How Much Is A 20000 Car Payment

Alright, let's talk about that 20,000 car payment. You're probably thinking it's just a number, but understanding the anatomy of that payment – the interest, the principal, the amortization schedule – is crucial for everything from budgeting and refinancing to making informed decisions about early payoffs and even potential vehicle modifications down the line. Knowledge is power, especially when it comes to your finances.

The Purpose: Why Deconstructing Your Car Payment Matters

You might ask, "Why do I need to understand all this? I just make the payment every month." That's a fair point, but digging deeper offers several advantages:

- Refinancing: Knowing your current interest rate and principal balance allows you to effectively shop around for a better deal. A lower interest rate, even by a small margin, can save you thousands over the loan's lifetime.

- Early Payoff Strategies: Understanding how your payment is structured lets you strategically make extra payments, targeting the principal to accelerate your payoff and minimize interest paid. This can be a significant benefit if you're planning on selling or trading in your vehicle sooner than originally anticipated.

- Budgeting & Financial Planning: A clear picture of your car payment, including insurance and maintenance costs, is essential for creating a realistic budget. This information informs other financial decisions, like investing or saving for a down payment on a house.

- Trade-In Value Prediction: Knowing the current book value (what your car is worth based on market data) versus your remaining loan balance gives you a realistic estimate of your equity – or potential losses – when considering a trade-in.

- Negotiating Power: Having a firm grasp of the numbers involved in your car loan gives you more negotiating leverage with dealerships, lenders, and even insurance companies.

Key Specs and Main Parts of a Car Loan

Let's break down the components of your car loan. Think of it like taking apart an engine – you need to know the function of each piece to understand the whole.

Principal

The principal is the original amount of money you borrowed to purchase the car. In your case, it's $20,000. This is the base amount upon which interest is calculated.

Interest Rate

The interest rate is the percentage the lender charges you for borrowing the money. It's typically expressed as an Annual Percentage Rate (APR). For example, a 6% APR means you'll pay 6% of the outstanding principal each year as interest. This is the cost of borrowing.

Loan Term

The loan term is the length of time you have to repay the loan, usually expressed in months. Common car loan terms are 36, 48, 60, and 72 months. A longer term means lower monthly payments, but you'll pay more interest overall. Conversely, a shorter term means higher monthly payments, but you'll pay less interest. This is the duration of the loan.

Monthly Payment

The monthly payment is the fixed amount you pay each month to cover both the principal and interest. This payment is calculated using a formula (explained below) to ensure the loan is fully repaid within the specified term.

Amortization Schedule

The amortization schedule is a table that shows how much of each monthly payment goes towards the principal and how much goes towards interest. In the early months, a larger portion of your payment goes towards interest. As you get closer to the end of the loan term, a larger portion goes towards the principal. Understanding this schedule is key to making informed decisions about early payoffs. Think of it as the roadmap for your loan repayment.

Understanding the Payment Calculation

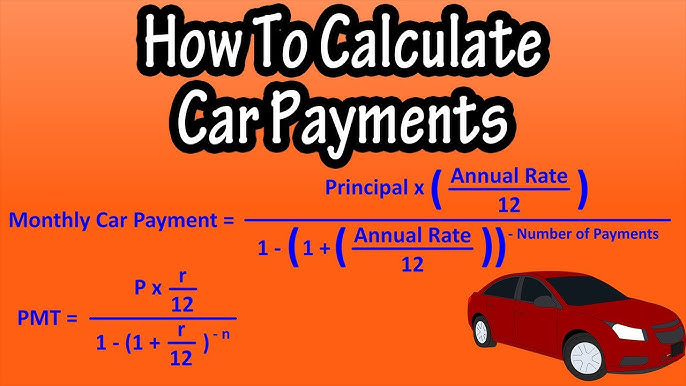

The formula for calculating your monthly car payment (M) is as follows:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- P = Principal loan amount ($20,000 in your case)

- i = Monthly interest rate (annual interest rate divided by 12)

- n = Number of months in the loan term

While the formula looks complex, there are plenty of online calculators that can do the math for you. Just plug in your principal, interest rate, and loan term to calculate your monthly payment.

Real-World Use: Basic Troubleshooting and Optimization

Let's say you're thinking about modifying your car – maybe adding a supercharger or upgrading the suspension. Before you drop a bunch of cash on modifications, it's wise to assess your financial situation. Here's how:

- Calculate your current loan balance: Check your loan statement online or call your lender to find out the exact amount you still owe on the car.

- Determine your car's current market value: Use resources like Kelley Blue Book or Edmunds to estimate the trade-in value of your vehicle. This gives you an idea of your equity (or lack thereof).

- Evaluate your debt-to-income ratio: This is the percentage of your monthly income that goes towards paying off debts, including your car loan. A high debt-to-income ratio could make it difficult to afford modifications and potentially lead to financial stress.

- Consider the impact of modifications on insurance: Some modifications can increase your insurance premiums. Check with your insurance company to see how the planned modifications will affect your rates.

Troubleshooting Scenario: You find that your car's value is significantly less than your remaining loan balance (you're upside down on the loan). In this situation, modifying the car might not be the best idea, as you'll be further underwater. Instead, focus on paying down the principal to build equity before making any significant changes.

Safety Considerations

While understanding your car payment isn't inherently dangerous, ignoring it can lead to financial risks. Here are some potential pitfalls:

- Defaulting on your loan: Failure to make timely payments can result in late fees, damage to your credit score, and even repossession of your vehicle.

- Overspending: Not understanding your budget can lead to overspending on non-essential items, leaving you struggling to make your car payment and other bills.

- Ignoring the fine print: Always read the terms and conditions of your car loan carefully. Pay attention to any penalties for early payoff or other hidden fees.

We've Got the Diagram (or rather, the Amortization Table)

Hopefully, this article has provided some useful insights into the anatomy of your car payment. To help you further visualize and understand the amortization schedule for your specific $20,000 loan (with varying interest rates and loan terms), we've prepared a sample amortization table. It's a spreadsheet showing how each monthly payment breaks down into principal and interest, along with the remaining loan balance. Contact us, and we will send you a link to download it. You can input your specific interest rate and loan term to see a customized breakdown.