How Much Extra Is Gap Insurance

Let's dive into the world of Gap Insurance, a financial safety net that often gets overlooked but can be a lifesaver for car owners. Understanding how much extra it costs, and more importantly, how it works, is crucial, especially for those who've invested time and money into their vehicles. Think of this as understanding a crucial part of your vehicle’s overall protection system.

Purpose of Understanding Gap Insurance Costs

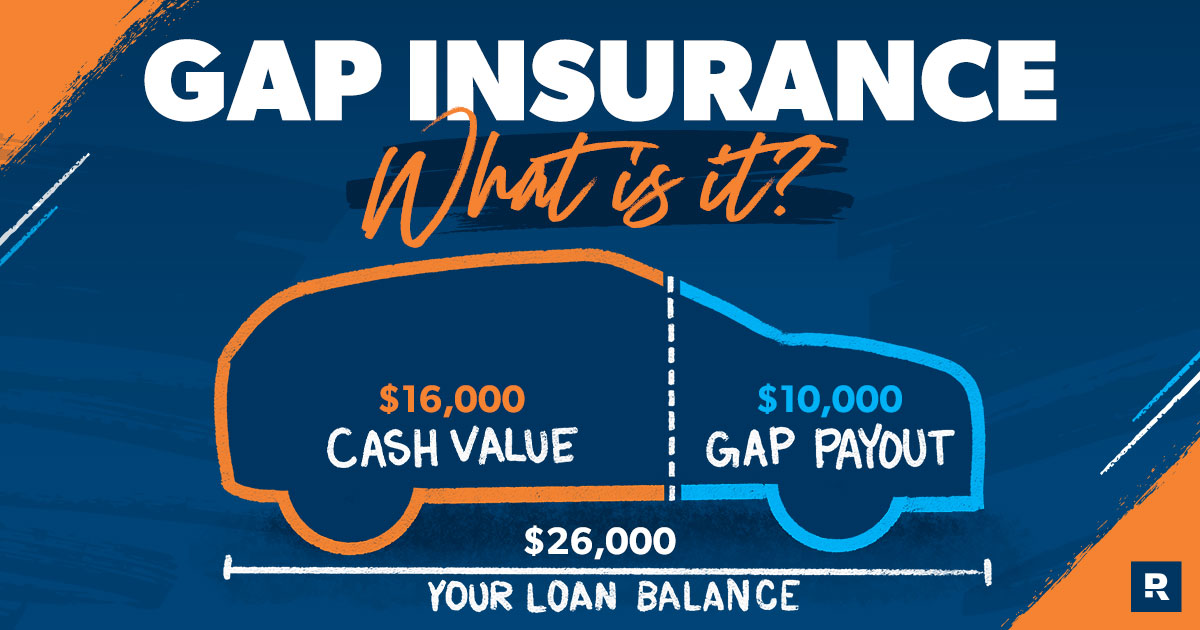

Why bother figuring out the intricacies of Gap Insurance costs? Simply put, knowledge is power. If your car is totaled or stolen, and you owe more on your loan or lease than the vehicle is worth, you're on the hook for the difference. This difference is the "gap" that Gap Insurance covers. Understanding the cost helps you determine if this protection is a worthwhile investment for your specific situation.

Key Specs and Main Parts of a Gap Insurance Calculation

Calculating the “extra” cost of Gap Insurance involves several key components. Let’s break them down:

- Vehicle's Actual Cash Value (ACV): This is the fair market value of your vehicle at the time of a total loss. Insurance companies determine this by considering factors like the vehicle's age, mileage, condition, and comparable sales data. Think of it as what someone would realistically pay for your car on the open market.

- Loan/Lease Balance: This is the outstanding amount you still owe to the lender or leasing company. This balance depreciates over time, but often slower than the vehicle's ACV in the early years of ownership.

- Gap Amount: The difference between the Loan/Lease Balance and the Vehicle's ACV. This is the amount Gap Insurance is designed to cover.

For example, if you owe $20,000 on your car loan and the car is only worth $15,000, the gap is $5,000.

- Gap Insurance Premium: This is the amount you pay for the Gap Insurance coverage itself. It can be a one-time fee rolled into your loan or lease, or a recurring payment added to your auto insurance premium.

- Deductible (if applicable): Some Gap Insurance policies have a deductible, similar to your collision or comprehensive coverage. This is the amount you'll pay out-of-pocket before the Gap Insurance kicks in.

Factors Influencing Gap Insurance Cost

Several factors influence how much Gap Insurance will cost:

- Vehicle Type: Newer vehicles, particularly those that depreciate quickly, often have higher Gap Insurance premiums. Luxury cars and vehicles with specialized modifications can also influence the cost.

- Loan/Lease Term: Longer loan or lease terms typically result in higher Gap Insurance costs because the "gap" is likely to be larger for a longer period.

- Down Payment: A larger down payment reduces the initial Loan/Lease Balance, thereby decreasing the potential "gap" and potentially lowering the Gap Insurance premium.

- Interest Rate: A higher interest rate means you'll be paying more towards interest, which slows down the reduction of your Loan/Lease Balance, potentially increasing the gap.

- Insurance Provider: Different insurance companies have different pricing models. Shopping around is crucial to find the best rate. Consider both dealerships and your existing auto insurance provider.

Symbols and Calculations

While there aren't specific symbols in the traditional sense like you'd find in a wiring diagram, let's think of it this way:

- ACV (V): Actual Cash Value of Vehicle

- LB (L): Loan/Lease Balance

- G: Gap Amount (G = L - V)

- P: Gap Insurance Premium

- D: Deductible (if applicable)

The core calculation is simple: G = L - V. The extra cost is essentially the P (premium), but you need to weigh this against the potential risk of G. A higher G justifies a higher willingness to pay for P, within reason. Deductibles (D) lower premium (P) but raise your out-of-pocket responsibility.

How It Works: The Gap Insurance Process

The process typically works like this:

- Total Loss: Your vehicle is declared a total loss due to an accident, theft, or other covered event.

- Insurance Claim: Your primary auto insurance provider pays out the Vehicle's ACV.

- Gap Insurance Claim: If the ACV is less than your Loan/Lease Balance, you file a claim with your Gap Insurance provider.

- Gap Payment: The Gap Insurance provider pays the difference (the "gap") up to the policy's limit, minus any deductible.

Important Note: Gap Insurance usually only covers the "gap" itself and may not cover items like overdue payments, security deposits, or extended warranties. Review your policy carefully.

Real-World Use: Troubleshooting and Decision Making

Here are some troubleshooting tips to help you make an informed decision about Gap Insurance:

- Get Multiple Quotes: Shop around for Gap Insurance from different providers to compare prices.

- Negotiate with the Dealer: If purchasing Gap Insurance through the dealership, don't be afraid to negotiate the price. Often, they have significant markup.

- Calculate Your Risk: Consider your vehicle's depreciation rate and the length of your loan or lease term to assess your potential "gap" risk. Use online car value estimators to get an idea of your vehicle's ACV.

- Read the Fine Print: Understand the terms and conditions of your Gap Insurance policy, including any exclusions or limitations.

- Consider Your Financial Situation: If you can easily afford to pay the "gap" out of pocket if your car is totaled, Gap Insurance might not be necessary.

Example: You purchase a car for $30,000, make a $3,000 down payment, and finance the remaining $27,000. After one year, the car is totaled. The insurance company determines the ACV is $22,000. You still owe $24,000 on the loan. The gap is $2,000. With Gap Insurance, you only pay the deductible (if applicable), and the Gap Insurance covers the $2,000.

Safety Considerations

While Gap Insurance itself doesn't pose any physical safety risks, ignoring it can lead to financial hardship. Be sure to consider it a vital part of your overall vehicle safety plan.

The "risky component" is assuming your car will retain its value, or that you'll be able to easily cover the difference if it doesn't. This assumption can be costly.

Important Considerations

It's also worth considering that some insurance companies offer "new car replacement" coverage, which essentially provides similar protection to Gap Insurance for a certain period (e.g., the first year or two of ownership). This coverage might be a more cost-effective alternative.

Finally, remember that Gap Insurance is only beneficial if you experience a total loss. If you keep your car for the entire loan or lease term, you won't need it. However, the peace of mind it provides can be worth the cost, especially if you're concerned about depreciation or have a long loan term.

Hopefully, this detailed explanation helps you understand the nuances of Gap Insurance costs. Weigh the factors specific to your situation, shop around, and make an informed decision to protect yourself financially.