How Long Does Gap Insurance Take

Alright, let's dive into the often-asked question: how long does it really take to process a Gap insurance claim? It's a common concern, and the answer isn't always straightforward. Several factors influence the timeline, and understanding them can help you manage your expectations and potentially expedite the process. This article will break down the typical timeframe, the key players involved, and what you can do to ensure a smoother experience. Think of this as your deep dive into the mechanics of Gap insurance claims processing.

Understanding the Gap Insurance Process

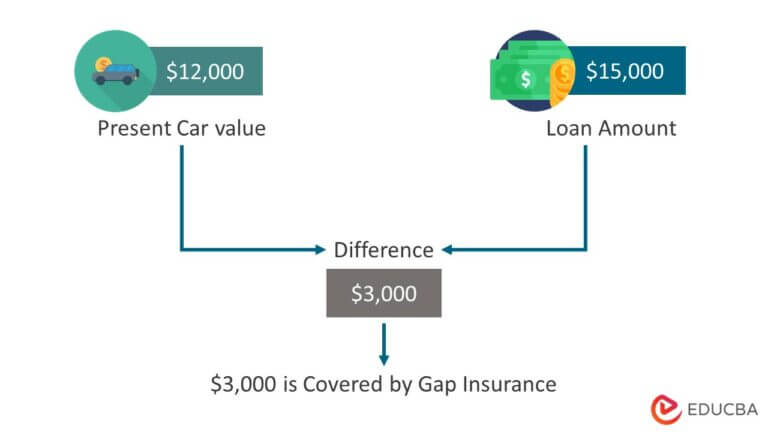

First, a quick refresher. Gap insurance, or Guaranteed Asset Protection insurance, is designed to cover the "gap" between what you owe on your car loan and what your insurance company pays out if your vehicle is totaled or stolen. This is crucial because a vehicle depreciates rapidly, especially in the first few years. Without Gap insurance, you could be stuck owing a significant amount of money on a car you no longer have.

Key Specs and Main Parts of the Claim Process

The Gap insurance claim process isn't a simple, linear process. It involves several stages and key players, each with its own processing time. Understanding these components is essential for predicting and potentially influencing the overall timeline.

- The Accident/Theft and Initial Notification: This is where it all starts. Once your vehicle is declared a total loss or stolen, you need to immediately notify your primary auto insurance company and, subsequently, your Gap insurance provider.

- Primary Insurance Claim Processing: This is arguably the longest and most critical stage. Your primary auto insurance company will investigate the incident, determine liability, and ultimately, determine the actual cash value (ACV) of your vehicle. This involves assessing the vehicle's pre-accident condition, mileage, and market value.

- Gap Insurance Claim Submission: Once the primary insurance company settles the claim and you receive their payout information (including the ACV), you can submit your Gap insurance claim. This involves providing all necessary documentation, including the primary insurance settlement letter, the loan or lease agreement, and proof of Gap insurance coverage.

- Gap Insurance Claim Review and Validation: The Gap insurance company will review your claim, verify the information provided, and calculate the "gap" amount. This involves confirming the outstanding loan balance, the ACV paid by your primary insurer, and any applicable deductibles or exclusions in your Gap insurance policy.

- Gap Insurance Payout: Once the claim is approved, the Gap insurance company will typically pay the difference directly to your lender or leasing company to satisfy the remaining loan balance.

Factors Affecting the Timeline

Now, let's break down the factors that can significantly impact how long each stage takes:

- Complexity of the Accident: Simple, straightforward accidents generally result in faster primary insurance claim processing. Accidents involving multiple vehicles, injuries, or disputed liability can significantly prolong the investigation and settlement process.

- Insurance Company Efficiency: Different insurance companies have different processing speeds. Some are known for their efficiency, while others are notoriously slow. This is often due to differences in staffing levels, technology, and internal procedures.

- Documentation Completeness: Providing complete and accurate documentation from the outset is crucial. Missing or incomplete documents will inevitably lead to delays as the insurance company requests additional information. Double-check everything!

- Gap Insurance Policy Terms: Your specific Gap insurance policy can contain clauses that affect the payout timeline. For instance, some policies have waiting periods or specific requirements that must be met before a claim can be processed.

- Lender Cooperation: The lender or leasing company needs to provide accurate information about the outstanding loan balance. Delays in obtaining this information can hold up the Gap insurance payout.

Typical Timeframes

So, what's a realistic timeframe? Here's a rough estimate, keeping in mind that these are just averages and can vary widely:

- Primary Insurance Claim Processing: 2 weeks to 2 months (or longer in complex cases). This is the biggest variable.

- Gap Insurance Claim Submission: This depends entirely on you. The faster you gather and submit the required documents, the faster the process can move. Aim for within a week of receiving the primary insurance settlement.

- Gap Insurance Claim Review and Validation: 1 week to 3 weeks. This depends on the Gap insurance company's workload and efficiency.

- Gap Insurance Payout: Typically within a week of claim approval.

Therefore, a reasonable estimate for the entire Gap insurance claim process is 3 weeks to 3 months. However, it's essential to remember that this is a broad range, and your individual experience may differ.

Real-World Use – Basic Troubleshooting Tips

Here are some tips to help expedite your Gap insurance claim:

- Stay Organized: Keep meticulous records of all communication with the insurance companies, including dates, times, and names of representatives you spoke with.

- Promptly Provide Documentation: Gather all required documents as quickly as possible and submit them to the Gap insurance company in a timely manner.

- Follow Up Regularly: Don't be afraid to follow up with the insurance companies to check on the status of your claim. Polite and persistent inquiries can often help move things along.

- Understand Your Policy: Familiarize yourself with the terms and conditions of your Gap insurance policy so you know what to expect and what your rights are.

- Escalate if Necessary: If you experience unreasonable delays or encounter problems with your claim, consider escalating the issue to a supervisor or filing a complaint with your state's insurance regulator.

Safety – Highlight Risky Components

While there aren't inherently "risky components" in the *process* itself in the same way you'd think of risky components in, say, an engine rebuild, there are potential pitfalls that can lead to financial risk and frustration. Failing to understand your policy, neglecting to provide complete documentation, or accepting a lowball offer from your primary insurance company can all have negative consequences. Furthermore, beware of unscrupulous Gap insurance providers who may try to deny valid claims or delay payments.

Always thoroughly review your Gap insurance policy documents and ask questions if anything is unclear. If you feel you're being treated unfairly, seek advice from a qualified attorney or insurance professional.

We have a detailed diagram outlining the Gap insurance claim process available for download. This diagram visually represents the various stages involved and can serve as a valuable resource for understanding the process and tracking your claim's progress.