How Much Is A 30000 Car Payment

So, you’re staring down the barrel of a $30,000 car payment, huh? Let's break down what that actually means in terms of monthly cost, interest, and the overall impact on your wallet. This isn’t just about plugging numbers into an online calculator; it’s about understanding the mechanics behind car loans, similar to how you'd understand the mechanics of your engine. Knowing these details is crucial, whether you're negotiating a price, planning modifications, or just managing your finances responsibly.

Understanding the Car Loan Landscape

Before we dive into the nitty-gritty, let's establish a few fundamental concepts. We're talking about an amortizing loan, meaning each monthly payment covers both principal (the original $30,000) and interest (the lender's profit). The interest rate is the percentage the lender charges you for borrowing the money. The loan term is the length of time you have to repay the loan, usually expressed in months (e.g., 60 months, 72 months).

Purpose: Understanding how car loans are structured allows you to make informed decisions. This knowledge empowers you to negotiate better rates, choose optimal loan terms, and ultimately save money over the life of the loan. It's as important as understanding torque specs when rebuilding an engine – knowing the details ensures a successful outcome.

Key Specs and Main Parts of a Car Loan Calculation

Here are the key elements that determine your monthly payment:

- Principal (P): The initial loan amount. In our case, $30,000.

- Interest Rate (r): The annual interest rate, expressed as a decimal (e.g., 6% becomes 0.06). This is usually provided by the lender.

- Loan Term (n): The number of months you have to repay the loan. A longer term means smaller monthly payments but more interest paid overall.

The mathematical relationship between these elements is defined by the loan amortization formula.

The Loan Amortization Formula

The formula to calculate your monthly payment (M) is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount ($30,000)

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Number of Months (Loan Term)

Let's break this down into smaller, more digestible chunks.

Example: Let's assume an interest rate of 6% (0.06 annually, or 0.005 monthly) and a loan term of 60 months.

Plugging these values into the formula, we get:

M = 30000 [ 0.005(1 + 0.005)^60 ] / [ (1 + 0.005)^60 – 1]

Solving this equation (you'll likely want a calculator or spreadsheet for this), we find that M ≈ $579.99.

Understanding the Variables and Their Impact

Interest Rate: Even a small change in the interest rate can significantly affect your monthly payment and the total interest paid. A higher interest rate will result in a higher monthly payment and more interest paid over the life of the loan.

Loan Term: A longer loan term (e.g., 72 months instead of 60) reduces your monthly payment, making it more affordable in the short term. However, you'll pay significantly more in interest over the longer period. A shorter term (e.g., 48 months) increases your monthly payment but saves you money on interest.

Real-World Use: Troubleshooting and Optimization

Scenario 1: Unaffordable Monthly Payment: If the calculated monthly payment is too high for your budget, you have several options:

- Negotiate a lower price: Reducing the principal (P) directly lowers the monthly payment.

- Shop for a lower interest rate: Even a small reduction in the interest rate can make a difference.

- Extend the loan term: Be mindful of the increased total interest paid.

- Increase your down payment: This also reduces the principal (P).

Scenario 2: Comparing Loan Offers: Don't just focus on the monthly payment. Look at the Annual Percentage Rate (APR), which includes all loan costs (fees, etc.), and the Total Cost of the Loan (all payments made over the loan term). These metrics provide a more accurate comparison of different loan offers.

Safety: Potential Financial Hazards

Just like working on a car, handling finances involves risks. Here are some things to watch out for:

- Predatory Lending: Avoid lenders offering extremely high interest rates or unfavorable terms. These can lead to a cycle of debt.

- Overextending Yourself: Don't take on a car loan that stretches your budget too thin. Factor in other expenses like insurance, maintenance, and fuel.

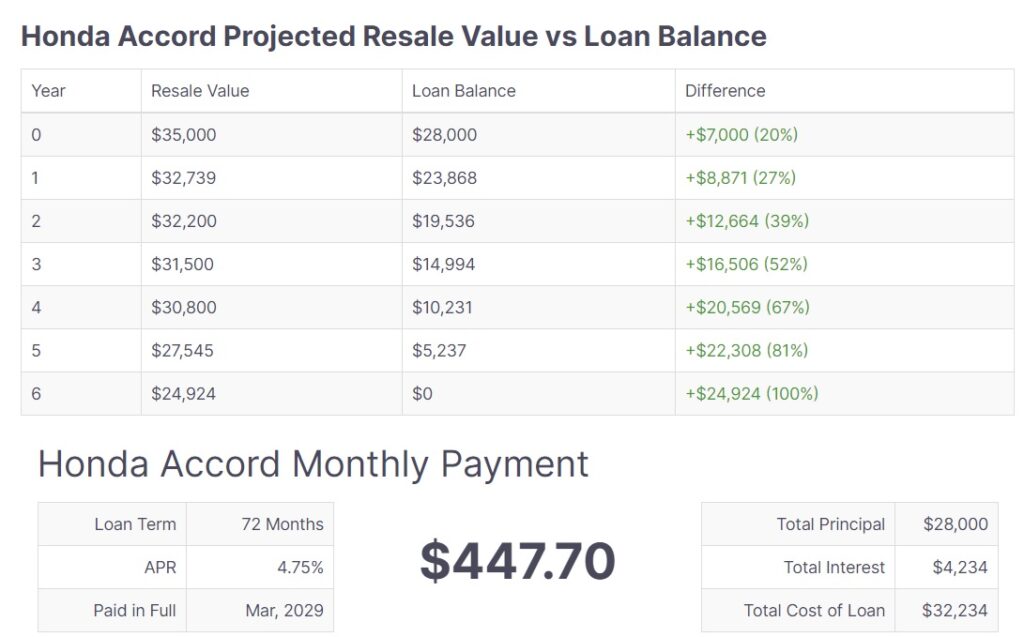

- Negative Equity: If you owe more on your car than it's worth, you're in a negative equity situation. This can be problematic if you need to sell or trade in your car. This happens more often if you have a long loan term and the car depreciates quickly.

Beyond the Basics: The Time Value of Money

Understanding the time value of money can help you make even smarter financial decisions. Simply put, money today is worth more than the same amount of money in the future, due to its potential earning capacity. By paying off your car loan faster (making extra payments, for example), you not only save on interest but also free up cash flow sooner, which you can then invest or use for other financial goals.

In conclusion, understanding the mechanics of a car loan, and especially calculating your $30,000 car payment, is essential for making informed decisions. By understanding the amortization formula and the impact of interest rates and loan terms, you can optimize your loan to fit your budget and financial goals. Just like diagnosing a complex engine problem, a little bit of knowledge can go a long way.