How Much Is A Car Note

Okay, let's talk about something that hits every car owner right in the wallet: your car note. Understanding how much that piece of paper really represents is crucial, whether you're just starting out or looking to upgrade. This isn't just about the sticker price; it's about the whole financial ecosystem surrounding your vehicle.

Purpose: Decoding the Real Cost of Your Ride

Why does understanding your car note matter, especially for a DIYer like yourself? Because it's the foundation for making informed decisions about your vehicle. Think of it as a financial blueprint. It helps you:

- Estimate Total Cost of Ownership: Beyond the monthly payment, you'll factor in insurance, maintenance, fuel, and potential repairs.

- Plan for Resale Value: Knowing your loan terms and how quickly you're paying down the principal can influence when and how you sell or trade in your car.

- Identify Refinancing Opportunities: Lower interest rates could save you thousands over the life of the loan.

- Budget Effectively: A clear understanding of your car payment allows you to allocate funds for other expenses, including those sweet aftermarket upgrades you've been eyeing.

Key Specs and Main Parts: The Anatomy of a Car Loan

A car loan, at its core, is a financial product. Let's break down the key components:

- Principal: This is the initial amount you borrow to purchase the vehicle.

- Interest Rate (APR): The Annual Percentage Rate is the cost of borrowing money, expressed as a yearly percentage. It's crucial to shop around for the best APR because even a small difference can significantly impact your total repayment.

- Loan Term: The length of time you have to repay the loan, usually expressed in months (e.g., 36, 48, 60, 72 months). Shorter terms mean higher monthly payments but lower overall interest paid. Longer terms mean lower monthly payments but higher overall interest paid.

- Monthly Payment: The fixed amount you pay each month to the lender. This covers both principal and interest.

- Down Payment: The amount of money you pay upfront toward the purchase of the vehicle. A larger down payment reduces the loan principal, lowering your monthly payments and overall interest paid.

- Fees: Various fees may be associated with the loan, such as origination fees, documentation fees, and early repayment penalties. Always read the fine print!

The relationship between these parts is governed by a mathematical formula called an amortization schedule. This schedule details how each payment is allocated between principal and interest over the loan term.

Symbols: The Language of Loan Documents

While not exactly 'symbols' in the traditional sense of a wiring diagram, loan documents use specific terminology that can seem like a foreign language. Let's decipher some common terms:

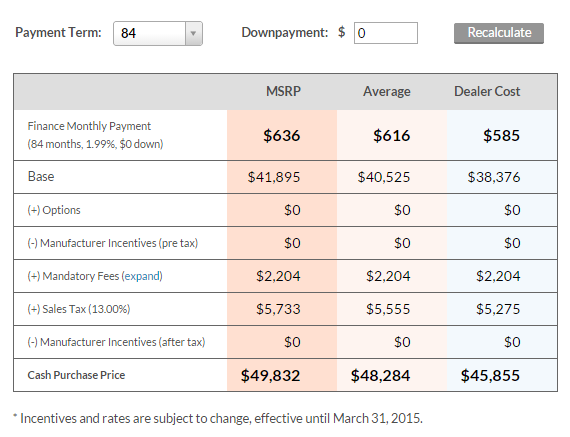

- MSRP: Manufacturer's Suggested Retail Price - the price recommended by the car manufacturer. It's a starting point for negotiation, not a fixed price.

- Invoice Price: The price the dealer pays to the manufacturer for the vehicle. While you likely won't get this price directly, it's a valuable benchmark.

- Residual Value: The estimated value of the vehicle at the end of the lease term (if you're considering a lease).

- GAP Insurance: Guaranteed Auto Protection insurance covers the difference between the outstanding loan balance and the vehicle's actual cash value if the car is totaled or stolen. This is particularly important if you put little to no money down.

- Credit Score: A numerical representation of your creditworthiness. A higher credit score usually translates to a lower interest rate.

How It Works: The Mechanics of a Car Loan

The core of a car loan is the amortization process. Each month, a portion of your payment goes towards the principal, and the remainder goes towards the interest. In the early stages of the loan, a larger percentage of your payment goes towards interest. As you progress through the loan term, more of your payment is applied to the principal.

You can use online car loan calculators to experiment with different loan terms, interest rates, and down payments to see how they impact your monthly payments and overall cost. These calculators use the following formula (or a variation of it) to calculate the monthly payment:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1] Where: M = Monthly Payment P = Principal Loan Amount i = Monthly Interest Rate (Annual Rate / 12) n = Number of Payments (Loan Term in Months)

Real-World Use: Troubleshooting Your Loan

Let's say you're a few years into your loan and wondering if you can improve your situation:

- High Interest Rate: Check your credit score. If it has improved significantly since you took out the loan, consider refinancing with a different lender to secure a lower interest rate.

- Struggling to Make Payments: Contact your lender immediately. They may be able to offer temporary solutions, such as deferment or forbearance. Ignoring the problem will only lead to late fees and damage your credit score. Also, re-evaluate your budget. Can you cut back on other expenses to free up more cash for your car payment?

- Considering an Upgrade: Determine your car's trade-in value and compare it to your remaining loan balance. If you're underwater (owe more than the car is worth), you'll need to factor that negative equity into your new loan.

Safety: Avoiding Financial Hazards

Just like working on your car's engine, dealing with car loans requires caution. Here are some potential financial hazards to watch out for:

- Predatory Lending: Be wary of lenders who offer loans with extremely high interest rates or hidden fees. Always read the fine print and compare offers from multiple lenders.

- Upselling Add-ons: Dealers may try to sell you unnecessary add-ons, such as extended warranties or paint protection. Evaluate whether these products are truly worth the cost.

- Overextending Yourself: Don't buy more car than you can afford. Factor in all the associated costs of ownership, not just the monthly payment.

- Skipping Payments: Missing payments can have severe consequences, including late fees, a damaged credit score, and even repossession of your vehicle.

Taking out a car loan is a major financial decision. By understanding the key specs, how it works, and potential pitfalls, you can make informed choices and avoid costly mistakes. Treat this loan with the same respect and attention to detail you give to any mechanical repair!

We have a detailed amortization schedule template and a car loan calculation spreadsheet available for download to further assist you in understanding the financial aspects of your car loan. It's a valuable tool for planning and managing your automotive finances.