How Does Car Leasing Work In Usa

So, you’re thinking about leasing a car instead of buying. Smart move! It's like renting, but with some unique twists. Understanding how leasing works can save you a ton of money and prevent headaches down the road, especially when it comes to figuring out the fine print. Think of this article as your comprehensive guide to decoding the leasing agreement.

Purpose – Why Understanding Leasing Matters

Why bother learning all this leasing jargon? Because knowledge is power, my friend! A solid grasp of the leasing process empowers you in several key areas:

- Negotiation: Knowing the terms like the Money Factor and the Residual Value gives you leverage when negotiating with the dealership. You can challenge their numbers and potentially lower your monthly payments.

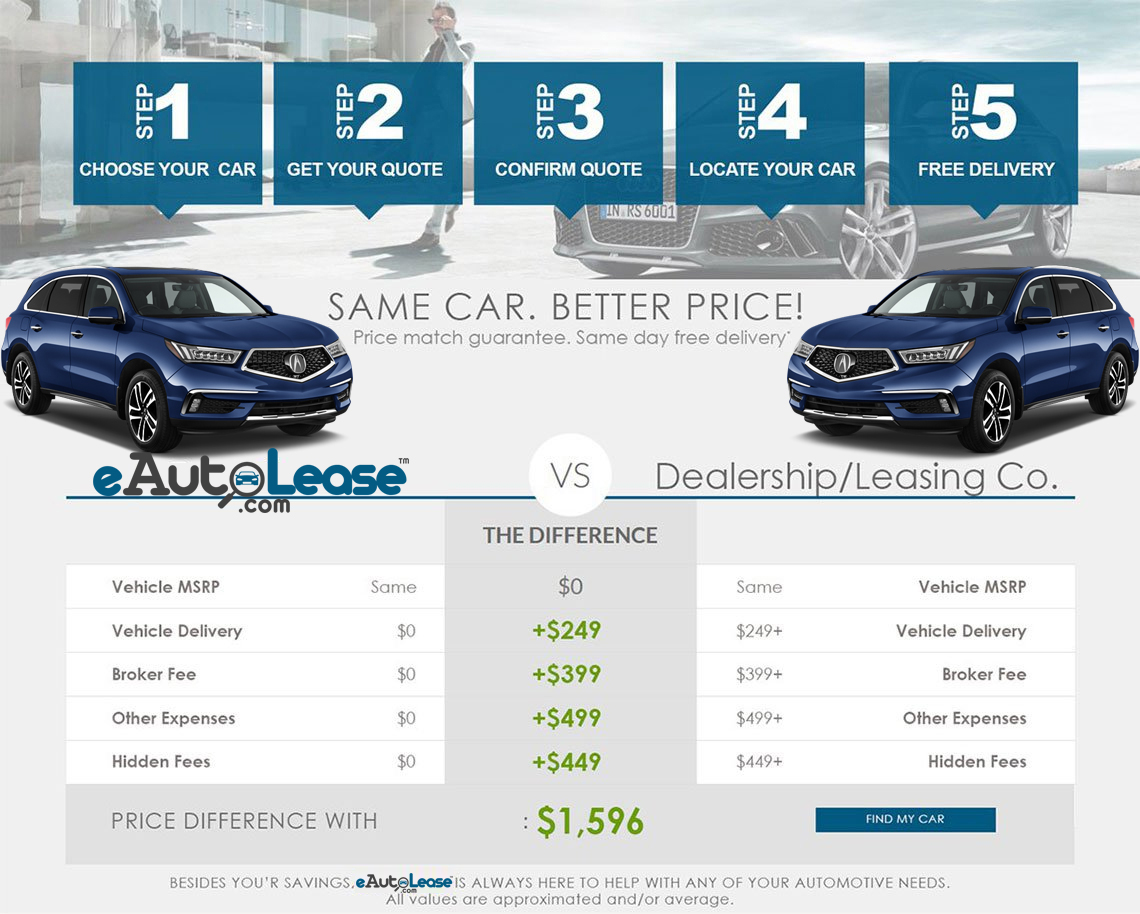

- Cost Awareness: Leasing isn’t just about the monthly payment. There are other fees and potential penalties. Understanding these costs beforehand prevents unwelcome surprises.

- Making Informed Decisions: Leasing isn’t right for everyone. Maybe you drive a lot, or you like modifying your cars. Understanding the limitations of a lease helps you decide if it’s the right option for you.

- Avoiding Scams: Unfortunately, some dealerships try to take advantage of uninformed customers. Knowing your stuff protects you from these shady practices.

Key Specs and Main Parts of a Car Lease

Let's break down the core components of a car lease. These are the terms you'll see in your lease agreement, so pay close attention.

- MSRP (Manufacturer's Suggested Retail Price): This is the sticker price of the car. It's the starting point for negotiations but not necessarily what you'll pay.

- Capitalized Cost (Cap Cost): This is the negotiated price of the car that the lease is based upon. It’s like the sale price in a purchase agreement, but specifically for leasing.

- Capitalized Cost Reduction (Cap Cost Reduction): This is any down payment, trade-in value, or rebate that lowers the Cap Cost. Putting more money down reduces your monthly payments, but remember that down payments are generally non-refundable if the car is totaled.

- Adjusted Capitalized Cost: Cap Cost minus the Cap Cost Reduction. This is the base amount you’re effectively financing through the lease.

- Residual Value: This is the predicted value of the car at the end of the lease term. It's a percentage of the MSRP and is determined by the leasing company. A higher residual value means lower monthly payments.

- Depreciation: The difference between the Adjusted Capitalized Cost and the Residual Value. This is the amount you're paying for the car to depreciate during the lease term.

- Money Factor: This is the lease interest rate. It's usually a small decimal number (e.g., 0.0025). To get the approximate annual interest rate, multiply the Money Factor by 2400.

- Lease Term: The length of the lease, typically 24, 36, or 48 months.

- Mileage Allowance: The number of miles you're allowed to drive per year. Exceeding this allowance results in per-mile overage charges.

- Acquisition Fee: A fee charged by the leasing company to initiate the lease.

- Disposition Fee: A fee charged at the end of the lease to cover the cost of preparing the car for resale.

How It Works

Okay, let's put all those pieces together and see how a lease actually works:

- Negotiate the Price: Start by negotiating the Capitalized Cost of the car, just like you would if you were buying. Don't be afraid to walk away if you're not getting a good deal.

- Determine the Adjusted Capitalized Cost: Subtract any Cap Cost Reduction from the Capitalized Cost.

- Calculate Depreciation: Subtract the Residual Value from the Adjusted Capitalized Cost. This is the total depreciation over the lease term.

- Calculate Finance Charges: The Money Factor is multiplied by the sum of the Adjusted Capitalized Cost and the Residual Value. This gives you the monthly finance charge.

- Calculate the Monthly Payment: Divide the total depreciation by the lease term (number of months). Then, add the monthly finance charge. This gives you your base monthly payment.

- Add Taxes and Fees: Sales tax and other fees (acquisition fee, disposition fee) are added to the base monthly payment to get your total monthly payment.

Example: Let's say you're leasing a car with a MSRP of $30,000. You negotiate a Capitalized Cost of $28,000. You put down $2,000 as a Cap Cost Reduction. The Residual Value is 60% ($18,000). The Money Factor is 0.002. The lease term is 36 months.

- Adjusted Capitalized Cost: $28,000 - $2,000 = $26,000

- Depreciation: $26,000 - $18,000 = $8,000

- Monthly Finance Charge: 0.002 * ($26,000 + $18,000) = $88

- Base Monthly Payment: $8,000 / 36 + $88 = $310.22

- Total Monthly Payment: $310.22 + (Taxes and Fees)

Real-World Use – Basic Troubleshooting Tips

Here are a few common leasing issues and how to address them:

- Excess Mileage: Track your mileage carefully. If you anticipate exceeding your allowance, contact the leasing company before you go over. You may be able to purchase additional miles at a lower rate than the end-of-lease overage charge.

- Wear and Tear: Leases typically have stricter wear-and-tear standards than purchased vehicles. Scratches, dents, and worn tires can result in charges at the end of the lease. Consider repairing minor damage before turning in the car.

- Early Termination: Breaking a lease early can be very expensive. You'll likely be responsible for the remaining payments, plus a termination fee. Explore options like transferring the lease to someone else (lease swapping) before terminating.

- Negotiating the Disposition Fee: Sometimes, you can negotiate this fee down or even waive it entirely, especially if you lease another car from the same dealership.

Safety – Highlight Risky Components

The riskiest component in a lease is arguably the agreement itself. Carefully scrutinize every clause and term. Don't be afraid to ask questions and get clarification on anything you don't understand. Pay special attention to:

- Mileage Allowance: Ensure it aligns with your driving habits.

- Wear and Tear Standards: Understand what constitutes "excessive" wear and tear.

- Early Termination Penalties: Know the financial consequences of breaking the lease.

- Hidden Fees: Be aware of all fees associated with the lease, including acquisition, disposition, and documentation fees.

Remember, leasing is a financial contract. Treat it with the same level of care and attention you would give to any other major financial transaction.

Now you’re armed with the knowledge to navigate the leasing landscape. Remember that dealerships are businesses that want to make money. Understanding the terms and being prepared to negotiate will get you the best deal possible. Happy driving!