How Much Is A Car Note Per Month

Alright, let's talk about something that affects nearly every car owner: the monthly car payment, or "car note" as it's commonly called. Figuring out *how much that car note is per month* isn't just about looking at the sticker price. It's a calculation based on several key factors, and understanding those factors empowers you to make informed decisions, negotiate effectively, and potentially save a significant amount of money over the life of your loan. Think of this article as your technical manual for understanding your car payment.

Purpose: Decoding Your Monthly Car Payment

Why should you, as an experienced DIYer or car enthusiast, care about how your car payment is calculated? Simple. Understanding the components of your car note allows you to:

- Negotiate Better Deals: Knowing how interest rates and loan terms affect your monthly payment puts you in a stronger position at the dealership.

- Plan Your Budget: A clear understanding helps you budget effectively and avoid financial strain.

- Identify Refinancing Opportunities: Spotting a high interest rate early allows you to explore refinancing options.

- Calculate Total Cost of Ownership: Go beyond the initial purchase price to understand the true cost of your vehicle.

Key Specs and Main Parts of the Car Loan Calculation

The monthly car payment is primarily determined by the following four elements:

- Principal (P): This is the amount of money you borrow. It's the car's price minus any down payment, trade-in value, or rebates.

- Annual Interest Rate (r): This is the percentage the lender charges you for borrowing the money. It's crucial to understand that a seemingly small difference in interest rate can significantly impact your total cost. This rate is almost always expressed as an Annual Percentage Rate (APR).

- Loan Term (n): This is the length of the loan, expressed in months (e.g., 60 months for a 5-year loan). Longer terms mean lower monthly payments but higher total interest paid.

- Monthly Payment (M): This is the amount you pay each month. It's the figure we're ultimately trying to determine.

These elements are related through a standard loan amortization formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where 'i' is the monthly interest rate (r/12). Yes, it looks intimidating, but it's the core formula. Let's break it down further.

Understanding the Formula

The formula is based on the concept of amortization. Amortization is the process of paying off a loan over time through regular installments. Each payment includes a portion of the principal and a portion of the interest. In the early stages of the loan, a larger portion of your payment goes towards interest, while later in the loan, a larger portion goes towards principal.

- P (Principal): As mentioned before, this is the initial amount borrowed. A larger principal naturally results in a higher monthly payment.

- i (Monthly Interest Rate): The annual interest rate (r) is divided by 12 to get the monthly interest rate. This is critical for accurate calculation. A higher interest rate dramatically increases the monthly payment.

- n (Number of Payments): This is the total number of payments you'll make over the loan term. A longer loan term (higher 'n') spreads out the payments, reducing the monthly amount, but substantially increasing the total interest paid over the life of the loan.

While you can calculate this by hand (with a good calculator!), online loan calculators are readily available and far more convenient.

Real-World Use: Troubleshooting Your Car Payment

Here are some common scenarios where understanding these calculations can be invaluable:

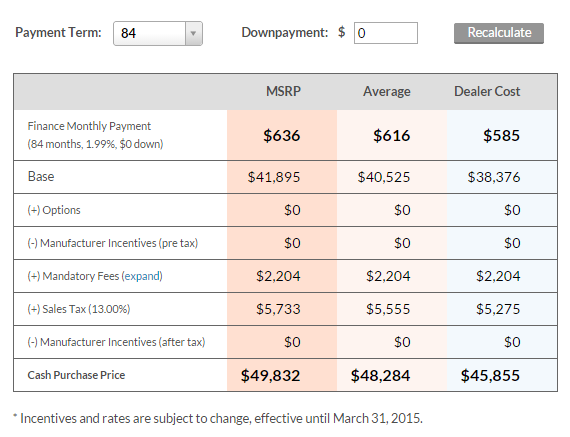

- "My payment is higher than I expected!" Double-check the interest rate and loan term on your loan agreement. Lenders sometimes make errors (rare, but it happens!). Also, factor in taxes, title, and registration fees; these are often rolled into the loan.

- "Can I afford a more expensive car?" Plug different car prices (principal amounts) into a loan calculator, using your expected interest rate and loan term, to see how it affects your monthly payment.

- "Should I refinance?" Compare the interest rate on your current loan to current market rates. If you can secure a lower rate, refinancing might save you a significant amount of money. Be sure to calculate any refinancing fees to ensure the savings outweigh the costs.

- "Should I make extra payments?" Absolutely! Even small extra payments each month can significantly reduce the total interest paid and shorten the loan term. This is because extra payments go directly towards reducing the principal.

Key Considerations & Hidden Costs

Beyond the core loan calculation, be aware of these additional factors:

- Sales Tax: Varies by state and can add a significant amount to the total purchase price, impacting the principal of your loan.

- Fees: Dealerships often tack on various fees, such as documentation fees, processing fees, and destination charges. Negotiate these down whenever possible.

- Insurance: You'll need car insurance, and the cost can vary depending on your driving record, location, and the type of coverage you choose. Factor this into your monthly budget.

- Maintenance and Repairs: Budget for regular maintenance (oil changes, tire rotations, etc.) and potential unexpected repairs. This is especially important for older vehicles.

- Depreciation: Cars depreciate in value over time. Consider this when deciding how much to spend on a vehicle.

- Gap Insurance: If you put little or no money down, consider Gap Insurance. This covers the "gap" between what you owe on the loan and the car's actual value if it's totaled.

Safety: Avoiding Predatory Lending

Be extremely cautious of loan offers that seem too good to be true. Watch out for:

- High Interest Rates: Anything significantly above the average market rate should raise a red flag.

- Hidden Fees: Scrutinize the loan agreement for any unexpected or unexplained fees.

- Unclear Terms: If the loan terms are confusing or difficult to understand, walk away.

- Pressure Tactics: Reputable lenders won't pressure you into signing a loan agreement you're not comfortable with.

Always shop around and compare offers from multiple lenders before committing to a loan. Consider credit unions, banks, and online lenders.

Understanding your monthly car payment isn’t rocket science, but it does require a basic grasp of the underlying principles. By understanding these factors, you can make informed decisions and potentially save thousands of dollars over the life of your loan.

We've got a detailed spreadsheet with all the formulas outlined, along with some interactive examples. You can download it to play with the numbers yourself and get a better feel for how the different variables affect your monthly payment. Understanding this is as crucial to car ownership as knowing how to change your oil.