How Do You Get A Car Loan

Alright, let's talk about car loans. If you're comfortable wrenching on your ride, tackling modifications, or even doing some basic diagnostics, you've probably run into situations where you need to understand the underlying systems to get the job done right. Think of this article the same way – as a breakdown of how to acquire a car loan. It’s the financial equivalent of understanding your engine's combustion cycle; knowing the process makes you better equipped to navigate it successfully and avoid costly mistakes.

Purpose: Understanding the Financial Engine

Why bother diving into the intricacies of car loans? Because buying a car is a significant financial undertaking, and understanding the loan process is crucial for making informed decisions. Just like knowing how your car's cooling system works helps you prevent overheating and expensive repairs, understanding how car loans work helps you avoid getting taken advantage of, secure the best possible terms, and ultimately save money. This knowledge empowers you to negotiate effectively, understand the loan agreement, and make choices that align with your financial goals. It's about financial self-reliance, the same way you prefer fixing your own car instead of blindly trusting a mechanic.

Key Specs and Main Parts of a Car Loan

Let's break down the core components of a car loan. Think of these as the essential parts under the hood of your financial machine:

- Principal: This is the amount of money you borrow to purchase the car. It's the starting point of the whole loan process.

- Interest Rate (APR): The Annual Percentage Rate (APR) is the cost of borrowing money, expressed as a percentage. It includes the interest rate and any fees associated with the loan. APR is what you should focus on when comparing loan offers, not just the stated interest rate.

- Loan Term: This is the length of time you have to repay the loan, typically expressed in months (e.g., 36 months, 60 months, 72 months). A longer term means lower monthly payments but higher overall interest paid.

- Monthly Payment: The fixed amount you pay each month to the lender until the loan is paid off.

- Down Payment: The amount of money you pay upfront towards the purchase price of the car. A larger down payment reduces the loan principal and can lower your monthly payments and the overall interest paid.

- Credit Score: Your credit score is a numerical representation of your creditworthiness. It's a critical factor in determining your eligibility for a car loan and the interest rate you'll receive. A higher score generally means a lower interest rate.

- Loan-to-Value (LTV) Ratio: This is the ratio of the loan amount to the value of the vehicle. A higher LTV ratio means you're borrowing more money relative to the car's value. Lenders often prefer lower LTV ratios.

These are the critical specs you need to understand before even thinking about applying. Just like you wouldn't start an engine rebuild without knowing your bore and stroke, you shouldn't start a loan application without understanding these terms.

The Car Loan Process: A Step-by-Step Guide

Here's a breakdown of the car loan process, from start to finish. This is the "how it works" section:

- Check Your Credit Score: Before you even start shopping for a car, check your credit score. You can get a free credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) annually. Knowing your score will give you a realistic idea of the interest rates you can expect.

- Determine Your Budget: Figure out how much you can afford to spend on a car each month. Consider not just the loan payment, but also insurance, gas, maintenance, and potential repairs. Be realistic about your financial capabilities.

- Shop Around for Loans: Don't just accept the first loan offer you receive. Get quotes from multiple lenders, including banks, credit unions, and online lenders. Compare the APRs, loan terms, and fees associated with each loan. This is like comparing different brands of spark plugs – they all look similar, but the performance can vary greatly.

- Get Pre-Approved: Getting pre-approved for a car loan gives you a solid bargaining position when you're negotiating the price of the car at the dealership. It shows the dealer that you're a serious buyer and that you have the financing in place.

- Choose Your Car: Once you know how much you can borrow, you can start shopping for a car that fits your budget and needs. Remember to factor in the cost of ownership, not just the purchase price.

- Negotiate the Price: Negotiate the price of the car with the dealer. Don't be afraid to walk away if you're not happy with the offer. Knowing you have pre-approved financing gives you leverage.

- Finalize the Loan: Once you've agreed on a price, you'll need to finalize the loan with the lender. Review the loan agreement carefully before signing it. Make sure you understand all the terms and conditions.

- Make Your Payments: Make your loan payments on time each month to avoid late fees and damage to your credit score. Consider setting up automatic payments to ensure you never miss a payment.

Real-World Use: Basic Troubleshooting Tips

Here are some common issues you might encounter during the car loan process and how to address them:

- Low Credit Score: If your credit score is low, you may still be able to get a car loan, but you'll likely pay a higher interest rate. Consider improving your credit score before applying for a loan by paying your bills on time and reducing your debt. You might also explore options like a secured car loan or having a co-signer.

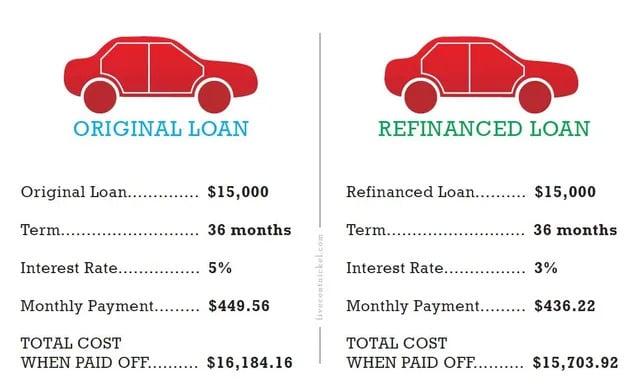

- High Interest Rate: If you're offered a high interest rate, shop around for other loan offers. A small difference in the APR can save you a significant amount of money over the life of the loan.

- Unable to Afford Monthly Payments: If you're struggling to afford the monthly payments, consider refinancing your loan to a longer term or a lower interest rate. You might also explore options for selling the car and purchasing a less expensive vehicle.

- Dealer Financing vs. Independent Financing: Dealer financing can be convenient, but it's often not the best deal. Dealers often mark up the interest rate to make a profit. Always compare dealer financing with offers from banks, credit unions, and online lenders.

Safety: Avoiding Predatory Lending

The car loan market, like any industry, has its share of shady operators. Be wary of lenders who pressure you to sign quickly, offer loans with extremely high interest rates, or don't fully disclose the terms and conditions of the loan. These are red flags that you might be dealing with a predatory lender. Always read the fine print and don't be afraid to walk away from a deal that doesn't feel right. Protect yourself from predatory lending practices by doing your research, comparing loan offers, and understanding your rights as a borrower.

Remember, acquiring a car loan is a significant financial commitment. Just like you wouldn't blindly trust someone working on your engine without understanding their qualifications, you shouldn't enter into a car loan agreement without understanding the terms and conditions. Take your time, do your research, and make informed decisions to secure the best possible loan for your needs.

This information provides a solid foundation. If you would like to download a car loan process diagram illustrating these steps visually, we have that available for download. It's like having a wiring diagram for your car's electrical system – a helpful reference for navigating the complexities.