How Does Auto Gap Insurance Work

Let's talk about Auto Gap Insurance, a financial safety net designed to protect you when the unexpected happens. Think of it as the insurance for your insurance, specifically tailored for situations where your car is totaled or stolen and the standard insurance payout doesn't quite cover your remaining loan balance. For those of you who like to tinker under the hood, understand car specs, and appreciate financial prudence, this explanation will break down how Gap Insurance works in a straightforward, no-nonsense manner.

Purpose of Understanding Gap Insurance

Why bother learning about Gap Insurance? Because it's a crucial aspect of financial planning when you're dealing with a car loan. Knowing its ins and outs can save you from a significant financial hit in case of a total loss. This knowledge isn't about repairs in the traditional sense like fixing a blown head gasket; it's about repairing your finances after a major vehicle incident. Understanding this will help you make informed decisions about whether or not to purchase this type of insurance, saving you potentially thousands of dollars in the long run.

Key Specs and Main Components

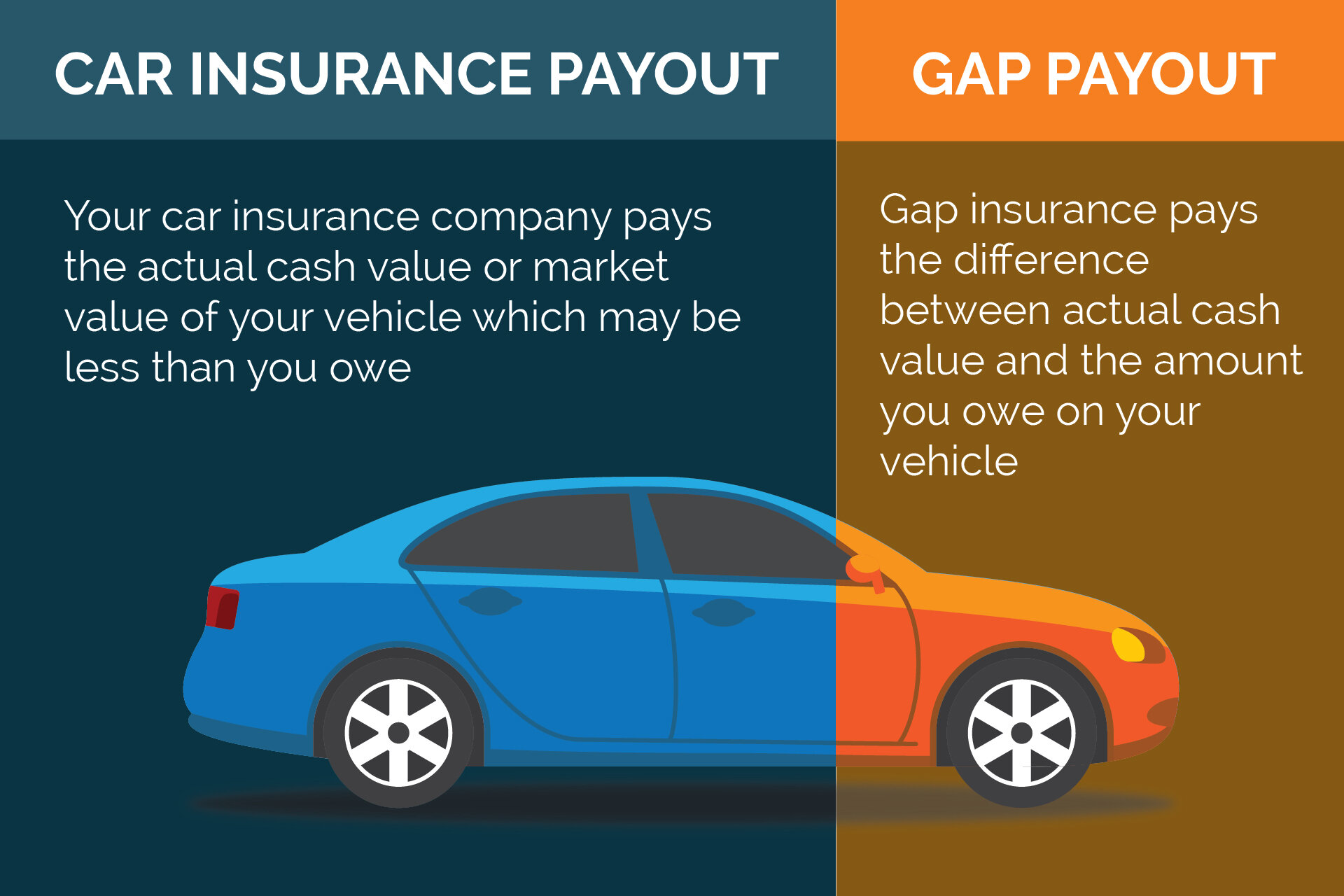

Gap Insurance, formally known as Guaranteed Asset Protection Insurance, focuses on the *gap* between your vehicle's Actual Cash Value (ACV) and the outstanding balance on your loan. Here's a breakdown of the key components:

- Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of loss. It's determined by factors like age, mileage, condition, and prevailing market rates. Think of it like the Kelley Blue Book or Edmunds value, adjusted for your car's specific condition.

- Outstanding Loan Balance: This is the amount you still owe the lender on your car loan.

- Gap Amount: This is the difference between the ACV and the outstanding loan balance. This is the amount Gap Insurance aims to cover (within its policy limits).

- Policy Limits: Gap Insurance policies have maximum payout limits. These limits vary by insurer and policy, so it's crucial to know your specific limits.

- Deductible (Sometimes): Some Gap Insurance policies might have a deductible, similar to your regular car insurance.

The 'specs' here are really about the policy details. You need to understand the coverage limits, exclusions (what isn't covered), and the claims process.

How It Works

The core principle of Gap Insurance is simple: it bridges the financial gap when your car is a total loss, and your insurance payout doesn't cover the remaining loan balance. Let's walk through a scenario:

- Scenario: You buy a new car for $30,000 and finance the entire amount.

- Depreciation: Cars depreciate quickly. Let's say after two years, your car's ACV is $20,000.

- Accident: You're involved in an accident, and your car is deemed a total loss.

- Insurance Payout: Your regular car insurance pays you the ACV, which is $20,000.

- Loan Balance: But you still owe $25,000 on your car loan.

- The Gap: The gap between the ACV ($20,000) and your loan balance ($25,000) is $5,000.

- Gap Insurance Steps In: Assuming your Gap Insurance policy covers the $5,000 (and you don't exceed your policy limits), it will pay the lender the $5,000, effectively paying off your loan. You owe nothing further on the vehicle.

Without Gap Insurance, you'd still be on the hook for that $5,000, even though you no longer have the car.

The process typically involves filing a claim with your primary insurance company first. Once they determine the ACV and payout, your Gap Insurance provider will work with the lender to cover the remaining loan balance, up to the policy's limit. There will likely be paperwork involved from both your insurance company and lender.

Real-World Use – Basic Considerations

Here are a few things to consider regarding Gap Insurance:

- Negative Equity: Gap Insurance is especially important if you rolled negative equity (the unpaid balance from a previous car loan) into your current loan. This significantly increases the chances of being "upside down" on your loan.

- Large Depreciation: Cars that depreciate rapidly (some luxury cars or those with a history of poor resale value) are prime candidates for Gap Insurance.

- Small Down Payment: If you made a small down payment (or no down payment at all), you're more likely to be underwater on your loan.

- Loan Term: Longer loan terms mean slower equity buildup, making Gap Insurance more beneficial.

- Early Loan Stages: The early years of a car loan are when depreciation is steepest, making Gap Insurance most valuable during this period.

Troubleshooting Tip: Review your car insurance policy and loan agreement carefully. Understand the ACV determination process and your policy limits. Don't wait until an accident happens to figure this out. Read the fine print!

Safety – Important Considerations

While Gap Insurance itself isn't a physical component that poses a safety risk, here's a crucial point:

Financial Safety: Not having Gap Insurance when you need it is a major financial risk. It can leave you owing thousands of dollars on a car you no longer have. This can significantly impact your credit score and financial stability.

Be aware of exclusions in the Gap Insurance policy. Many policies don't cover things like:

- Late payment penalties

- Security deposits

- Extended warranties

- Carry-over balances from previous loans

- Modifications or accessories added after the original purchase (aftermarket parts) – This is especially important for modders!

Where to Get Gap Insurance

You can typically purchase Gap Insurance from several sources:

- Your Car Dealer: Dealers often offer Gap Insurance as part of the financing package. This is convenient but might not always be the cheapest option.

- Your Insurance Company: Some major insurance companies offer Gap Insurance as an add-on to your regular car insurance policy.

- Banks and Credit Unions: Your lender might offer Gap Insurance as a loan protection product.

- Standalone Gap Insurance Providers: Several companies specialize in offering Gap Insurance directly to consumers.

Always compare quotes from multiple sources to ensure you're getting the best coverage at the most competitive price.

Conclusion

Gap Insurance is a valuable tool for protecting yourself from financial loss in the event of a totaled or stolen vehicle. By understanding the key components, how it works, and the potential risks of not having it, you can make an informed decision about whether it's right for you. Remember to carefully review your policy documents and compare quotes before making a purchase.

We have a detailed policy document breakdown available for download. This document provides a clearer picture of policy inclusions and exclusions. To gain access, please [link to download].