How Do You Get Pre Approved

Alright folks, let's talk about getting pre-approved for a car loan. Think of this as diagnosing your financial engine *before* you even pop the hood on that new ride. Just like knowing what spark plugs to buy *before* tearing apart your ignition system, understanding the pre-approval process empowers you to negotiate effectively and avoid getting ripped off.

Purpose – Why Understanding Pre-Approval Matters

Why bother with pre-approval? Simple: knowledge is power. This process gives you a realistic picture of your borrowing power before you fall in love with a specific car. Here's the breakdown:

- Negotiating Power: Walking into a dealership with a pre-approval in hand instantly puts you in a stronger negotiating position. You know your interest rate and loan amount, forcing the dealer to offer you a competitive deal. Think of it as already having a calibrated torque wrench when everyone else is using a rusty adjustable.

- Realistic Budget: Pre-approval helps you understand what you can *actually* afford. No more daydreaming about that top-of-the-line model only to realize the monthly payments are more than your rent. It keeps you grounded.

- Time Saver: The dealership's finance department can be a black hole of paperwork and waiting. Pre-approval streamlines the process, cutting down on the time you spend twiddling your thumbs. You’ve done the prep work, like installing new brake lines – now you can focus on the test drive!

- Protection from Unfavorable Terms: Without pre-approval, you're vulnerable to accepting whatever terms the dealer throws at you. They might inflate the interest rate or tack on unnecessary add-ons. Pre-approval acts as a safety net.

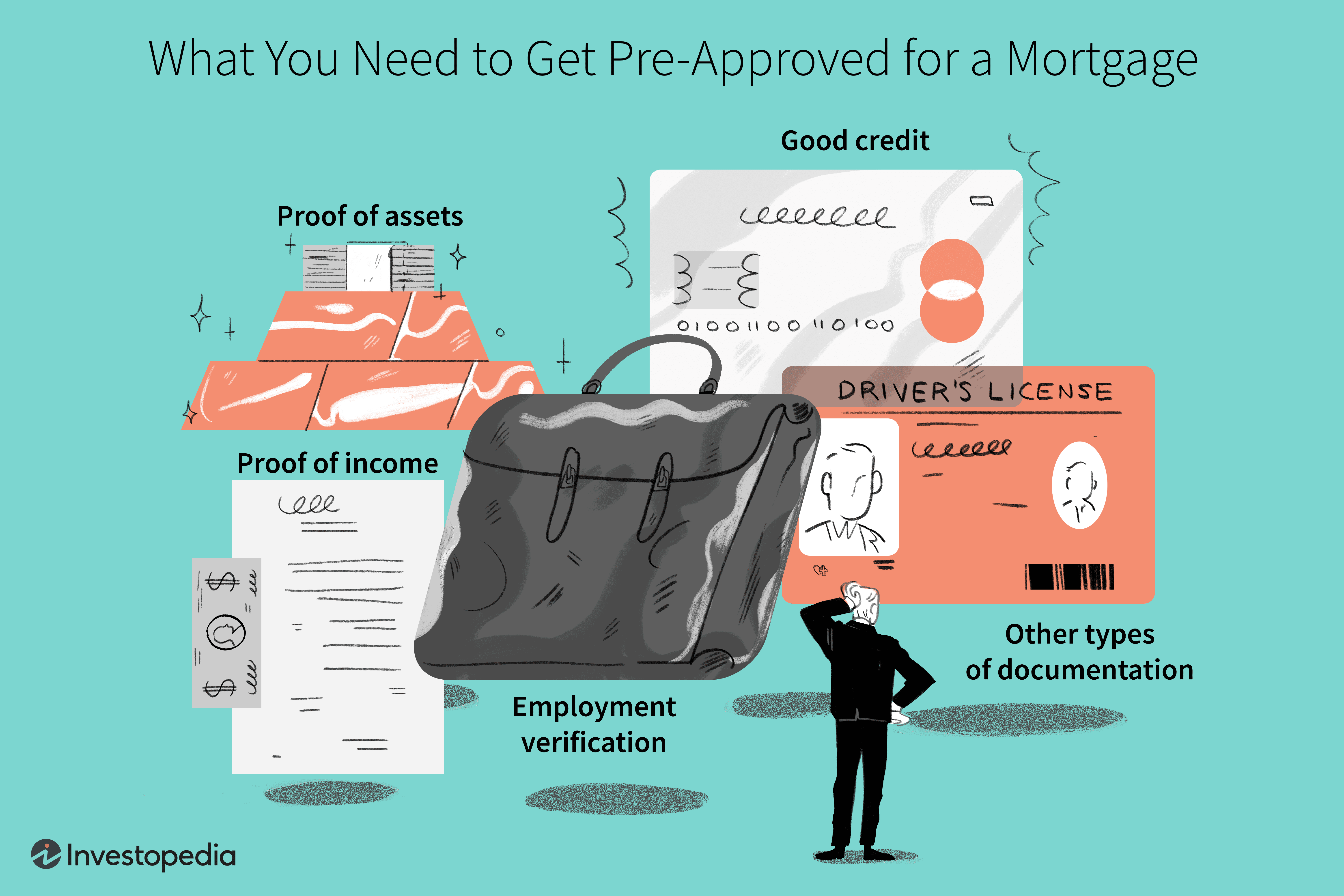

Key Specs and Main Parts of the Pre-Approval Process

The pre-approval process involves several key players and components. Think of it like the different parts of your car's cooling system; each has a specific role.

- Credit Score: This is arguably the most crucial factor. Lenders use your credit score to assess your creditworthiness. A higher score signals a lower risk. Think of it like the octane rating of your fuel. Higher is better.

- Credit Report: This document details your credit history, including payment history, outstanding debts, and any bankruptcies. It’s like the detailed maintenance log for your car. Check it regularly for errors.

- Debt-to-Income Ratio (DTI): This is the percentage of your gross monthly income that goes towards paying debts. Lenders use this to determine if you can comfortably afford the loan payments. A lower DTI is generally preferred. It’s akin to the air-fuel mixture in your engine; you want it balanced.

- Income Verification: Lenders will require proof of income, such as pay stubs, W-2s, or tax returns, to verify your ability to repay the loan. This is like checking the fuel pump to ensure it's delivering the right amount of gas.

- Loan Application: This form collects your personal and financial information, allowing the lender to assess your eligibility for a loan.

- Annual Percentage Rate (APR): The *total* cost of the loan, including interest rate and fees, expressed as an annual rate. Always compare APRs, not just interest rates.

Symbols – Decoding the Language of Lenders

While there aren't exactly "symbols" like on a wiring diagram, there are specific terms and concepts that act as shorthand in the lending world. Understanding these helps you "read" the lender's signals.

- Hard Inquiry: When a lender checks your credit report as part of a loan application, it's recorded as a hard inquiry. Too many hard inquiries in a short period can negatively impact your credit score. It's like repeatedly starting your car without letting it warm up – it puts unnecessary strain on the system.

- Soft Inquiry: Checking your own credit score or when a company pre-approves you (without you applying) typically results in a soft inquiry, which doesn't affect your credit score.

- Credit Bureau: There are three major credit bureaus: Experian, Equifax, and TransUnion. Each collects and maintains credit information. Think of them as three different garages keeping records of your car's service history.

- Secured Loan: A loan backed by an asset, such as the car itself. If you default on the loan, the lender can repossess the asset.

- Unsecured Loan: A loan not backed by an asset. These are typically harder to obtain and come with higher interest rates.

How It Works – The Pre-Approval Process in Detail

The pre-approval process is a fairly straightforward procedure. Here's a step-by-step guide:

- Check Your Credit Score and Report: Obtain copies of your credit reports from all three major credit bureaus. Review them carefully for any errors or inaccuracies and dispute them immediately. Websites like AnnualCreditReport.com provide free access to your reports. This is like inspecting your engine for leaks *before* you start driving.

- Gather Your Financial Documents: Collect your pay stubs, W-2s, tax returns, and bank statements. The more organized you are, the smoother the process will be.

- Determine Your Budget: Calculate how much you can realistically afford to spend on a car each month, considering all expenses, including loan payments, insurance, gas, and maintenance.

- Shop Around for Pre-Approval: Contact multiple lenders, including banks, credit unions, and online lenders. Compare their interest rates, loan terms, and fees. Don't just settle for the first offer. This is like comparing prices on aftermarket parts from different suppliers.

- Complete the Loan Application: Fill out the loan application accurately and completely. Be prepared to provide supporting documentation.

- Receive Pre-Approval: If approved, you'll receive a pre-approval letter outlining the loan amount, interest rate, and terms.

Real-World Use – Basic Troubleshooting Tips

Even with pre-approval, things can sometimes go wrong. Here are a few common issues and how to troubleshoot them:

- Pre-Approval Amount Too Low: If the pre-approved loan amount isn't enough for the car you want, consider increasing your down payment or looking at less expensive models.

- Interest Rate Higher Than Expected: This could be due to a change in your credit score or market conditions. Try improving your credit score or shopping around for better rates.

- Pre-Approval Expires: Pre-approvals typically have an expiration date (usually 30-60 days). If it expires before you find a car, you'll need to reapply.

- Loan Denied: If your application is denied, the lender is required to provide you with a reason. Address the issue (e.g., improve your credit score, reduce your debt) and reapply later.

Safety – Highlight Risky Components

Just like working on your car, there are potential risks involved in the pre-approval process. Here are some things to watch out for:

- Predatory Lenders: Avoid lenders who offer unusually high interest rates or demand upfront fees. These lenders often target individuals with poor credit. Think of them as the shady mechanic who tries to sell you unnecessary repairs.

- Hidden Fees: Carefully review the loan terms and conditions to identify any hidden fees, such as prepayment penalties or origination fees.

- Overextending Yourself: Don't borrow more than you can realistically afford to repay. Defaulting on a car loan can severely damage your credit score. It's like putting too much boost through your engine without proper tuning – you're asking for trouble.

- Identity Theft: Be cautious about sharing your personal information online or with unfamiliar lenders.

Understanding your credit score and finances is key to a smooth pre-approval process. Treat it like preventative maintenance for your finances!

You've got the knowledge now to navigate the pre-approval process like a seasoned mechanic. Remember, we've compiled a detailed checklist and a sample pre-approval letter diagram. We've got the file, and it's available for download to help you even further.