How Much Does A Car Cost A Month

Okay, let's talk about something that hits every car owner's wallet: the true monthly cost of owning a vehicle. We're not just talking about the car payment. We’re diving deep into all the expenses, from the predictable to the unexpected. This information is crucial for budgeting, making informed decisions about repairs vs. replacement, and understanding the long-term financial implications of your ride.

Breaking Down the Monthly Car Costs

When we're talking about monthly car costs, we need to look at two primary categories: fixed costs and variable costs. Fixed costs are expenses that stay relatively consistent each month, regardless of how much you drive. Variable costs, on the other hand, fluctuate depending on your usage.

Fixed Costs: Predictable Expenses

These are the costs you can generally anticipate each month, making them easier to budget for. Think of them as the base operating costs of owning the vehicle.

- Car Payment (Principal & Interest): This is the most obvious fixed cost. The amount you pay each month towards your loan, including both the principal (the amount borrowed) and the interest (the cost of borrowing). Your amortization schedule will break this down further.

- Car Insurance Premium: Your monthly insurance payment, providing coverage for accidents, theft, and other potential damages. The type and amount of coverage will greatly affect this cost. Things like collision, comprehensive, liability, and uninsured motorist coverage all play a role.

- Registration Fees: Annual registration fees, often paid monthly through escrow if you have a car loan, but sometimes paid directly to the DMV. These fees contribute to road maintenance and other state-related costs.

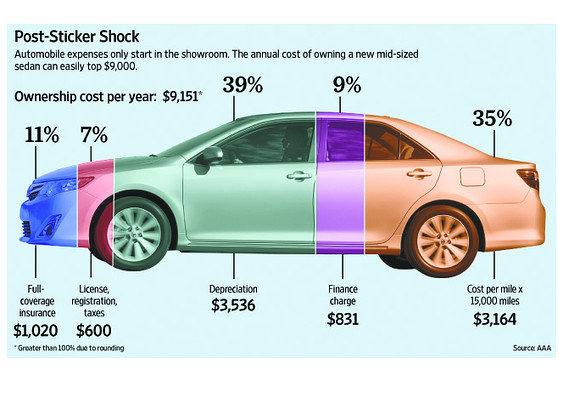

- Depreciation: Though not a direct cash outflow each month, depreciation is a crucial economic cost. It represents the decline in your car's value over time. While you don't write a check for it, it's a real cost that you need to consider, especially when planning to sell or trade in your vehicle.

Variable Costs: Usage-Dependent Expenses

These costs fluctuate based on how often and how far you drive. Keeping track of these can help you identify areas where you can potentially save money.

- Fuel Costs: The cost of gasoline or diesel. This is highly dependent on your driving habits, fuel efficiency (MPG), and the current price of fuel. Factors like aggressive driving, stop-and-go traffic, and using premium fuel when it's not required can significantly increase your fuel expenses.

- Maintenance: Routine maintenance like oil changes, tire rotations, filter replacements (air, fuel, cabin), and scheduled services. Proactive maintenance can prevent larger, more expensive repairs down the road. Follow your owner's manual's recommended maintenance schedule.

- Repairs: Unexpected repairs due to component failure, accidents, or wear and tear. This is the most unpredictable cost, but a well-maintained vehicle is less likely to require frequent repairs.

- Tires: The cost of replacing tires due to wear and tear. The lifespan of tires depends on driving habits, tire type, and road conditions. Proper inflation and regular rotations can extend tire life.

- Tolls & Parking: Any costs associated with toll roads, bridges, or parking fees. If you regularly commute through toll areas, these can add up significantly.

- Cleaning & Detailing: Costs associated with car washes, detailing services, and cleaning supplies. While not essential, keeping your car clean can help maintain its value and appearance.

Calculating Your Total Monthly Cost

To get a realistic picture of your monthly car expenses, you need to track both fixed and variable costs. Here's a practical approach:

- Track Your Expenses: Use a spreadsheet, budgeting app, or even a notebook to record all car-related expenses each month. Be meticulous and don't forget anything!

- Annualize Variable Costs: For variable costs like maintenance, repairs, and tires, estimate your annual spending and divide by 12 to get a monthly average. For instance, if you spend $600 on tires per year, that's $50 per month. Look back at your records from previous years for a more accurate estimate.

- Calculate Depreciation: Determine the annual depreciation of your car. This can be estimated using online depreciation calculators, resources like Kelley Blue Book, or by comparing your car's current market value to its value a year ago. Divide the annual depreciation by 12 to get a monthly estimate.

- Add It All Up: Sum up all your fixed and variable monthly costs to arrive at your total monthly cost of owning the car.

Real-World Use: Troubleshooting Your Budget

Once you have a handle on your monthly car costs, you can start identifying areas for potential savings. Here are a few troubleshooting tips:

- Fuel Efficiency: Monitor your MPG and try to improve your driving habits (avoiding aggressive acceleration and braking). Consider combining trips to reduce mileage. Ensure your tires are properly inflated, as underinflated tires can reduce fuel economy.

- Maintenance Schedule: Adhere to your vehicle's recommended maintenance schedule to prevent costly repairs. DIY as much maintenance as you're comfortable with (oil changes, filter replacements, etc.).

- Insurance Shopping: Periodically shop around for car insurance quotes to ensure you're getting the best rates. Consider increasing your deductible to lower your premium.

- Loan Refinancing: If you have a high interest rate on your car loan, explore refinancing options to potentially lower your monthly payments.

- DIY Repairs: If you're mechanically inclined, consider tackling some basic repairs yourself. Resources like YouTube, online forums, and repair manuals can be invaluable.

Safety Considerations for DIY Repairs

While DIY repairs can save money, safety should always be your top priority. Working on cars can be dangerous if you're not careful.

- Disconnect the Battery: Always disconnect the negative terminal of the battery before working on any electrical components. This prevents accidental shocks and shorts.

- Use Jack Stands: Never work under a car supported only by a jack. Always use sturdy jack stands placed on designated jacking points.

- Wear Safety Glasses: Protect your eyes from flying debris and fluids.

- Use Proper Tools: Use the correct tools for the job to avoid damaging components and injuring yourself.

- Consult Repair Manuals: Refer to a repair manual for detailed instructions and torque specifications.

- Be Aware of Hazardous Fluids: Engine oil, coolant, brake fluid, and other fluids can be hazardous. Wear gloves and dispose of them properly.

- Airbag Safety: Airbags can be extremely dangerous if deployed accidentally. Never attempt to repair or tamper with airbag systems without proper training. Disconnect the battery and wait at least 30 minutes before working near airbags. Consult a professional if necessary.

Important Note: Some repairs are best left to professionals. Working on critical systems like brakes, airbags, and complex engine components requires specialized knowledge and equipment. If you're unsure about your abilities, err on the side of caution and seek professional assistance.

Understanding the true cost of car ownership is a vital part of responsible vehicle management. By meticulously tracking your expenses, identifying areas for savings, and prioritizing safety when performing DIY repairs, you can keep your car running smoothly and your finances in order. Now you have a good understanding of the complexities involved, and you're empowered to manage your vehicle ownership expenses more effectively.