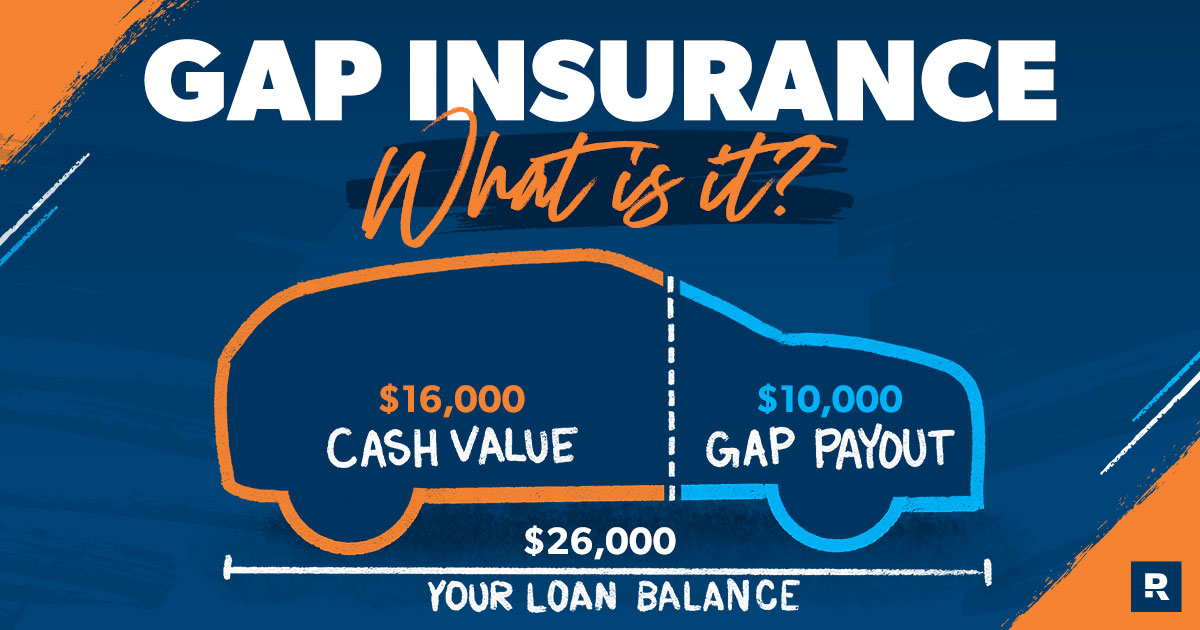

- Gap Amount: The difference between your loan/lease balance and the vehicle's ACV. This is the "gap" that gap insurance is designed to cover.

- Deductible: The amount you pay out of pocket before your primary auto insurance coverage kicks in. Your gap policy might or might not cover your deductible.

- Policy Limits: Gap insurance policies have maximum coverage limits. Make sure you know yours.

- Primary Insurance Settlement: The payment you receive from your primary auto insurance company for the total loss of your vehicle.

Now, let's look at the main players involved in a gap insurance claim:

- You (The Policyholder): Responsible for reporting the total loss and filing claims.

- Primary Auto Insurance Company: Determines the ACV and pays out the primary insurance settlement.

- Gap Insurance Provider: Pays the gap amount, subject to policy terms and limits. This might be the dealership where you purchased the car, a finance company, or a standalone insurance provider.

- Lender/Lessor: The entity holding your auto loan or lease. They receive the payments from the primary and gap insurance companies.

The Flow of a Gap Insurance Claim - How it Works

The gap insurance claim process can be broken down into several key steps:

- Total Loss Declaration: Your primary auto insurance company determines your vehicle is a total loss and provides you with an ACV settlement offer.

- Acceptance of Settlement: You accept the ACV settlement offer from your primary auto insurance company. Don't do this until you've confirmed the amount with your gap insurance provider! They may have specific requirements.

- Primary Insurance Payout: Your primary auto insurance company pays out the ACV settlement to you and/or your lender/lessor.

- Gap Insurance Claim Submission: You file a gap insurance claim with your gap insurance provider. This typically involves providing documentation such as:

- A copy of your gap insurance policy.

- A copy of your primary auto insurance settlement.

- A copy of your auto loan/lease agreement.

- Proof of payoff amount from your lender/lessor.

- A police report (if applicable).

- Any other documentation requested by the gap insurance provider.

- Gap Insurance Review: The gap insurance provider reviews your claim and verifies the information.

- Gap Insurance Payout: The gap insurance provider pays the gap amount (up to the policy limits) to your lender/lessor.

- Loan/Lease Closure: Your lender/lessor closes your auto loan or lease account.

Real-World Use: Basic Troubleshooting Tips

Even with a clear understanding of the process, things can sometimes go wrong. Here are a few common issues and how to address them:

- Low ACV: If you believe the ACV offered by your primary insurance company is too low, you can provide comparable sales data (similar vehicles, mileage, condition) to negotiate a higher settlement. This will increase the ACV, potentially reducing the gap.

- Deductible Issues: Determine whether your gap insurance covers your primary insurance deductible. Some policies do, some don't. Factor that into your calculations.

- Policy Exclusions: Be aware of any exclusions in your gap insurance policy. For example, some policies exclude coverage for negative equity rolled over from a previous loan, or for modifications to the vehicle that increase its value beyond the manufacturer's specifications.

- Delayed Payouts: If your claim is taking longer than expected, contact your gap insurance provider to inquire about the status. Keep detailed records of all communication.

- Gap Insurance Not Covering the Full Amount: Remember that gap insurance has policy limits. If the gap amount exceeds the policy limit, you'll still be responsible for the difference.

Safety – Risks and Limitations

While gap insurance is a valuable protection, it's important to be aware of its limitations and potential risks:

- Not All Losses Are Covered: Gap insurance typically only covers total losses due to collision, theft, or other covered perils under your primary auto insurance policy. It doesn't cover mechanical failures, wear and tear, or other issues not covered by your primary insurance.

- Policy Limits: Gap insurance policies have maximum coverage limits. If the gap between your loan/lease balance and the vehicle's ACV exceeds the policy limit, you'll still be responsible for the difference. This is especially important if you put little or no money down or if your vehicle depreciates rapidly.

- Premium Costs: Gap insurance premiums can vary depending on the provider, the vehicle, and the loan/lease terms. Make sure to shop around and compare quotes before purchasing a policy.

- Double Coverage: In some cases, you might already have similar coverage through your primary auto insurance policy (e.g., loan/lease payoff coverage). Review your primary insurance policy to avoid paying for duplicate coverage.

- Cancellation: If you pay off your auto loan or lease early, you can typically cancel your gap insurance policy and receive a prorated refund of the premium. Contact your gap insurance provider for instructions.

Conclusion

Understanding the mechanics of gap insurance is essential for responsible car ownership. By understanding the key concepts, the claim process, and potential pitfalls, you can ensure that you're adequately protected in the event of a total loss. Remember to carefully review your policy documents and contact your insurance provider if you have any questions. Knowledge is power, especially when it comes to protecting your financial interests.

We have a detailed diagram illustrating the gap insurance claim flow available for download. It visually represents the steps we've discussed, making the process even clearer. You can find it [link to diagram - placeholder].