How Much Is A 60000 Car Payment

Let's break down what a $60,000 car payment actually entails. This isn't about a single number; it's about understanding the underlying factors that contribute to that final monthly bill. We're diving into the financial mechanics, much like you'd dive under the hood of your car, to understand the relationship between loan amount, interest, term length, and how these interplay to create your payment.

Purpose: Decoding Your Car Payment

Understanding the components of your car payment is crucial for several reasons:

- Budgeting and Financial Planning: Knowing where your money goes allows you to plan your finances effectively, potentially identifying areas for savings.

- Negotiation Power: Armed with knowledge, you can negotiate better loan terms with lenders, potentially saving thousands of dollars over the life of the loan.

- Refinancing Opportunities: Understanding your loan terms helps you identify when refinancing might be beneficial, especially if interest rates drop.

- Early Payoff Strategies: Recognizing the principal and interest portions allows you to devise strategies for paying off the loan faster and minimizing interest paid.

- Understanding the Loan Agreement: Car loans are complex documents. This breakdown helps you decipher the fine print and avoid potential pitfalls.

Key Specs and Main Parts of a Car Loan

The final car payment is a product of these factors working together. The main ingredients are:

- Principal Loan Amount (P): In this case, $60,000. This is the initial amount borrowed to purchase the vehicle.

- Annual Interest Rate (r): Expressed as a percentage (e.g., 6%). This is the cost of borrowing the money, usually expressed per year. Lower interest rates translate to lower monthly payments and less total interest paid over the life of the loan.

- Loan Term (n): The length of the loan, usually expressed in months (e.g., 60 months or 5 years). Shorter loan terms result in higher monthly payments but less total interest paid, while longer terms result in lower monthly payments but more total interest paid.

- Monthly Payment (M): The fixed amount you pay each month, which includes both principal and interest. This is what we're trying to calculate and understand.

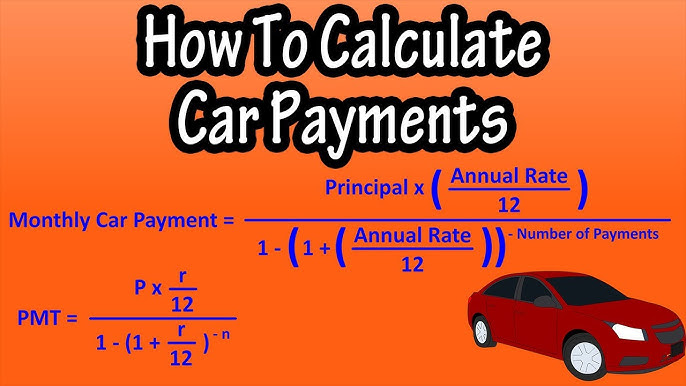

The relationship between these is captured in a standard loan amortization formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount ($60,000)

- i = Monthly interest rate (annual interest rate / 12) (r/12)

- n = Number of months (loan term)

Let's illustrate this with an example. Imagine an annual interest rate (r) of 6% and a loan term (n) of 60 months (5 years). First, we need to find the monthly interest rate (i):

i = 6% / 12 = 0.06 / 12 = 0.005

Now we can plug these values into the formula:

M = 60000 [ 0.005(1 + 0.005)^60 ] / [ (1 + 0.005)^60 – 1]

Calculating this results in a monthly payment (M) of approximately $1,159.98.

Beyond the Basic Calculation

It's also important to consider other factors that can influence the final amount you pay each month:

- Sales Tax: This is a percentage of the vehicle's purchase price that is added to the loan amount.

- Title and Registration Fees: These are fees charged by the state for registering the vehicle in your name.

- Dealer Fees: These can include documentation fees, preparation fees, and other charges that the dealer adds to the price of the vehicle. These are often negotiable.

- Gap Insurance: This insurance covers the difference between the loan balance and the vehicle's actual cash value if the vehicle is totaled.

- Extended Warranty: This warranty covers repairs beyond the manufacturer's warranty period.

- Down Payment: A larger down payment reduces the principal loan amount, leading to lower monthly payments and less total interest paid.

How It Works: The Amortization Schedule

The amortization schedule breaks down each monthly payment into the portions allocated to principal and interest. Initially, a larger portion of the payment goes toward interest, and a smaller portion goes toward principal. As the loan progresses, this ratio gradually shifts, with more of each payment going toward principal and less toward interest.

Understanding the amortization schedule helps you visualize how your loan is being paid down and allows you to make informed decisions about prepaying the loan. By making extra payments, even small ones, you can significantly reduce the total interest paid and shorten the loan term.

Real-World Use: Troubleshooting Your Payment

Let's say you've noticed your payment is higher than you expected. Here's a basic troubleshooting approach:

- Verify the Loan Agreement: The first step is to carefully review your loan agreement to confirm the principal loan amount, interest rate, loan term, and any other fees included in the loan.

- Check for Errors: Look for any discrepancies between the loan agreement and the actual payment. Were there any unexpected fees added? Did the interest rate change at the last minute?

- Calculate the Payment Yourself: Use the formula mentioned above to calculate the monthly payment based on the loan terms in the agreement. If the calculated payment differs significantly from the actual payment, contact the lender to inquire about the discrepancy.

- Consider Prepayment Options: If your budget allows, consider making extra payments toward the principal. Many lenders offer prepayment options, but it's important to check for any prepayment penalties.

- Refinancing: If interest rates have dropped since you took out the loan, consider refinancing to a lower rate. This can save you thousands of dollars over the life of the loan.

Safety: Understanding the Risks

The most significant risk associated with a car loan is defaulting on the loan. If you fail to make your payments, the lender can repossess the vehicle. Repossession can severely damage your credit score, making it difficult to obtain future loans or credit.

Another risk is becoming upside down on the loan, meaning that the vehicle is worth less than the outstanding loan balance. This can happen if the vehicle depreciates rapidly or if you financed a large portion of the purchase price. If you need to sell the vehicle, you may have to come up with the difference between the sale price and the loan balance.

Always borrow within your means. Accurately assess your budget and ensure you can comfortably afford the monthly payments before taking out a car loan.

Conclusion

Understanding how your $60,000 car payment is calculated empowers you to make informed financial decisions. By understanding the principal, interest rate, loan term, and amortization schedule, you can negotiate better loan terms, explore refinancing options, and develop strategies for paying off the loan early. This knowledge gives you the control to master your finances and avoid potential pitfalls. We have put together a downloadable spreadsheet you can use to calculate your own potential car payments and generate an amortization schedule. It can be a useful tool in your car buying process.