How Much Is A Gap Insurance

Let's talk GAP insurance. Not exactly the sexiest topic, I know, but it's crucial for protecting your investment in your ride, especially if you've got a newer vehicle or a hefty loan. Think of it as the safety net your regular auto insurance might leave out. Today, we're diving deep into understanding how the cost of GAP insurance is calculated, what factors influence the premium, and how to shop around for the best deal. We're going beyond the simple "price" and exploring the underlying principles that determine its value to you.

Purpose of Understanding GAP Insurance Costs

Knowing the ins and outs of GAP insurance pricing isn't just about saving a few bucks (although that's certainly a bonus!). It's about making an informed decision that aligns with your specific needs and risk tolerance. This knowledge empowers you to:

- Avoid Overpaying: Understanding the cost drivers allows you to identify potential markups and negotiate more effectively.

- Make Informed Decisions: You can weigh the cost of GAP insurance against the risk of a total loss and your financial situation.

- Identify Potential Gaps in Coverage: Recognizing what factors are considered in pricing helps you understand the limits of the coverage.

Key Factors and Components of GAP Insurance Costs

Several factors influence the price of GAP insurance, making it difficult to give a single, universal number. Let's break down the key components:

Vehicle Value

The starting point for calculating GAP insurance cost is the actual cash value (ACV) of your vehicle. This is what your insurance company determines your car is worth *right now*, taking into account depreciation. Higher value vehicles typically translate to slightly higher GAP premiums because the potential "gap" between the ACV and what you owe can be larger. Keep in mind that modifications and aftermarket parts generally *don't* increase the ACV for insurance purposes, so don't expect your souped-up suspension to raise the GAP premium – but it won't *lower* it either.

Loan Amount and Term

This is where things get interesting. The bigger your loan and the longer the loan term, the greater the potential for a gap to exist. A longer loan term means you'll be paying off the loan more slowly, while your car depreciates more quickly. This creates a larger difference between what you owe and what the car is worth. Loan-to-Value (LTV) ratio is a key concept here. This ratio compares the amount of your loan to the vehicle's value. A higher LTV (e.g., owing 110% of the car's value) usually results in a higher GAP insurance premium.

Interest Rate

Higher interest rates mean you're paying more overall for the car, increasing the total loan amount over time. This contributes to a larger potential gap, and insurers may factor this into their calculations. While the direct impact might be small compared to loan amount and term, it's still a contributing factor.

Deductible

Some GAP insurance policies have a deductible, similar to your regular auto insurance. A higher deductible will usually translate to a lower premium, but you'll need to pay more out-of-pocket if you ever need to use the GAP coverage. Carefully consider your financial situation when choosing a deductible. Some policies may not have a deductible at all, but this will result in higher premium.

Provider

Different insurance companies and lenders offer GAP insurance, and their pricing models can vary significantly. Some dealerships might bundle GAP insurance into the financing package, which can sometimes be more expensive than purchasing it separately from an insurer or credit union. Shop around and get quotes from multiple sources.

Where you buy it?

You can purchase GAP insurance from several different places, all of which has different costs. For instance, purchasing GAP insurance from the dealership is the most convenient, but often the most expensive way to purchase. You can sometimes purchase GAP insurance through your lender. This is frequently cheaper than the dealership, but still may not be the best option. In some cases, you can purchase GAP insurance from your insurance company. This option is sometimes the least expensive way to purchase it. It is always best to shop around and see what the best option is for you.

How GAP Insurance Works

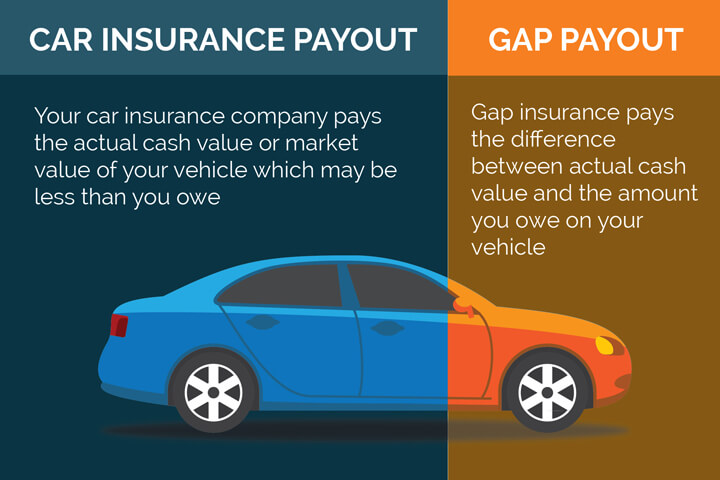

The core principle of GAP insurance is simple: it covers the "gap" between what you owe on your car loan and what your insurance company pays out if your vehicle is totaled or stolen. Let's walk through an example:

Suppose you owe $25,000 on your car loan, but your car is totaled in an accident. Your auto insurance company determines the actual cash value (ACV) of your car to be $20,000. This leaves a $5,000 "gap." Without GAP insurance, you'd still be responsible for paying that $5,000 to the lender.

GAP insurance steps in to cover that $5,000 gap, protecting you from having to pay for a car you no longer own. However, it's important to note that GAP insurance *doesn't* typically cover things like:

- Late payment fees: GAP insurance only covers the outstanding loan balance, not any penalties.

- Rolled-over debt from a previous loan: If you rolled debt from a previous car loan into your current loan, GAP insurance may not cover that portion.

- Negative equity: A similar concept to rolled-over debt, but it represents how much more you owe than your car is worth at the time of purchase.

Real-World Use – Troubleshooting GAP Insurance Costs

Here are some basic troubleshooting tips to help you navigate the world of GAP insurance costs:

- Compare Quotes: As mentioned before, get quotes from multiple sources. Don't just rely on the dealership's offer.

- Negotiate: Don't be afraid to negotiate the price of GAP insurance, especially at the dealership. They often have room to lower the price.

- Check Your Regular Auto Insurance: Some comprehensive auto insurance policies offer "loan/lease payoff" coverage, which is similar to GAP insurance. Check your policy to see if you already have this protection.

- Consider the Loan Term: Shorter loan terms reduce the risk of a gap developing, potentially making GAP insurance less necessary or reducing the premium.

- Down Payment: A larger down payment reduces the initial loan amount and lowers the loan-to-value ratio, which can also decrease the GAP insurance premium.

Safety Considerations

While GAP insurance itself doesn't involve any physical risks, the financial implications of not having it can be significant. The most dangerous thing is to assume your standard auto insurance will cover everything. It's a safety net for a specific scenario, and understanding that scenario is critical. Skipping GAP insurance can leave you with significant debt if your car is totaled or stolen, especially if you have a high-interest loan or a long loan term. It is also important to note, GAP insurance policies will not cover any bodily injury that occurs during an accident.

We've covered a lot of ground here, but hopefully, you now have a solid understanding of the factors that influence the cost of GAP insurance. Remember, knowledge is power, and understanding these principles will empower you to make informed decisions about protecting your investment.