How Does Gap Car Insurance Work

Let's talk about something that doesn't involve wrenching on your engine, but is crucial for protecting your investment: Gap insurance. Think of this article as your guide to understanding gap insurance, much like a wiring diagram helps you diagnose electrical issues in your ride. We'll dissect the "system" of gap insurance, its components, and how it works so you can make informed decisions.

Purpose

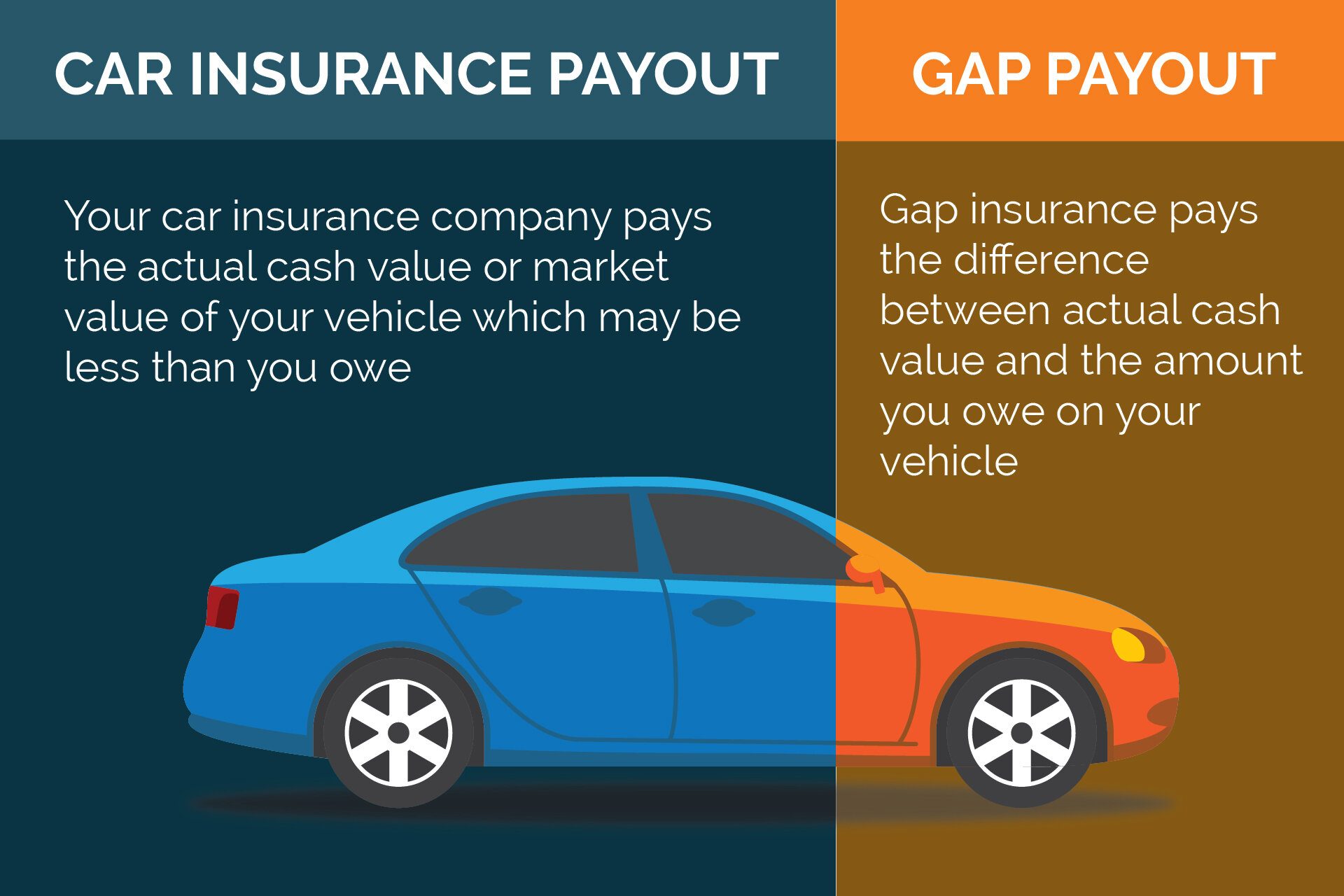

Why bother understanding gap insurance? Because depreciation is a silent killer of vehicle value. It’s the difference between what you owe on your car and what it’s actually worth. If your car is totaled or stolen, and you owe more than its actual cash value (ACV), you're in a "gap." Gap insurance exists precisely to cover this difference. Understanding how it works is critical for deciding if you need it and for navigating a claim should the worst happen. It’s not about repairs or modifications directly, but it's about financial security when things go sideways. Just like a complex engine, if you understand the underlying system of Gap insurance, you can keep the system healthy.

Key Specs and Main Parts

Gap insurance isn't a tangible "part" like a carburetor or spark plug, but it's a financial contract with key specs and components:

- The Policy: This is the overarching agreement between you and the insurance company. It outlines the terms, conditions, and coverage limits. Think of it as the master blueprint.

- Actual Cash Value (ACV): This is the market value of your vehicle at the time of loss, considering depreciation. It's determined by sources like Kelley Blue Book or NADAguides. This is a critical number, as it’s what your standard comprehensive or collision insurance will pay.

- Loan/Lease Balance: This is the outstanding amount you owe on your car loan or lease at the time of loss.

- The "Gap": The difference between the ACV and the loan/lease balance. This is the amount gap insurance is designed to cover. Gap = Loan/Lease Balance - ACV

- Coverage Limit: The maximum amount the gap insurance will pay out. Most policies have a cap. It's vital to know this limit.

- Deductible: Some gap insurance policies have a deductible, which is the amount you pay out-of-pocket before the gap insurance kicks in.

- Exclusions: Gap insurance policies often have exclusions, such as coverage for overdue payments, carry-over balances from previous loans, or modifications that increase the vehicle's value beyond its original MSRP (Manufacturer's Suggested Retail Price).

Understanding these components is crucial to knowing the amount of financial risk you're protecting against. Just like knowing the torque specs when tightening bolts, knowing your policy's key limits protects your engine.

"Symbols" - Understanding the Contract

Unlike a wiring diagram with literal symbols, gap insurance uses contractual language. Let's decode some common "symbols":

- "Total Loss": This signifies the event that triggers gap insurance coverage. It means your vehicle is deemed irreparable or the cost of repair exceeds a certain percentage (often 70-80%) of its ACV.

- "Primary Insurer": This refers to your standard comprehensive or collision insurance policy. Gap insurance only kicks in after your primary insurer has paid out.

- "Claim Settlement": This is the process by which the gap insurance company calculates and pays the difference between the ACV and the loan/lease balance, up to the policy's coverage limit.

- Fine Print (Read it!): The details of the policy, which spells out exclusions, claim procedures and responsibilities of both the insurer and insured.

Think of these as the 'symbols' of your insurance contract. Understand these so you'll understand your coverage.

How It Works

Here's a step-by-step breakdown of how gap insurance typically works:

- Accident/Theft: Your vehicle is involved in an accident or is stolen and deemed a total loss by your primary insurance company.

- Primary Insurance Claim: You file a claim with your comprehensive or collision insurance. They assess the damage, determine the ACV of your vehicle, and pay you that amount (minus your deductible).

- Gap Insurance Claim: After your primary insurer has settled the claim, you file a claim with your gap insurance provider.

- Gap Calculation: The gap insurance company calculates the difference between the loan/lease balance and the ACV paid by your primary insurer. They factor in any deductible on the gap insurance policy and any applicable exclusions.

- Payment: The gap insurance company pays the difference (up to the policy's coverage limit) directly to your lender or lessor. This pays off the remaining balance on your car loan or lease.

Example: You owe $20,000 on your car loan. Your primary insurance determines the ACV is $15,000 and pays that amount. The "gap" is $5,000. Assuming your gap insurance has a $0 deductible and a coverage limit of at least $5,000, it will pay $5,000 to your lender, clearing your loan.

Important note: Gap insurance typically only covers the *vehicle* itself. It usually *doesn't* cover things like negative equity rolled over from a previous car loan, extended warranties, or aftermarket accessories. Those will typically still be your responsibility.

Real-World Use - Basic Troubleshooting

Here are some common "troubleshooting" scenarios related to gap insurance:

- Claim Denial: If your gap insurance claim is denied, carefully review the policy's exclusions. Common reasons for denial include exceeding the coverage limit, overdue loan payments, or modifications that weren't disclosed. Appeal the denial if you believe it's unwarranted, providing documentation to support your case.

- Insufficient Coverage: If the gap is larger than your policy's coverage limit, you'll still be responsible for the remaining balance. In this case, negotiation with the lender or lessor might be necessary.

- Understanding ACV: If you disagree with your primary insurer's ACV assessment, gather evidence to support your claim for a higher valuation. This could include comparable sales data for similar vehicles in your area.

Just like checking sensor data for an engine problem, knowing the data and policy language is key to troubleshoot a potential problem.

Safety - Risky Components

While gap insurance itself doesn't have physically "risky" components, there are potential financial pitfalls to be aware of:

- Overlapping Coverage: Don't purchase gap insurance if you already have similar coverage through your primary insurance policy or another source.

- Unnecessary Coverage: If you made a large down payment on your car or your vehicle depreciates slowly, you may not need gap insurance. Assess your risk level carefully.

- Hidden Fees: Some dealerships may try to inflate the price of gap insurance or bundle it with other unnecessary products. Shop around and compare prices from different providers.

- Policy Limit Ensure your policy has a sufficient limit for your car. It would be best if the limit is more than the expected amount of your total loan.

Buying an inappropriate Gap insurance is like using the wrong oil filter: it can cause an expensive problem later. Take the time to choose the right one for your need.

Final Thoughts

Gap insurance can be a valuable safety net for certain car owners, especially those with new vehicles, long-term loans, or leases. However, it's essential to understand how it works, its limitations, and whether it's the right fit for your individual circumstances. By taking the time to educate yourself, you can make informed decisions and protect yourself from potential financial hardship. Think of it as preventative maintenance for your wallet.

We have a detailed gap insurance policy diagram available for download. This diagram outlines the workflow of how coverage is applied when a vehicle is totaled. Reviewing this diagram will help solidify your understanding of gap insurance.