How Does The Gap Insurance Work

So, you’re looking into Gap Insurance, huh? Good on you for being proactive. A lot of folks get burned because they don’t understand how it works until it’s too late. Think of this article as a deep dive into the nuts and bolts of financial protection, a kind of preventative maintenance for your wallet. We're going to break down the mechanics of Gap Insurance, explaining its function, key components, and even some real-world scenarios where it can save your bacon.

Purpose – Understanding the Financial Landscape After a Loss

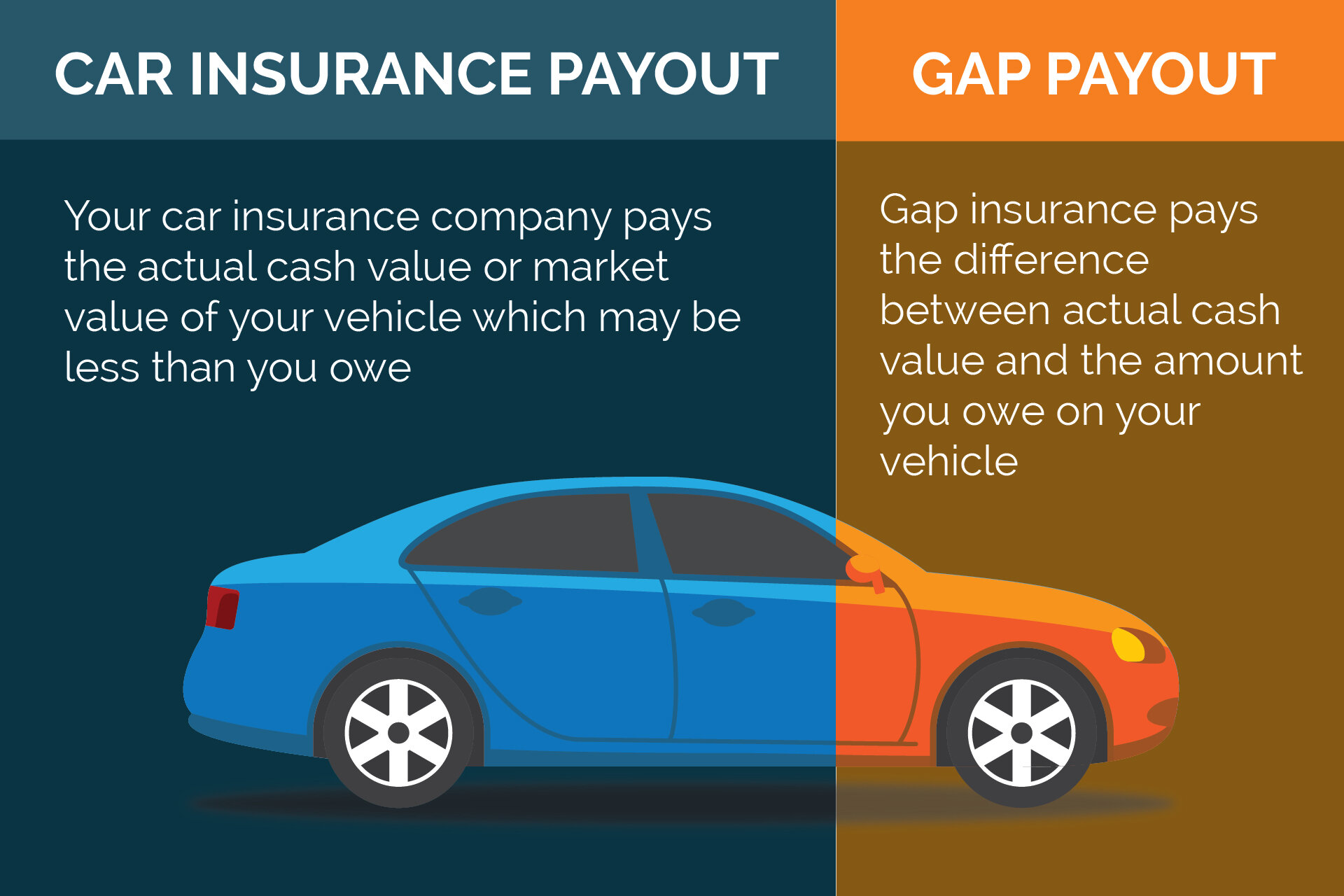

The purpose of understanding Gap Insurance is simple: financial protection in the event of a total loss. Imagine you finance a brand-new truck for $50,000. A year later, due to a collision or theft, it's totaled. Your comprehensive/collision insurance will pay out the actual cash value (ACV) of the vehicle at the time of the incident, let’s say $40,000. Here's the kicker: You still owe the bank the remaining $10,000 plus any deductible from your regular insurance policy! That's where Gap Insurance steps in. It covers the "gap" between what you owe on the loan and what your insurance company deems the car is actually worth. Essentially, it prevents you from being upside-down on your car loan after a total loss.

Key Specs and Main Parts of Gap Insurance

While Gap Insurance isn’t a physical component like an engine part, it's a contractual agreement with specific terms. Let's break down the "specs" and key parts:

- Policy Limit: This is the maximum amount the Gap Insurance will pay out. It's crucial to know this limit to ensure it adequately covers the potential gap between your loan balance and the vehicle's ACV. This is typically a dollar amount (e.g., $50,000).

- Eligibility Requirements: Gap Insurance usually has eligibility criteria. For example, your loan amount might need to be within a certain percentage of the vehicle's MSRP (Manufacturer's Suggested Retail Price), or your loan term might need to be within a specific range. It is usually purchased at the time of buying the car.

- Covered Losses: Gap Insurance typically covers total losses due to collision, theft, or natural disasters. However, it doesn't cover mechanical failures, engine problems, or wear and tear.

- Deductible: Some Gap Insurance policies cover your primary insurance deductible, while others don’t. This is a crucial detail to consider.

- Exclusions: Understand the exclusions. Common exclusions include losses due to illegal activities, intentional damage, or unapproved modifications to the vehicle. For example, adding an aftermarket turbocharger that then causes an accident may void the coverage.

- Claim Process: The claim process involves working with both your primary insurance company and the Gap Insurance provider. Typically, your primary insurer settles the ACV of the vehicle, and then the Gap Insurance provider pays the remaining balance, up to the policy limit.

How Gap Insurance Works: The Financial Flow

Here’s a simplified step-by-step breakdown of how Gap Insurance works in the event of a total loss:

- Incident Occurs: The vehicle is deemed a total loss due to collision, theft, or a covered event.

- Primary Insurance Claim: You file a claim with your primary auto insurance company (e.g., State Farm, Progressive). They determine the Actual Cash Value (ACV) of the vehicle at the time of the loss. This takes into account depreciation, mileage, and condition.

- ACV Settlement: Your primary insurer pays you the ACV minus your deductible. For instance, if the ACV is $40,000 and your deductible is $500, they pay you $39,500.

- Gap Insurance Claim: You file a claim with your Gap Insurance provider. You'll need to provide documentation, including the primary insurance settlement paperwork, your loan agreement, and proof of the total loss.

- Gap Calculation: The Gap Insurance provider calculates the "gap" between what you owe on the loan and the ACV paid by your primary insurer. The formula is: Loan Balance - ACV = Gap

- Gap Payment: The Gap Insurance provider pays the remaining loan balance up to the policy limit, potentially including your deductible if your policy covers it.

- Loan Closure: The loan is paid off, and you avoid owing money on a car you can no longer drive.

Example: You owe $42,000 on your car loan. Your primary insurance pays out $40,000 (ACV). The gap is $2,000. Your Gap Insurance pays the $2,000 (or $2,500 if they cover your $500 deductible), closing out the loan.

Real-World Use – Scenarios and Considerations

Gap Insurance is most beneficial in specific scenarios:

- New Vehicle Purchase: New cars depreciate rapidly in the first few years.

- Long Loan Term: The longer the loan term, the slower you build equity in the vehicle.

- High Loan-to-Value Ratio: If you financed a large percentage of the vehicle's value, the gap between the loan balance and the ACV is likely to be larger.

- Vehicle with High Depreciation Rate: Certain makes and models depreciate faster than others.

Troubleshooting Tip: Before purchasing Gap Insurance, calculate the potential gap between your loan balance and the projected ACV of your vehicle in a year or two. Use online depreciation calculators and check Kelley Blue Book or Edmunds to estimate future values. If the potential gap is significant, Gap Insurance is worth considering.

Safety Considerations

Gap Insurance itself doesn't pose any physical safety risks, unlike faulty brakes or worn tires. However, there are financial "safety" considerations:

- Avoid Overlapping Coverage: Don't buy Gap Insurance if you already have Loan/Lease Payoff Coverage included in your primary auto insurance policy. You'll be paying for duplicate coverage.

- Read the Fine Print: Thoroughly review the policy terms and conditions, especially the exclusions and claim process.

- Compare Quotes: Shop around for the best Gap Insurance rates from different providers, including your car dealer, bank, and insurance company.

- Understand the Cancellation Policy: In many cases, you can cancel Gap Insurance and receive a prorated refund if you pay off your loan early or refinance.

Important Terms to Remember

Let's quickly review some important terms:

- ACV (Actual Cash Value): The fair market value of your vehicle at the time of a total loss, considering depreciation.

- Loan-to-Value Ratio: The percentage of the vehicle's value that you financed.

- Depreciation: The decrease in a vehicle's value over time.

Remember, Gap Insurance is a tool – a financial safety net. Understanding its workings empowers you to make informed decisions and protect yourself from potential financial hardship. It is a relatively inexpensive investment compared to the possible thousands of dollars you could be left owing on a totaled car. It’s like putting on your seatbelt – you hope you never need it, but you’re darn glad it’s there if you do.

We have a detailed Gap Insurance diagram available for download. This visual aid provides a clear representation of the claim process and payment flow. With this resource, you'll be equipped to navigate the complexities of Gap Insurance with confidence.