How Do You Use Gap Insurance

Okay, let's dive into the world of Gap Insurance. You might think of it as a 'nice-to-have', but in reality, it can be a financial life-saver in specific circumstances. We're going to break down exactly what it is, how it works, and when you might need it. Think of this as a 'behind the scenes' look at a financial product, similar to understanding the workings of your car's engine.

Purpose of Understanding Gap Insurance

Why bother understanding Gap Insurance? Simple: financial protection. Many car owners, especially those financing their vehicles, are vulnerable to a significant loss if their car is totaled or stolen. Knowing the ins and outs of Gap Insurance allows you to make an informed decision about whether it's the right coverage for your specific situation. It's about mitigating risk, plain and simple. It matters because it could save you from being saddled with debt on a car you no longer own.

Key Specs and Main Parts

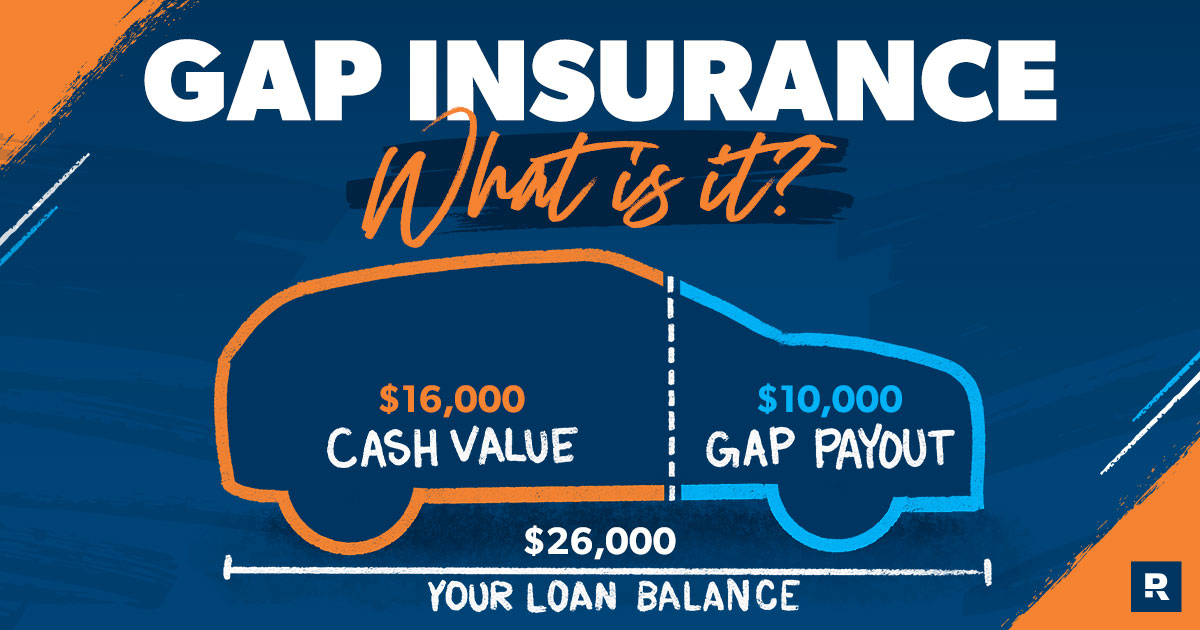

Gap Insurance, short for Guaranteed Asset Protection, bridges the "gap" between what your insurance company pays out for a totaled or stolen vehicle and what you still owe on your car loan or lease. Let's break down the key components:

- Vehicle's Actual Cash Value (ACV): This is the fair market value of your car at the time of the incident. Your primary auto insurance policy will pay out based on this value, factoring in depreciation and mileage.

- Outstanding Loan/Lease Balance: This is the amount you still owe to the lender or leasing company.

- Gap Amount: This is the difference between the ACV and the outstanding loan/lease balance. This is the amount Gap Insurance aims to cover.

- Deductible: Some Gap Insurance policies have a deductible, similar to your regular auto insurance. This is the amount you pay out-of-pocket before the Gap Insurance kicks in.

- Coverage Limits: Gap Insurance policies have maximum coverage limits. Make sure the limit is sufficient to cover the potential gap between your car's value and your loan balance.

- Exclusions: It's crucial to understand what's not covered. Common exclusions include mechanical breakdowns, damage from neglect, and unpaid late fees on your loan.

Think of it like this: your car is an asset, and your loan is a liability. Gap Insurance protects you when that liability (what you owe) exceeds the asset's value (what the insurance company will pay).

How It Works

The process is generally straightforward:

- Incident Occurs: Your car is totaled in an accident or stolen.

- Primary Insurance Claim: You file a claim with your primary auto insurance company. They determine the ACV of the vehicle.

- ACV Payout: Your insurance company pays out the ACV, minus any deductible.

- Gap Assessment: You (or your lender) contact your Gap Insurance provider. You provide them with documentation, including the primary insurance settlement and your loan/lease agreement.

- Gap Calculation: The Gap Insurance provider calculates the gap amount (outstanding balance - ACV).

- Gap Payout: The Gap Insurance provider pays the difference, up to the policy limits, to your lender. This effectively pays off (or significantly reduces) your remaining loan balance.

Let's say your car's ACV is determined to be $15,000, but you owe $20,000 on your loan. The gap is $5,000. If your Gap Insurance has a $0 deductible and a sufficient coverage limit, it would pay $5,000 to your lender.

Important Note: Gap Insurance typically only covers the remaining loan balance. It doesn't cover things like down payments, security deposits, or rolled-over debt from a previous vehicle. Also, it doesn't cover any injuries or property damage resulting from the accident - that's what your regular auto insurance is for.

Real-World Use - Basic Troubleshooting Tips

Here are some common issues and how to address them:

- Gap Insurance Claim Denied: The most common reason for denial is that the claim falls outside the policy's coverage. This could be due to policy exclusions (e.g., unpaid late fees), exceeding coverage limits, or failing to provide the necessary documentation. Review your policy carefully and gather all required documents. Contact the insurance company directly to understand the specific reason for the denial and explore your options for appeal.

- Lower Than Expected ACV: The ACV determined by your primary insurance company might be lower than you anticipated. Research comparable vehicles in your area to see if you can negotiate a higher settlement. Document any upgrades or modifications you've made to the vehicle that increase its value.

- Confusion About Deductibles: Confirm whether your Gap Insurance policy has a deductible. If so, you'll need to pay that amount before the Gap Insurance kicks in. This deductible amount is subtracted from the Gap Insurance payout.

- Policy Lapsed: Ensure your Gap Insurance policy is active and that you've paid your premiums on time. A lapsed policy won't cover your loss.

Remember meticulous record-keeping is key. Keep copies of your loan agreement, insurance policies (both primary and Gap), and any communication with your insurance companies. This documentation will be invaluable if you need to file a claim.

Safety - Highlight Risky Components

While Gap Insurance doesn't involve physical safety risks in the same way as working on your car's brakes, there are still financial risks to be aware of. The "risky components" here are the terms and conditions of the policy. Here's what to watch out for:

- Coverage Limits: Make sure the coverage limit is sufficient to cover the maximum potential gap between your car's value and your loan balance, especially if you made a small down payment or are leasing a vehicle with high depreciation. Underestimating the potential gap can leave you still owing money on a car you no longer have.

- Exclusions: Understand exactly what's not covered. For example, some policies exclude coverage if you were driving under the influence or committed fraud. Failure to understand these exclusions could lead to a denied claim when you expect coverage.

- Cancellation Clauses: Be aware of the terms under which the insurance company can cancel your policy. For instance, some policies can be canceled if you fail to make timely payments on your car loan. Knowing these clauses will help you maintain continuous coverage.

- Overlapping Coverage: Avoid purchasing redundant coverage. For instance, some auto loans may already include some form of gap protection. Be sure to understand what coverage you already have to avoid paying for unnecessary insurance.

Basically, read the fine print! Treat your Gap Insurance policy with the same scrutiny you'd give a complex wiring diagram. Understand the limitations and ensure it provides the protection you need.

Symbols – Explain Lines, Colors, and Icons (if applicable)

While Gap Insurance isn't a physical system with diagrams in the traditional sense, we can think of the different components as having symbolic representations in the financial landscape.

- Dollar Signs ($): Representing the actual cash value (ACV), loan balance, and ultimately the amount paid out.

- Equals Sign (=): Illustrating the calculation of the gap between the ACV and the loan/lease payoff.

- Downward Arrow (↓): Symbolizing the depreciation of a vehicle over time, which is a critical factor in determining the ACV.

- Scale Icon: Represents the idea of balance in covering loan and asset value.

Think of these as shorthand for understanding the flow of money and the underlying principles of Gap Insurance.

We have a sample Gap Insurance policy document available for download. This example will allow you to see typical clauses and coverage details. It will help you understand how the concepts discussed translate into real-world policy language. Remember, always consult with a financial advisor to determine the best coverage for your individual circumstances. Download it here.