How Much Does Gap Coverage Cost

Let's talk about something that often gets overlooked when financing a vehicle: Guaranteed Asset Protection (GAP) insurance. It's not as glamorous as a turbocharger upgrade or a new set of rims, but GAP coverage can save you from a major financial headache. Think of it as a safety net for your auto loan, specifically designed to protect you if your car is totaled or stolen.

Purpose of Understanding GAP Coverage Costs

Understanding the cost of GAP insurance matters for several reasons. First and foremost, it allows you to make an informed decision about whether or not it's a worthwhile investment for your specific situation. Second, knowing the factors that influence the price can help you shop around and potentially negotiate a better deal. Finally, recognizing the terms and conditions of your GAP policy prevents surprises down the road should you need to file a claim.

Key Specs and Main Parts of GAP Insurance

GAP insurance is relatively straightforward in its function, but the nuances are in the details. Let's break down the key specs and components:

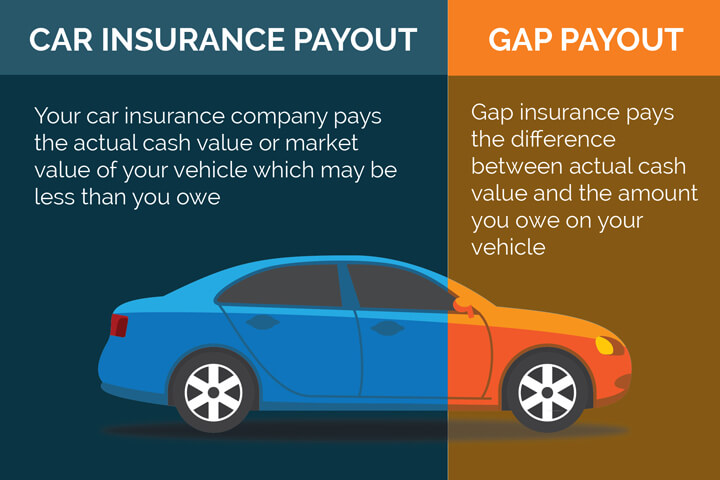

- Coverage Amount: This isn't a set number. GAP insurance covers the difference between your vehicle's actual cash value (ACV) at the time of loss and the outstanding balance on your auto loan. The bigger the gap between these two, the more valuable GAP coverage becomes.

- Policy Term: This is the duration of the GAP coverage, typically aligned with the length of your auto loan. Shorter loan terms might mean you need it less, and longer loans (where the car depreciates faster than you pay it off) might make it more necessary.

- Deductible: Some GAP policies have a deductible, similar to your regular auto insurance. A higher deductible will usually translate to a lower premium, but you'll have to pay more out-of-pocket in the event of a claim.

- Exclusions: GAP insurance isn't a catch-all. It usually doesn't cover things like:

- Late payment penalties: If you're behind on your loan, GAP won't cover the penalties.

- Carry-over balances from previous loans: Rolling over negative equity from a previous car loan into your new one won't be covered.

- Vehicle modifications or aftermarket parts: That sweet new exhaust system? GAP won't reimburse you for it.

- Refundable portions of extended warranties or service contracts: If you bought these along with the car, the refundable parts won't be covered.

- Premium: This is the price you pay for the GAP insurance. It can be a one-time fee added to your loan or a monthly premium included in your regular car payment.

Factors Influencing GAP Insurance Costs

The cost of GAP insurance isn't fixed; it varies depending on several factors:

- Vehicle Type: Newer cars, especially those with higher depreciation rates, often command higher GAP premiums. Luxury vehicles and SUVs, known for their rapid depreciation, can be prime examples.

- Loan Amount and Term: A larger loan amount and a longer loan term typically increase the risk for the GAP insurer, resulting in a higher premium. This is because you're likely to owe more on the car for a longer period.

- Down Payment: A larger down payment reduces the gap between the loan amount and the vehicle's initial value, potentially lowering the GAP premium. Conversely, a small or no down payment increases the risk and the premium.

- Interest Rate: A higher interest rate means you'll pay off the loan principal slower, potentially increasing the "gap" early in the loan term. This might lead to a slightly higher GAP premium.

- Credit Score: Similar to how your credit score affects your auto loan interest rate, it can also influence the cost of GAP insurance. Lower credit scores often translate to higher premiums.

- Lender or Provider: The source of your GAP insurance can significantly impact the price. Dealers often mark up GAP coverage, while credit unions or independent insurers may offer more competitive rates.

- State Regulations: Insurance regulations vary by state, which can affect the cost of GAP coverage.

How It Works: The Cost Calculation

While the exact formulas insurers use are proprietary, the underlying principle is based on risk assessment. The insurer tries to predict the likelihood and magnitude of a "gap" arising between the ACV of the vehicle and the loan balance. Here's a simplified illustration:

- Determine Vehicle Value: The insurer estimates the vehicle's depreciation rate based on factors like make, model, age, and historical depreciation data.

- Project Loan Balance: The insurer calculates the projected loan balance over the loan term, considering the interest rate and payment schedule.

- Assess the Gap Risk: The insurer compares the projected ACV and loan balance at various points in the loan term. The greater the potential difference between these values (the "gap"), the higher the risk.

- Factor in Overhead and Profit: The insurer adds its operating expenses, profit margin, and a risk buffer to arrive at the GAP premium.

It's crucial to remember that this is a simplified model. Actual calculations are more complex and involve sophisticated actuarial analysis.

Real-World Use: Comparing GAP Quotes and Evaluating Needs

So, how do you use this knowledge in the real world? Here are some basic troubleshooting tips:

- Shop Around: Don't just accept the GAP coverage offered by the dealership. Get quotes from your bank, credit union, or independent insurance providers.

- Compare Coverage Details: Carefully examine the policy terms and exclusions. Make sure the coverage amount is adequate and that the exclusions don't invalidate the policy for your specific circumstances.

- Negotiate: Dealers often have markup flexibility on GAP insurance. Don't be afraid to negotiate the price. Let them know you've gotten quotes from other sources.

- Consider Your Risk Tolerance: If you're making a large down payment, have a short loan term, and are confident in your driving record, you might be comfortable skipping GAP coverage. However, if you're putting little money down, have a long loan term, or live in an area prone to accidents, GAP coverage might be a worthwhile investment.

- Factor in Depreciation: Research the typical depreciation rate for your vehicle model. Cars that depreciate quickly are better candidates for GAP insurance.

Example: Let's say you purchase a new SUV for $40,000, finance the entire amount with a 72-month loan, and make a small down payment. The SUV depreciates quickly, losing 20% of its value in the first year. If the SUV is totaled after 12 months, you might owe $36,000 on the loan, but the insurance company only pays out the ACV of $32,000. GAP insurance would cover the $4,000 difference, saving you from a significant financial loss.

Safety: Understanding Policy Exclusions and Loan Agreements

While GAP insurance itself doesn't involve physical risks, it's crucial to understand the terms of your policy and loan agreement to avoid unexpected financial burdens. Pay close attention to the exclusions, especially those related to:

- Policy Lapses: If you fail to maintain comprehensive and collision insurance, your GAP coverage may be voided.

- Fraudulent Activities: Any fraudulent activity related to the vehicle or the loan will invalidate the GAP policy.

- Unauthorized Repairs: If you modify your vehicle without notifying the lender or GAP insurer (especially modifications that significantly alter the vehicle's value), your coverage might be affected.

Always keep your insurance and loan documents readily available and understand your responsibilities under both agreements.

Ultimately, the decision of whether or not to purchase GAP insurance is a personal one. By understanding the costs, benefits, and risks, you can make an informed choice that aligns with your individual financial situation and risk tolerance.