How Much Does Gap Insurance Pay

Let's talk about GAP insurance – Guaranteed Asset Protection. It's not the most glamorous topic, but understanding how it works can save you a boatload of money if the worst happens and your car is totaled or stolen. Think of this as preventive maintenance for your finances, a way to protect yourself from being underwater on your car loan. This isn't about horsepower or torque, but it's just as crucial to know about as the inner workings of your engine. This article will break down the key elements determining GAP insurance payouts, empowering you to understand how it works and what factors influence its value. We'll cover the technical aspects in a clear and accessible way, similar to how you'd approach a car repair manual.

Purpose of Understanding GAP Insurance Payouts

Why bother understanding the mechanics of GAP insurance payouts? Well, several reasons. Firstly, it empowers you to make informed decisions when purchasing a vehicle and associated insurance. You'll understand the risks and whether GAP insurance is a worthwhile investment for your specific circumstances. Secondly, in the unfortunate event of a total loss, this knowledge allows you to verify the insurance company's calculation and ensure you're receiving a fair settlement. Insurance companies aren't always right, and knowing how the formula works allows you to advocate for yourself. Finally, understanding GAP insurance helps you to manage your finances effectively and avoid potentially crippling debt.

Key Specs and Main Parts of a GAP Insurance Calculation

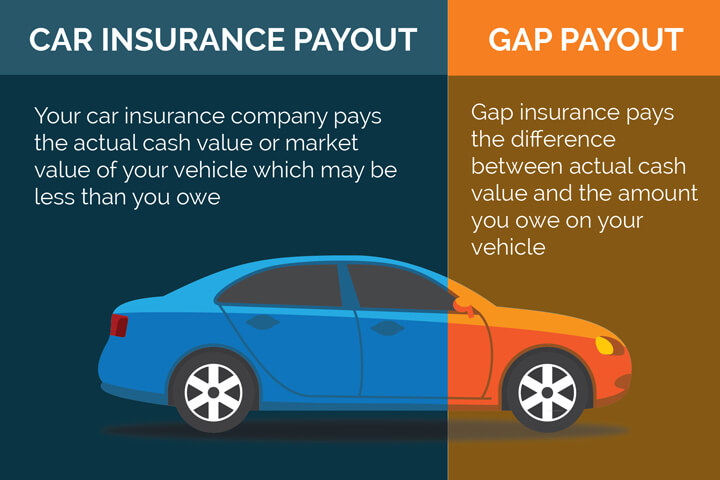

The GAP insurance payout is all about bridging the 'gap' between what you owe on your car loan and what your car is actually worth (its actual cash value or ACV). Here's a breakdown of the key components involved:

- Outstanding Loan Balance: This is the amount you still owe on your car loan at the time of the incident. This includes the principal, interest, and any other fees rolled into the loan. The more you owe, the larger the potential GAP insurance payout.

- Actual Cash Value (ACV): This is the market value of your vehicle immediately before it was totaled or stolen. Insurance companies typically use resources like the National Automobile Dealers Association (NADA) or Kelley Blue Book (KBB) to determine the ACV, taking into account the vehicle's make, model, year, mileage, condition, and options.

- Primary Insurance Settlement: This is the amount your primary auto insurance company pays out for the total loss. It represents the ACV, less your deductible.

- Deductible: This is the amount you have to pay out-of-pocket before your primary insurance coverage kicks in. It's subtracted from the ACV to determine the primary insurance settlement.

- GAP Insurance Coverage Limits: Most GAP insurance policies have coverage limits, both in terms of the maximum amount they'll pay out and the maximum Loan to Value (LTV) ratio they'll cover. We'll dive into LTV ratios shortly.

- Refundable Items: Some lenders and GAP policies will refund unearned portions of certain items like extended warranties or credit life insurance if the loan is paid off early via a GAP claim.

The basic GAP insurance formula is:

GAP Insurance Payout = Outstanding Loan Balance - Primary Insurance Settlement (ACV - Deductible) - Refunds (if any)

However, there are some nuances to this formula, so let's delve deeper.

Loan to Value (LTV) Ratio

The Loan to Value (LTV) ratio is a critical factor in determining whether you need GAP insurance and how much it might pay out. It's calculated as:

LTV = (Loan Amount) / (Vehicle Value)

If your LTV is high – meaning you borrowed a significant amount compared to the vehicle's value – you're at a higher risk of having a 'gap' between what you owe and what the car is worth. Factors that contribute to a high LTV include:

- Little or no down payment

- Long loan terms (e.g., 72 or 84 months)

- Rolling negative equity from a previous car loan into the new loan

- Adding optional features and accessories to the loan

Most GAP insurance policies have a maximum LTV ratio they'll cover. For example, a policy might state it covers LTVs up to 150%. If your LTV exceeds this limit at the time you purchased the car, the GAP insurance might not cover the entire gap, or even be invalidated completely.

Common Scenarios and Payout Examples

Let's walk through a couple of scenarios to illustrate how GAP insurance works:

Scenario 1: Modest Gap

- Outstanding Loan Balance: $20,000

- Actual Cash Value (ACV): $17,000

- Deductible: $500

- Primary Insurance Settlement: $16,500 ($17,000 - $500)

- GAP Insurance Payout: $20,000 - $16,500 = $3,500

Scenario 2: Significant Gap with Coverage Limits

- Outstanding Loan Balance: $30,000

- Actual Cash Value (ACV): $20,000

- Deductible: $1,000

- Primary Insurance Settlement: $19,000 ($20,000 - $1,000)

- GAP Insurance Policy Maximum Payout: $5,000

- GAP Insurance Payout: Limited to $5,000 (Even though the gap is $11,000, the policy limit is $5,000). You would be responsible for the remaining $6,000.

These examples highlight the importance of understanding the policy's coverage limits. Always read the fine print!

Real-World Use: Basic Troubleshooting Tips

If you find yourself needing to file a GAP insurance claim, here are some tips:

- Document everything: Keep copies of your loan agreement, insurance policy, and any communication with the insurance company.

- Verify the ACV: Research the ACV of your vehicle using multiple sources (NADA, KBB) and compare it to the insurance company's valuation. If there's a significant discrepancy, provide evidence to support your claim for a higher ACV.

- Check for Exclusions: GAP policies often have exclusions, such as unpaid late fees, extended warranties not purchased through the dealership, or aftermarket modifications not disclosed to the lender. Make sure you understand these exclusions and whether they apply to your situation.

- Act promptly: File your claim as soon as possible after the total loss. Many policies have deadlines for filing claims.

- Negotiate: Don't be afraid to negotiate with the insurance company if you believe their offer is unfair. Providing supporting documentation and a clear explanation of why you disagree can be effective.

Safety Considerations

While GAP insurance itself doesn't involve physical safety risks like working on your car's engine, there are financial risks to be aware of. Ensure that you obtain GAP insurance from a reputable source. Some less-than-scrupulous dealers may inflate the cost of GAP insurance or sell policies with limited coverage. Compare prices from different providers and read reviews before making a purchase. Furthermore, never rely solely on GAP insurance to protect yourself from financial hardship. Make a responsible down payment and choose a loan term that you can comfortably afford.

Understanding how GAP insurance works is critical. It's not a 'set it and forget it' type of coverage. It's something that requires your active participation and understanding to ensure you're adequately protected. Think of it as another tool in your financial toolkit, ready to be deployed when you need it most.

Remember, this information is for educational purposes only and should not be considered financial advice. Consult with a qualified insurance professional to determine the best coverage for your individual needs.