How Do You Get Gap Insurance

Okay, let's talk about something that's not exactly sexy, but incredibly important if you want to protect yourself financially when dealing with vehicles: Guaranteed Asset Protection (GAP) insurance. Think of this as the safety net you need when your car's value takes a dive faster than a rock in a pond. You might be thinking, "Insurance? I already have full coverage!" But trust me, GAP insurance is a different beast altogether. It covers the gap between what you owe on your car loan and what your insurance company says your car is worth if it's totaled or stolen. Let's dive in.

Purpose of Understanding GAP Insurance

Why should a DIYer like you care about GAP insurance? Well, imagine you've poured time and money into modifying your car, adding performance parts, maybe even some cosmetic upgrades. You think your car is worth a fortune! Then, disaster strikes – an accident, theft, flood. Your standard auto insurance pays out... but it's far less than what you owe the bank. The difference could be thousands. That's where GAP insurance steps in. Knowing how it works helps you make informed decisions about whether you need it, and from whom to buy it. It also lets you intelligently discuss coverage specifics with your insurance provider, ensuring you're adequately protected. Understanding the policy's terms and conditions is crucial to avoid unpleasant surprises later.

Key Specs and Main Parts of a GAP Insurance Policy

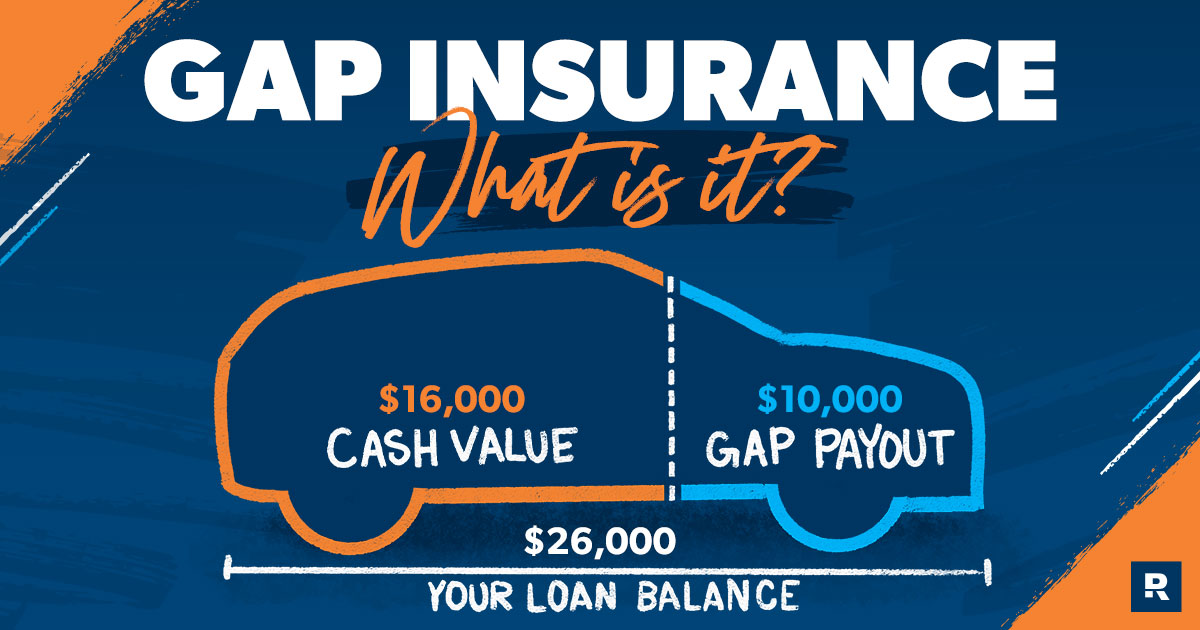

Think of a GAP insurance policy as a simple equation: Loan Balance - Actual Cash Value (ACV) = GAP. Let's break that down:

- Loan Balance: This is the amount you still owe on your car loan at the time of the incident (theft or total loss). This includes principal and interest.

- Actual Cash Value (ACV): This is the fair market value of your car at the time it's totaled or stolen, as determined by your primary insurance company. ACV takes into account depreciation, mileage, condition, and market conditions. It's not necessarily what you think your car is worth, especially with modifications.

- GAP: This is the difference between the loan balance and the ACV. GAP insurance aims to cover this difference, up to the policy's limits.

Key Specs to consider:

- Coverage Limit: This is the maximum amount the GAP insurance will pay out. Make sure it's high enough to cover the potential gap, especially if you made a small down payment or have a long loan term. Typical limits can range from $5,000 to $50,000.

- Eligibility Requirements: GAP insurance often has eligibility requirements. For example, the loan may need to be under a certain age or the vehicle may need to be within a certain mileage range. Some policies might require you to have comprehensive and collision coverage.

- Exclusions: Know what's *not* covered. Common exclusions include:

- Delinquent Loan Payments: If you're behind on your car payments, the GAP insurance may not cover the gap.

- Refundable Items: GAP insurance generally does not cover items that are refundable, such as extended warranties or credit life insurance.

- Carryover Balances: If you rolled over negative equity from a previous car loan into your current loan, the GAP insurance may not cover that portion.

- Modifications: Aftermarket modifications (unless specifically covered) are generally not factored into the ACV by your primary insurer and therefore not covered by GAP.

- Deductible: Some GAP insurance policies may have a deductible, though many don't.

- Policy Term: The policy term usually matches the length of your car loan. However, it's wise to review the policy to see when the coverage actually ends.

Understanding the Fine Print: Policy Symbols and Language

Unlike a wiring diagram, a GAP insurance policy doesn’t have literal symbols. However, it does have its own language and 'symbols' that you need to understand:

- "Total Loss" - Be sure you understand what the policy considers a total loss. Usually, it means the cost to repair the vehicle exceeds a certain percentage (often 70-80%) of its ACV.

- "Actual Cash Value" (ACV) - As mentioned above, this is key. Policies will detail how the ACV is determined (e.g., using a nationally recognized valuation service like NADA or Kelley Blue Book).

- "Primary Insurance Settlement" - The GAP insurance payout is contingent on the settlement from your regular auto insurance. You need to understand how your primary insurance company will handle the claim, as that directly impacts the potential GAP amount.

- "Financed Amount" - Know what exactly is included in your financed amount. This may affect what is covered.

How GAP Insurance Works: The Process

Let's walk through a hypothetical scenario:

- You buy a car and finance it for $30,000. You also purchase GAP insurance.

- Two years later, you still owe $20,000 on the loan.

- You total your car in an accident.

- Your primary insurance company determines the ACV of your car to be $15,000.

- There's a $5,000 gap between what you owe ($20,000) and what the insurance company is paying ($15,000).

- You file a claim with your GAP insurance provider.

- The GAP insurance provider reviews the claim and, assuming all eligibility requirements are met and exclusions don't apply, pays the $5,000 to your lender, satisfying the remaining loan balance.

Important Considerations:

- Shop Around: GAP insurance is offered by dealerships, lenders, and insurance companies. Compare prices and coverage terms before you buy. Dealerships often mark up the price considerably.

- Read the Fine Print: Don't just skim the policy. Understand the eligibility requirements, exclusions, and claim process.

- Consider Your Down Payment: A larger down payment reduces the risk of owing more than the car is worth. If you put down a significant amount, GAP insurance might not be necessary.

- Consider Loan Length: Longer loan terms mean slower equity buildup. GAP insurance is more valuable for longer-term loans.

Real-World Use: Troubleshooting and Common Issues

Here are some common issues and how to troubleshoot them:

- Claim Denial: If your GAP insurance claim is denied, carefully review the policy terms and the reason for the denial. Common reasons include delinquent loan payments, exclusions, or exceeding the coverage limit. If you believe the denial is unjustified, gather supporting documentation and appeal the decision.

- Dispute Over ACV: If you disagree with the ACV determined by your primary insurance company, you can challenge it. Provide evidence supporting your valuation, such as recent sales of similar vehicles in your area or an independent appraisal. Remember, GAP coverage is tied to the primary insurer's ACV.

- Misunderstanding Coverage: Many people mistakenly believe GAP insurance covers everything related to the loss. It only covers the gap between the loan balance and the ACV. It doesn't cover your deductible on your primary insurance policy, missed payments, or aftermarket modifications that aren't covered by your primary insurance.

- Policy Cancellation: If you pay off your car loan early or refinance, you can usually cancel your GAP insurance policy and receive a pro-rated refund. Contact your GAP insurance provider to initiate the cancellation process.

Safety Considerations: Potential Financial Pitfalls

GAP insurance isn't inherently "risky" in terms of physical danger. However, there are financial pitfalls to be aware of:

- Overpaying: As mentioned earlier, dealerships often mark up GAP insurance significantly. Compare prices from different sources.

- Duplication of Coverage: In some cases, your primary auto insurance policy might already include loan/lease payoff coverage, which is similar to GAP insurance. Check your policy before buying redundant coverage.

- Unnecessary Coverage: If you make a large down payment or have a short loan term, the risk of owing more than the car is worth is low. In these situations, GAP insurance might not be necessary.

- Misunderstanding Exclusions: Failing to understand the exclusions in your GAP insurance policy can lead to unexpected claim denials. Always read the fine print carefully.

Bottom line: GAP insurance is a valuable tool for financial protection, especially if you have a long-term car loan or made a small down payment. However, it's essential to understand how it works and to shop around for the best coverage at the best price. Don’t let a totaled vehicle leave you with a huge debt! Understanding the ACV is also critical, especially as it pertains to aftermarket modifications and enhancements. You will need to ensure your primary insurance covers those modifications or they will likely not be considered in any gap calculation.

While we don't have a downloadable "diagram" in the traditional sense, consider this article your detailed guide. We can provide a sample GAP insurance policy document (PDF) to illustrate the terms and conditions discussed above. Contact us if you would like a sample document.