How Long Is A Car Payment

Understanding the typical car loan term – or how long you'll be making payments – is crucial for budgeting, financial planning, and even making informed decisions when purchasing a vehicle. This isn't just about knowing when you'll own the car outright; it significantly impacts your monthly payments, the total interest you pay, and even your ability to sell or trade in the vehicle down the line. Knowing the ins and outs empowers you to negotiate better loan terms and avoid potentially crippling financial commitments.

Purpose of Understanding Car Loan Terms

Why delve into the details of car loan terms? Several compelling reasons exist:

- Budgeting and Financial Planning: The loan term directly influences your monthly payment. A longer term reduces the payment, but increases the total interest paid. Understanding this trade-off allows for effective budget allocation.

- Negotiating Power: Armed with knowledge, you can confidently discuss loan options with lenders and dealerships. Knowing prevailing interest rates and typical loan terms puts you in a stronger bargaining position.

- Trade-in/Resale Considerations: The remaining loan balance affects the value of your car at trade-in. If you owe more than the car is worth (negative equity), you'll need to cover the difference when purchasing a new vehicle. Understanding the amortization schedule is critical for managing this risk.

- Preventing Financial Strain: Committing to a loan term that stretches your budget thin can lead to missed payments, repossession, and damage to your credit score. Proper evaluation prevents this.

Key Specs and Main Parts of a Car Loan

A car loan, like any loan, has several key components:

- Principal: The initial amount of money borrowed to purchase the car.

- Interest Rate (APR): The annual percentage rate charged by the lender for the loan. This is a crucial factor in determining the total cost of the loan. A lower APR results in lower overall interest payments.

- Loan Term: The length of time you have to repay the loan, expressed in months. Common terms range from 36 months (3 years) to 72 months (6 years) or even longer.

- Monthly Payment: The fixed amount you pay each month to the lender. This payment includes both principal and interest.

- Down Payment: The amount of money you pay upfront towards the purchase price of the car. A larger down payment reduces the principal amount and potentially the interest rate.

- Fees: Various charges associated with the loan, such as origination fees, documentation fees, and prepayment penalties.

- Amortization Schedule: A table showing how each monthly payment is allocated between principal and interest over the life of the loan. Early payments consist mostly of interest, while later payments consist mostly of principal.

The most common loan terms are 36, 48, 60, 72 and 84 months. The typical loan term has shifted over time. Historically, 36-48 months were most common. Today, longer terms like 60 and 72 months are more prevalent as car prices have increased. Even 84-month loans are becoming more common, although financially, they are generally not recommended due to the substantial interest accumulation.

Understanding the Loan Calculation

The monthly payment for a car loan is calculated using a formula that takes into account the principal amount, interest rate, and loan term. The formula is as follows:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly payment

- P = Principal loan amount

- i = Monthly interest rate (annual interest rate / 12)

- n = Number of months (loan term)

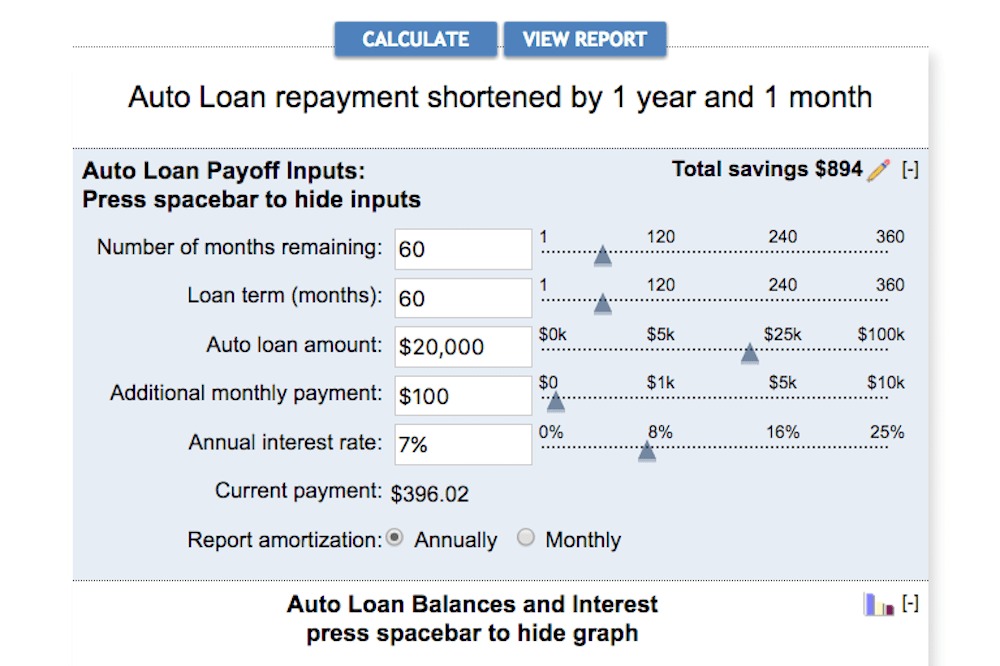

This formula can seem intimidating, but online loan calculators readily available can perform the calculation for you. However, understanding the formula helps you appreciate how each component affects the monthly payment.

How It Works: The Impact of Loan Term

The loan term has a significant impact on both the monthly payment and the total interest paid. A shorter loan term results in higher monthly payments, but significantly lower total interest. Conversely, a longer loan term results in lower monthly payments, but significantly higher total interest paid over the life of the loan.

Example: Consider a $25,000 car loan with a 6% APR.

- 36-month loan: Monthly payment = $760.57, Total interest paid = $2,380.58

- 60-month loan: Monthly payment = $483.32, Total interest paid = $3,999.33

- 72-month loan: Monthly payment = $410.85, Total interest paid = $4,581.38

As you can see, the 72-month loan has the lowest monthly payment, but you'll pay significantly more in interest over the life of the loan compared to the 36-month option. Choosing the right loan term requires a careful consideration of your budget and financial goals.

Real-World Use: Basic Troubleshooting Tips

Here's how to apply this knowledge in the real world:

- Shop Around: Don't settle for the first loan offer you receive. Get quotes from multiple lenders (banks, credit unions, online lenders) to compare interest rates and terms.

- Consider a Larger Down Payment: A larger down payment reduces the principal amount, which lowers both your monthly payment and the total interest paid.

- Avoid Rolling Over Negative Equity: If you're trading in a car with negative equity, avoid rolling that debt into your new car loan. This increases the principal amount and extends the loan term, costing you more in the long run.

- Review Your Credit Report: Your credit score significantly impacts the interest rate you'll receive. Check your credit report for errors and take steps to improve your score before applying for a car loan.

- Understand Prepayment Penalties: Some loans have prepayment penalties, which are fees charged for paying off the loan early. Avoid loans with prepayment penalties if you anticipate being able to pay off the loan faster.

Safety: Risky Loan Practices

Be wary of these potentially risky loan practices:

- Long Loan Terms (72+ Months): While tempting with lower monthly payments, they accumulate significant interest and increase the risk of being upside down on the loan (owing more than the car is worth).

- High Interest Rates: A high APR can significantly increase the total cost of the loan. Shop around and improve your credit score to secure a lower rate.

- Hidden Fees: Be aware of all fees associated with the loan. Ask the lender for a complete breakdown of all charges.

- Balloon Payments: A balloon payment is a large lump sum payment due at the end of the loan term. These can be difficult to manage and can lead to refinancing or defaulting on the loan.

- Spot Delivery Scams: Be cautious of dealerships that allow you to drive off the lot before the loan is finalized. They may later change the terms of the loan to your disadvantage.

Conclusion

Understanding the loan term is fundamental to responsible car ownership. By carefully evaluating your budget, shopping around for the best loan terms, and avoiding risky loan practices, you can make informed decisions that save you money and protect your financial well-being. Don't be afraid to ask questions and negotiate with lenders to secure the most favorable loan terms possible. Remember, knowledge is power when it comes to managing your car loan.