How Does A Gap Insurance Work

Alright, let's talk GAP insurance. You probably know it exists, but do you really know how it works? We're going to dig into the nuts and bolts of this financial safety net, so you understand the inner workings and can make informed decisions. Think of this as understanding the wiring diagram for your wallet – crucial knowledge for any informed car owner, especially if you're deep into modding or tackling your own repairs.

Purpose – Protecting Your Investment

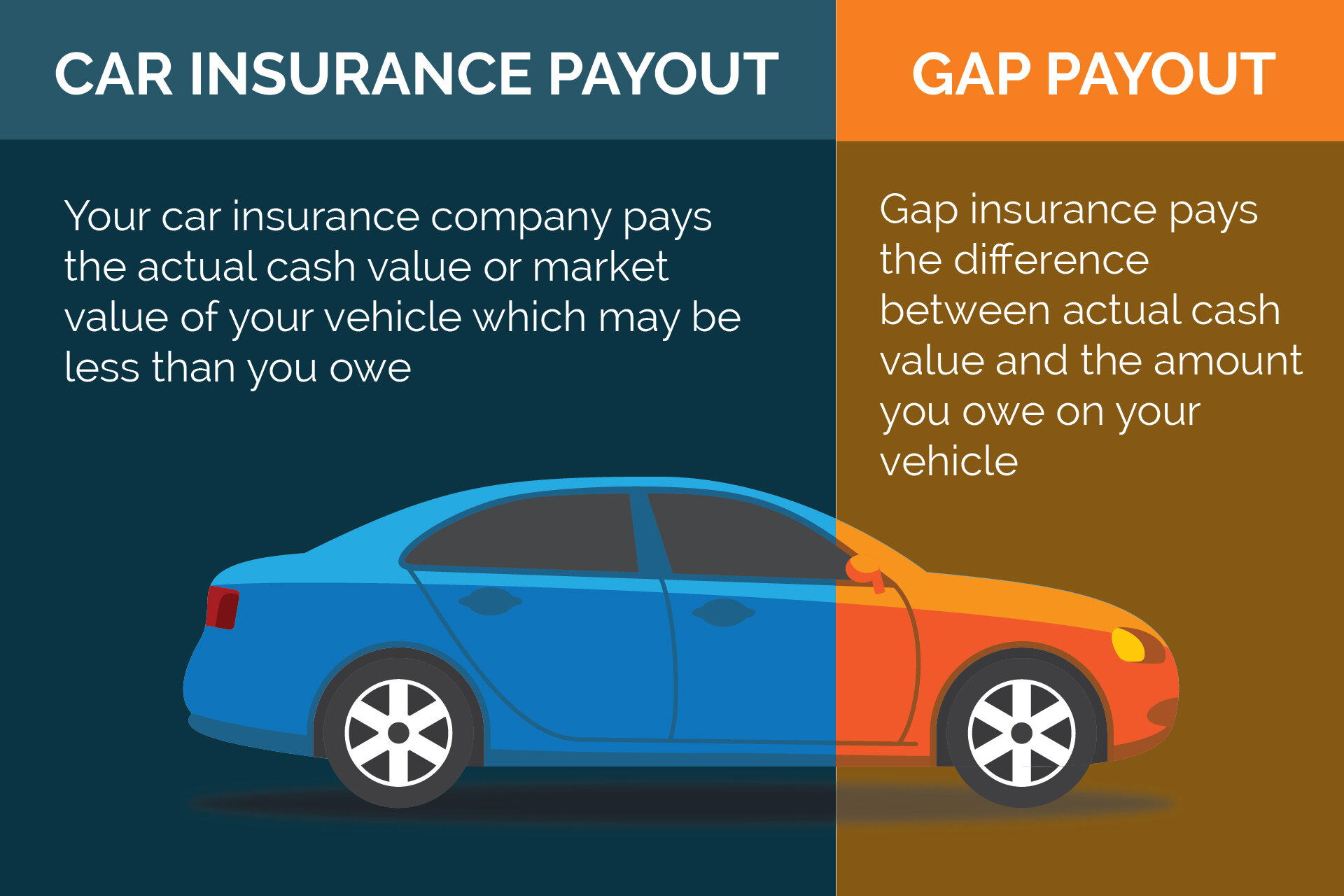

GAP insurance, or Guaranteed Asset Protection insurance, bridges the gap between what your car is worth (its actual cash value or ACV) and what you still owe on your auto loan if the vehicle is totaled or stolen and never recovered. Without it, you could be on the hook for potentially thousands of dollars even after your primary auto insurance pays out. The main purpose is simple: to prevent financial hardship in a worst-case scenario.

For DIYers and modders, this is especially important. Why? Because modifications often don't increase the insured value of your car, even if they significantly increase your investment. If your ride is totaled, your regular insurance will likely only cover the ACV of the vehicle before the modifications. GAP insurance helps protect against the loan balance, irrespective of those mods, providing a crucial safety net.

Key Specs and Main Parts

GAP insurance isn't a tangible component like a spark plug or brake rotor; it's a contract. But understanding its "parts" is essential.

- Actual Cash Value (ACV): This is the fair market value of your car at the time of the incident. It factors in depreciation, mileage, and condition. Your primary insurance company determines this value.

- Loan Balance: The remaining amount you owe to the lender on your auto loan. This includes the principal balance, accrued interest, and any fees.

- GAP Amount: The difference between the loan balance and the ACV. This is the amount GAP insurance potentially covers.

- Policy Limits: The maximum amount your GAP insurance will pay out. Most policies have a limit, usually around $50,000, or a percentage of the original loan amount. Always check these limits.

- Deductible (if any): Some GAP insurance policies have a deductible, similar to your regular auto insurance. This is the amount you pay out of pocket before the GAP coverage kicks in.

- Exclusions: These are situations or conditions that GAP insurance won't cover. Common exclusions include overdue loan payments, negative equity rolled over from a previous loan (more on that later), and instances where the accident was caused by illegal activity.

How It Works: The Nitty-Gritty

Let's walk through a scenario:

You buy a car for $30,000 and finance the entire amount. Two years later, after driving 30,000 miles, the car is totaled in an accident. Your insurance company assesses the ACV at $20,000. However, you still owe $25,000 on your loan.

Here's the breakdown:

- ACV: $20,000

- Loan Balance: $25,000

- Gap: $5,000

Without GAP insurance, you'd be responsible for paying the $5,000 difference to your lender, even though you no longer have the car. With GAP insurance, the policy would (typically) cover the $5,000, preventing a significant financial hit. Note that some policies will exclude or limit the amount if you were behind on payments or violated other terms of the loan.

The process involves filing a claim with your primary auto insurance company first. Once they settle the claim and pay out the ACV, you then file a claim with your GAP insurance provider. They will require documentation, including the police report, insurance settlement details, and loan paperwork.

Rolled-Over Negative Equity: This is a critical point. If you traded in a car with an existing loan and rolled the remaining balance into your new car loan (creating negative equity), many GAP insurance policies will not cover the portion of the gap attributable to that rolled-over debt. For example, if you rolled over $3,000 in negative equity, and the total gap is $5,000, your GAP insurance might only cover $2,000 (the difference between the ACV and the original loan amount for the new car, minus the rolled-over amount).

Real-World Use – Basic "Troubleshooting"

GAP insurance, being a financial product, doesn't really have "troubleshooting" in the traditional mechanical sense. However, here are some points to check and "troubleshoot" before you need to use it:

- Policy Limits: Ensure the policy limits are sufficient to cover the potential gap between your loan balance and the ACV, especially if you made a small down payment or have a longer loan term.

- Exclusions: Carefully read the exclusions section of your policy. Understand what is not covered.

- Claim Process: Familiarize yourself with the claim process. Know what documents you'll need and who to contact.

- Check Your Loan Agreement: Some lenders include GAP insurance in the loan agreement. Make sure you know if you already have it to avoid double coverage.

- Review Policy Annually: As your car depreciates and your loan balance decreases, reassess whether you still need GAP insurance. It may become less valuable over time.

Safety – Potential Financial Risks

While GAP insurance aims to protect you, there are potential financial "risks" to consider:

- Cost: GAP insurance adds to the overall cost of your vehicle. Compare prices from different providers.

- Double Coverage: As mentioned, ensure you're not already covered through your lender or another policy.

- Unnecessary Coverage: If you make a large down payment or have a short loan term, the gap between your loan balance and the ACV might be minimal, making GAP insurance less beneficial.

- Misunderstanding Exclusions: Failing to understand the policy's exclusions can lead to unexpected claim denials.

Key "Risky Component": The most "risky component" here is not understanding the terms and conditions of your GAP insurance policy. Ignorance is not bliss when it comes to financial contracts.

Final Thoughts

GAP insurance is a valuable tool for protecting yourself against financial loss if your car is totaled or stolen. However, it's essential to understand how it works, its limitations, and whether it's right for your specific situation. Don't just blindly accept it from the dealer; do your homework and shop around.

We hope this breakdown has given you a clearer picture of how GAP insurance operates. We have a simplified diagram illustrating the GAP insurance payout process, highlighting the relationship between ACV, loan balance, and the potential GAP amount. Feel free to reach out if you would like a copy of the diagram.